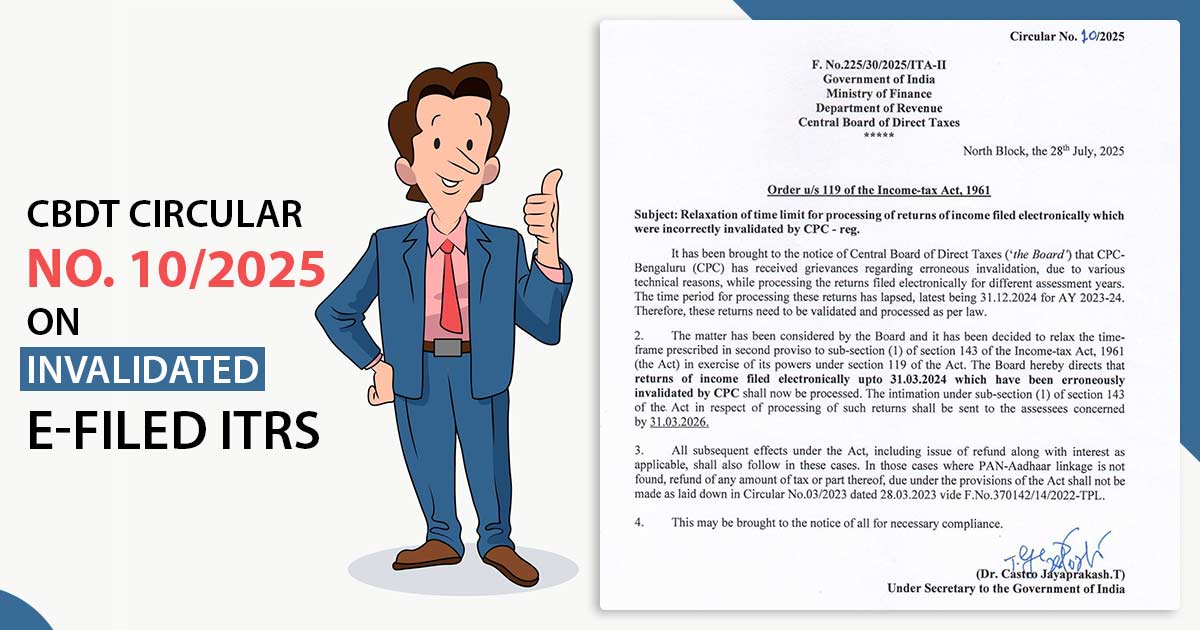

CBDT, via Circular No. 10/2025, has allowed the reprocessing of e-filed income tax returns (ITRs) that were mistakenly treated as invalid by the CPC in Bengaluru.

The CBDT has used its officials under section 119 of the Income-tax Act, 1961, to relax the time limit specified in Section 143(1). The same move has arrived to answer the issues of technical problems, which is directed to the incorrect invalidation of returns for various assessment years, primarily AY 2023-24, where the processing due date expired on December 31, 2024.

CPC has been authorised under the circular to process these electronically filed returns submitted up to March 31, 2024, even if earlier marked invalid. U/s 143(1) affected taxpayers will receive the intimation by March 31, 2026.

The circular reads that refunds, including with interest wherever applicable, will be issued. But for those cases where the PAN and Aadhaar of the taxpayer are not linked, then refunds shall not get processed, as per the CBDT Circular No. 03/2023 dated March 28, 2023.

This is to ease the grievances of the taxpayer, ease the return processing, and ensure that the taxpayers who are eligible get their refunds with no delay.

Read Circular No. 10/2025