The Andhra Pradesh GST AAR decided on M/s RV Hydraulic Services and their request for a tax benefit. They denied the company’s claim for a refund on the tax paid for imported machinery. The main reason for this decision was that the official document proving the import, called the Bill of Entry, was not registered in the applicant’s name.

Overview of the Matter

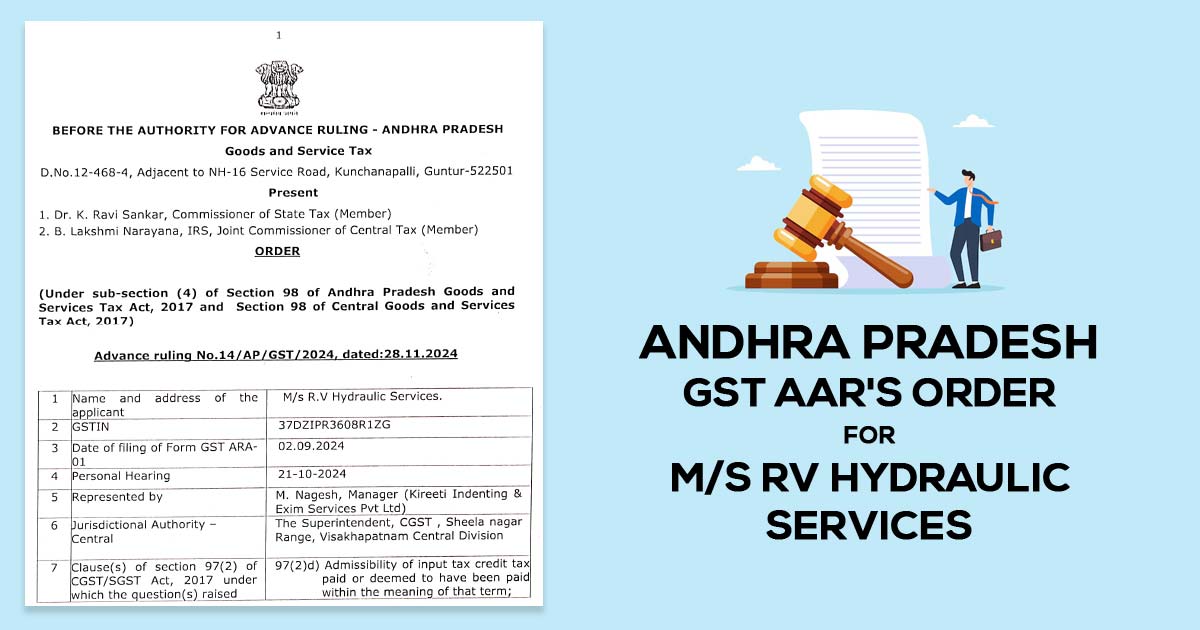

M/s RV Hydraulic Services, located in Visakhapatnam, Andhra Pradesh, specializes in steel plate processing services and operates under GSTIN 37DZIPR3608R1ZG. The company imported a Davi Full Hydraulic Plate Roll (Model MCB F30) from Promau SRL, Italy, at a total cost of €80,000.

The machinery was originally brought to India for display at the IMTEX 2024 event in Bangalore, and it was initially registered under the supplier’s name, Promau SRL. After the exhibition, a company called RV Hydraulic Services decided to buy the machinery and paid the required customs fees, including a tax of ₹14,23,964, using a specific payment form. However, the registration for the machinery remained under Promau SRL’s name.

Contentions of the Applicant

It was argued that-

- They had filed the applicable IGST and customs duties for the imported machinery.

- For the objective of the business, the machinery was procured and installed at their premises.

- According to Section 16 of the CGST Act, 2017, they were qualified to claim ITC as the tax had been filed.

The petitioner asked for the clarification on whether they can avail the IGST ITC even after the bill of entry not being in their name.

Key Legal Provisions Quoted

The authority analyzed the matter under:

- Overview of Section 16 under the CGST Act, 2017: Prerequisites for claiming ITC.

- Understanding Section 5 of the IGST Act, 2017: Imposition and Collection of Integrated Goods and Services Tax (IGST) on Imported Goods

- Provisions of Sections 3(7) and 3(8) of the Customs Tariff Act, 1975: IGST Valuation on imports.

GST AAR outlines that the Bill of Entry is a significant document to claim the ITC since it develops the ownership and tax obligation of the importer.

Analysis of Advance Ruling

It was discovered by the authority that-

- The Bill of Entry was issued in the name of Promau SRL, not M/s RV Hydraulic Services.

- Under Section 16(2)(a) of the CGST Act, ITC can merely be claimed if the receiver has a valid tax invoice or equivalent document in their name.

- IGST payment via a TR-6 challan is not enough to establish ITC eligibility without the related Bill of entry showing the applicant as the importer.

Decision

It was carried by GST AAR that M/s RV Hydraulic Services is not qualified to claim the ITC on IGST filed for the imported machinery as the Bill of Entry was not furnished in their name.

Ruling Implications

The ruling cites the importance of documentation in GST compliance, specifically for imports. It is to be ensured by the businesses that-

- Bills of Entry for imported goods are executed in their name.

- U/s 16 of the CGST Act all conditions are satisfied to claim ITC.

Closure

Procedural rigour mandated under GST laws is been emphasized under the advance ruling. The businesses that are involved in the imports should scrutinize their documentation to prevent the ITC refusal as of the procedural lapses. The very decision sets a precedent outlining that ownership and documentation would have a crucial function in computing ITC eligibility for imported goods.

| Case Title | M/s RV Hydraulic Services |

| GSTIN | 37DZIPR3608R1ZG |

| Date | 21.10.2024 |

| For the Respondent | M.Nagesh, Manager (Kireeti Indenting & Exim Services Pvt Ltd) |

| Andhra Pradesh GST AAR | Read Order |