In the process of filing a GST return , some of the GST liabilities come on the surface which was initially missed out by an individual. These additional liabilities that an individual needs to pay can be paid via provision given on the GST portal which allows us to do so.

Latest Update

- As per GST Notification No. 12/2024, to adjust or offset voluntary payments against a demand order, use the DRC-03A form. If you’ve already used a DRC-03 form, please submit a DRC-03A form to finish the process. View more

- “The 53rd Council recommended amendment in rule 142 of CGST Rules and issuance of a circular to prescribe a mechanism for adjustment of an amount paid in respect of a demand through form GST DRC-03 against the amount to be paid as pre-deposit for filing an appeal.”

Download GST Return Filing Software

What is Form GST DRC 03?

DRC 03 is a voluntary GST payment form that is taken up by the taxpayer or when the department approached him by show cause notice (SCN). Eligible individuals can view & download the Form GST DRC 03 in PDF format.

A Narrative on Form DRC 03 – For Voluntary and SCN Payments

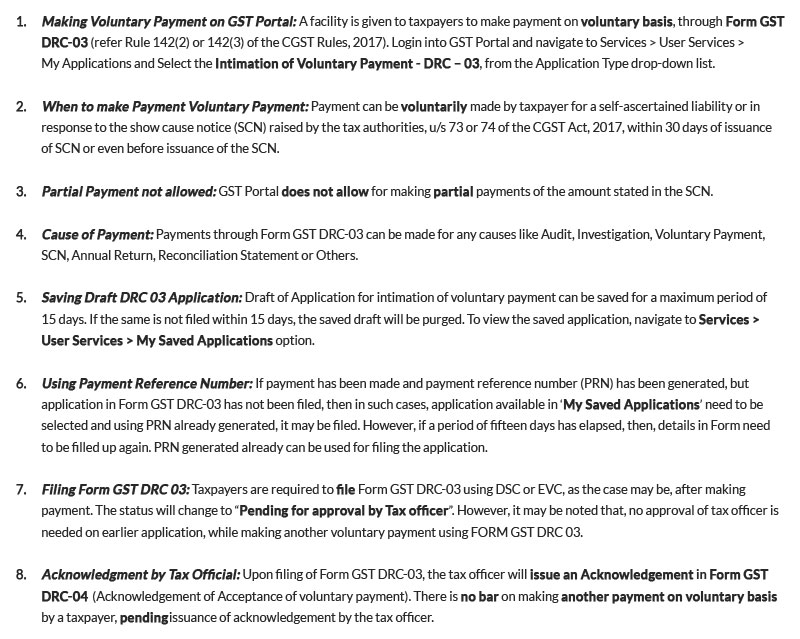

GST Portal now facilitates the availability of the GST DRC-03 Form used for entering the details of voluntary payments by the taxpayer.

Form DRC-03 is the form facilitating the intimation of voluntary payments made before the notice under sections 73 & 74 is issued or payments made within 30 days of issue of Show Cause Notice (SCN).

Now there is an available utility on the GST Portal which allows the user to enter his/her voluntary payments or payments made against SCN (refer Rule 142(2) S. Rule 142(3) of the CGST Rules, 2017).

DRC-03 is the form used for showing the voluntary payments or payments done against the Show Cause Notice (SCN) issued by the department or in adherence to section 142(2) and 142(3) of CGST Rules 2017.

Process to Apply Voluntary Payment for Form GST DRC-03

Let us go through the voluntary payment for GST DRC-03 Form steps of additional tax liability which has to be paid on the GST portal as per the instructions are given below along with the guided screenshots.

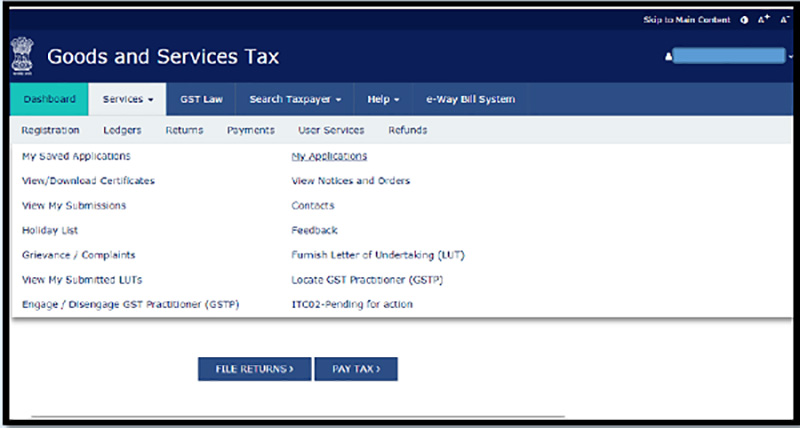

Step 1: Login to GST Portal > Select Services > User Services > My Applications (given in figure 1)

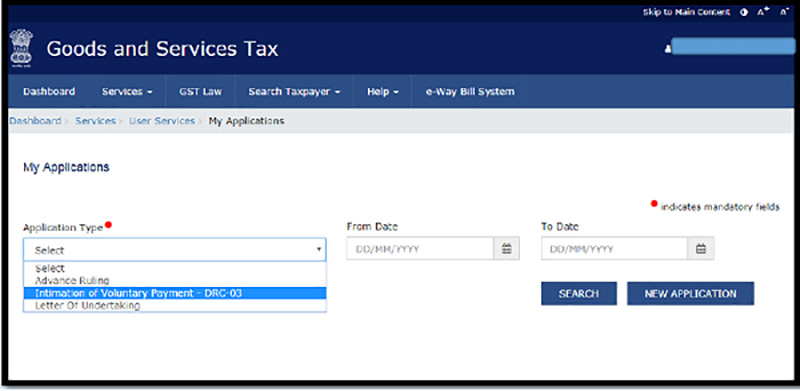

Step 2: Choose “Intimation of Voluntary Payment- DRC 03” available in the drop-down list of “Application Type”. Then Click on “New Application”.

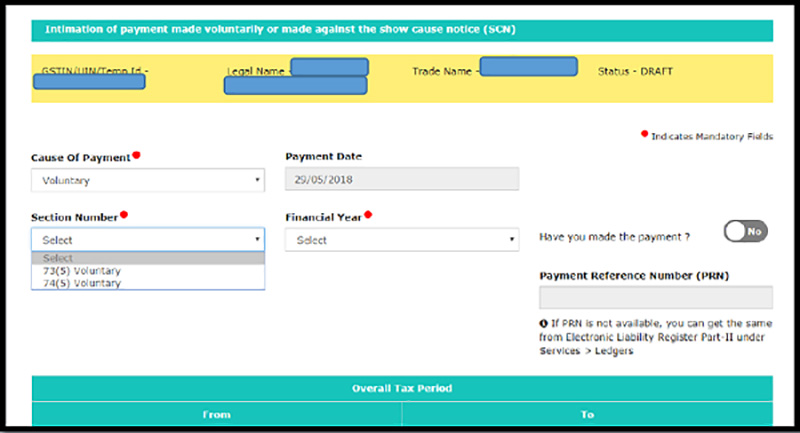

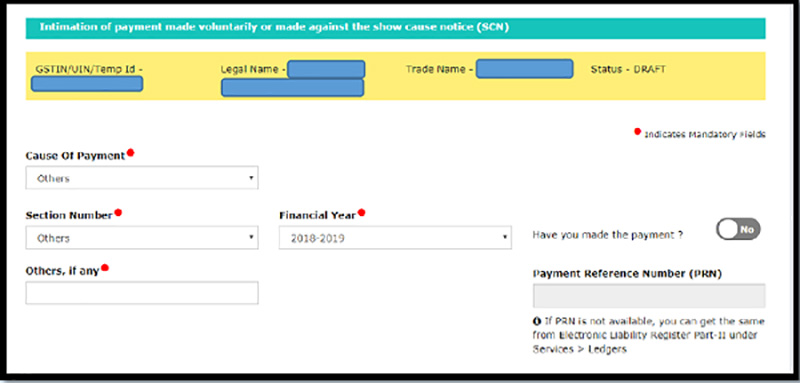

Step 3: Choose either of the three options under “Cause of Payment*” (Voluntary, SCN, and Others). Once the payment is done then give PRN.

If Voluntary Payment is selected-> Select the relevant section and related Financial Year from the list

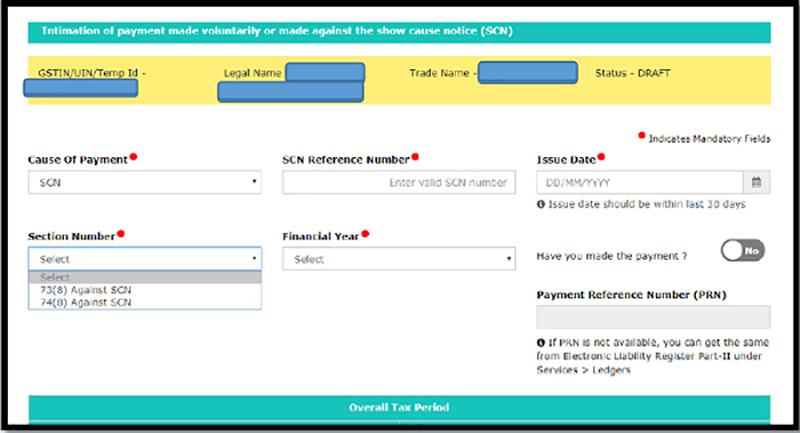

Step 4: If SCN is selected- > Select the relevant section and related Financial Year; enter the SCN Ref No. and date (either system generated or manual)

Step 5: If the taxpayer selects Others from the options > Provide appropriate section and related Financial Year

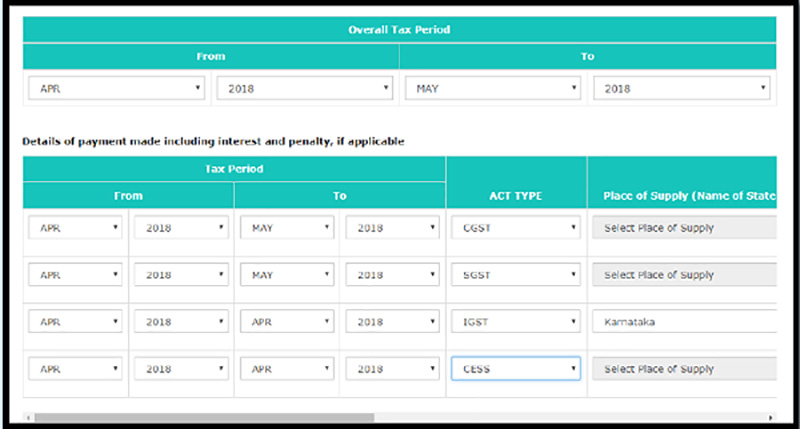

Step 6: Once the details are properly entered, Select Period and Act (visible on the bottom of the screen). > Proceed to Pay

Payment via DRC also carries two conditions: First is Voluntary payment by a taxpayer after encountering the deficit and the second is when the taxman issues a show-cause notice (SCN) inform DRC-01 or DRC-02.

The former condition is not bounded by any time limit while in the latter case a taxpayer has to inform about the tax payment to the proper officer inform Form DRC-03 within the period of 30 days from the date of issuance of such notice.

In both cases, a Taxpayer will receive an acknowledgement by taxman about receiving the tax. Where a person has voluntarily paid the taxes, interest or other dues in form DRC03 before issuance of SCN, tax officials will intimate confirmation in form DRC-04 to the taxpayer. When payments against SCN is done, form DRC-05 mentioning the conclusion about proceedings will be issued to the taxpayer

Read Also: GST Forms: Return Filing Sahaj Sugam

A taxpayer needs to fill many details in DRC 03 which includes GSTIN and name; Cause of payment (Voluntary, SCN, etc.); Section under which payment is made (73 or 74.Not applicable for voluntary payment); Reference number, if SCN issued in DRC-01 or DRC-02; Financial year, tax period and ACT; and payment details including interest, penalty, and others.

Interest is also payable on the payments of these additional liabilities. “On any delayed payment, there is an interest liability. This interest can be deposited at the time of making the additional tax payment,” says Roy.

FAQs Related to Voluntary & SCN Payments for DRC-03 Form

Q.1 – How Payment on Voluntary Basis can be done?

Payment on Voluntary Basis is the feature granted to all the taxpayers allowing them to make voluntary payments or payments against SNC (payments should be done within 30 days of issuance of SCN). The facility is monitored u/s 73 and 74 of CGST Act 2017. Taxpayers can make voluntary payments even before the SCN is issued under their names.

Q.2 – What is the prescribed time-limit for voluntary payments?

Voluntary payments can be made either before the notices under section 73 & 74 of CGST Act 2017 are issued or within 30 days starting from the day SCN is issued under the mentioned two sections. Voluntary payments are barred once the time limit of 30 days (from the issue of SCN) is over

Q.3 – Are there any conditions related to making voluntary payments?

Conditions related to making voluntary payments:

Case 1: If voluntary payment is made before issuing of SCN- Show Cause Notice (SCN) under governance of tax department should not be issued under the taxpayer’s name

- Voluntary Payments after the expiry of 30 days’ time limit will get rejected by the tax department

Q.4 – What is the process to make voluntary payments?

For making voluntary payments against tax liabilities (interest, tax or penalties) based on self-assurance one must go to Services > User Services > My Applications > Intimation of Voluntary Payments > Choose Form DRC-03.

Q.5 – Is partial payment allowed against the liability raised in a SCN?

There is no way a taxpayer can make partial payments against his/her SCN liabilities. The complete payment of the amount raised in demand by the tax department is required to be paid by the taxpayer against his/her SCN liability.

Q.6 – Is there a way of saving the application for intimation of voluntary payment?

Yes, there is a facility of saving the application for the intimation of voluntary payments. The application can be saved at any stage of filing. Provided that the maximum time limit is 15 days starting from the date when file is saved. If the application is not filed within 15 days then the saved draft will automatically be removed from GST Database.

To re-view the saved application go to Services > User Services > My Saved Applications option.

Q.7 – There is a lack of balance in my account to make payments against the SCN liability. What should I do?

In such a case the amount can be deposited in the Electronic Cash Ledger through “Create Challan” Utility which can be seen on the voluntary payment page. By clicking on the “Create Challan Button” the taxpayer will be directed the Create Challan Screen in Payment Module.

On the payment page the amount will be auto-populated based on the amount of cash required in addition considering the liabilities.

Q.8 – What will happen after Form GST DRC-03 is filed?

Once Form GST DRC-03 is successfully filed the Electronic Liability Register, Electronic Cash Ledger and Electronic Credit Ledger will automatically get updated. The entries will be posted and the PRN will get created automatically.

GST DRC-03 Form Payment Features on Voluntary Basis at GST Portal

We have paid diff of Liability pertains to Annual return via DRC-03 for 18-19, 19-20 & 20-21 now department asking clarification of said DSC . What reply we should submit. please guide.

“Please consult GST practitioner for the same”

Hi, I want to know if scn is issued but want to make payment after 30days of scn. how to make payment. please give a reply asap.

The mode of payment is mentioned in SCN. kindly follow the same

A BILL HAVING INVOICE DATE MAR20 ON WHICH WE HAD TAKEN CREDIT IN MAY20, SO WHAT IS FINANCIAL YEAR WE HAVE TO SELECT FOR DRC03 PAYMENT AND WHAT IS THE TAX PERIOD?

Since the invoice date is of Mar 20 so FY would be 2019-20 & tax period would be Mar20

DRC-03 FILE KA STATUS DEKHANE PAR -PENDING FOR ACTION BY TAX OFFICER

SO KONSA TAX OFFICER YE PROCESS COMPLETE KARNA CHAHIYE

Jurisdictional Officer, for more information, kindly contact to GST practitioner

Sir I have to reverse ineligible IGST credit claimed through DRC 03 as per DRC 01 A issued to me by the Dept under Section 73 (5). But while filling the columns in DRC 03, I am asked to show ‘Place of Supply’. Since I am not making any fresh supply I cannot show any POS now. How to make the payment. Please advise.

Sir, you have to mention that Purchase transaction POS whose ineligible ITC you want to reverse

Hi,

I have filled the DRC 03 form and once I go to create challan the challan is automatically created using my cash ledger balances, which are my balances paid for GSTR3B for Jan, and Feb, I do not want to use the cash nor credit ledger balances. So how do you I go with the payment. Kindly advice.

Regards,

Riddhi

Dear Sir, there may be an issue from the portal side as the payment made for Jan & Feb is separately reserved for payment for GSTR 3B, Hence you should complain to the GST portal regarding the same.

When a financial credit note is issued without breakup of CGST and SGST, should we reverse it and pay. In that case, how it should be paid? While filing GSTR 3B, or through GST DRC 03?

You can adjust the same in GSTR 3B

Very useful & helpful information.

Sir, How to pay the Interest amount of late filing of GSTR 3B & GSTR 1 through DRC -03 form

You can pay the same under voluntary head in DEC-03 form under interest column

Payment made through DRC-03 is appearing in cash ledger. How this amount is adjusted against GSTR-9?

In DRC-03, You have to select Annual return and adjust the cash amount towards the said liability

How to pay the penalty of GST test purchase? Is that through DRC03 or any other methods? Please let me know the whole process.

Yes, you can pay the same via DRC-03

I have sufficient ITC accumulated in my Electronic Credit Ledger. But, while calculating Refund on account of Inverted duty structure, I failed to calculate the exact refund admissibly and hence claimed pretty less than what could have been claimed. Can I debit more from my Electronic Credit ledger by DRC-03 and claim the refund after the RFD-01 has been filed.