For the case of a challenge against the refusal of the Input tax credit (ITC) u/s 16 (2)(c) of the Central Goods and Service Tax (CGST) Act, 2017, the High Court of Kerala permitted the benefit of circular and set aside the order to the extent it refuses ITC based on the provisions.

The applicant Arafa Plywood And Veneers, has refused the ITC as per the provisions included in section 16(2)(c) of the Central Goods and Services Tax/State Goods and Services Tax Acts, 2017 (CGST/SGST Acts). It was cited by the applicant that if the applicant is provided the benefit of the circulars directed to in paragraph No.101 of the judgment of this Court in M.Trade Links v. Union of India [2024], then the petitioner will be qualified to input tax credit, which has now been refused to it under the orders.

It was furnished by the Government pleader that the order was passed dated 24-04-2024 and the applicant does not file the same writ petition in the duration available to file a plea. It was furnished that a belated contest has been raised and these challenges must not be considered.

Read Also: Summary of GST Section 16 Under CGST Act with Eligibility

The applicant’s counsel, the Standing Counsel appeared for respondent No.5, and the Government Pleader was concerned with the directions furnished via the court in M.Trade Links (supra), opined that one chance could be allotted to the applicant to prove its claim as per the Circulars directed to in paragraph No.101 of the ruling of this Court in M.Trade Links (Supra) to the competent authority.

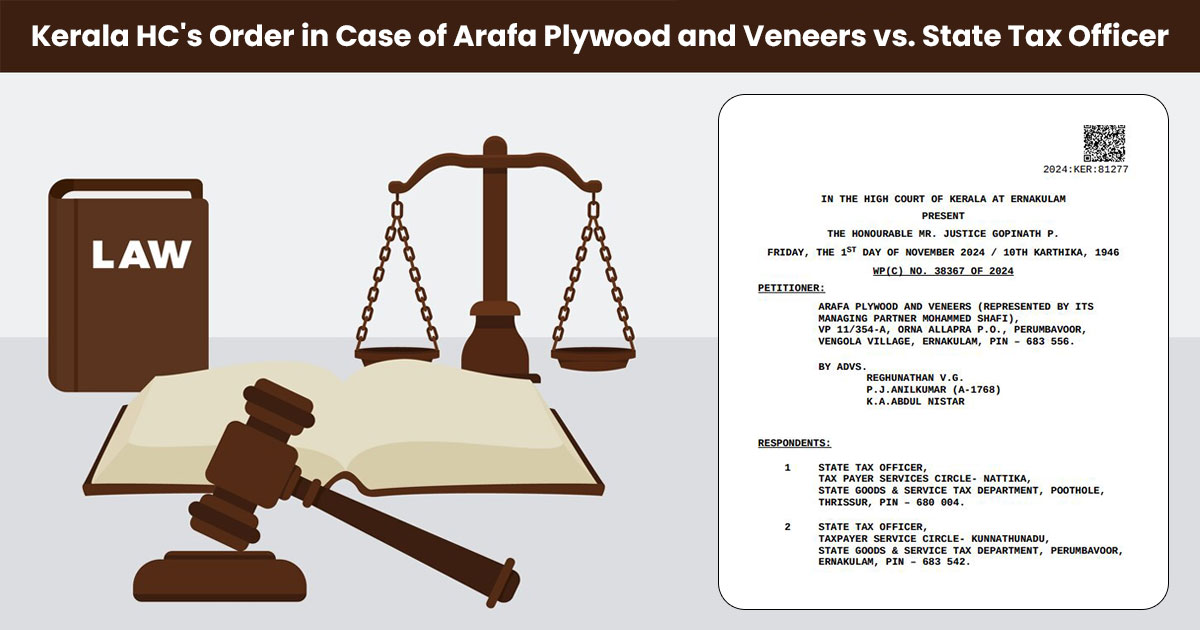

The writ petition has been allowed by the single bench of Justice Gopinath P. by setting aside the order to the extent it refuses the GST ITC for the provisions included in Section 16(2)(c) of the CGST/SGST Acts and referring that the claim of the applicant will be regarded as per the circulars directed to in paragraph No.101 of the ruling of this Court in M.Trade Links (Supra) after providing a chance of hearing to an authorized representative of the applicant. Reghunathan V.G., P.J.Anilkumar, and K.A.Abdul Nistar represented the applicant and Jasmin M M and V Girishkumar represented the respondent.

| Case Title | Arafa Plywood and Veneers vs. State Tax Officer |

| Citation | WP(C) NO. 38367 OF 2024 |

| Date | 01.11.2024 |

| Kerala High Court | Read Order |