The Patna High Court in the matter of Raiyan Traders vs. the Assistant Commissioner, the State of Bihar, the Additional Commissioner of State Taxes (Appeals), Patna vide Civil Writ Jurisdiction Case No. 12994 of 2024 dated 06.09.2024, addresses the problem on the existing legal debate on whether the GST pre-deposit for the appeals can get paid via Electronic Credit Ledger, and it aligns with the temporary relief furnished through the Supreme courts’ stay on the said portions of the previous ruling.

Hence the Patna High Court set aside the rejection of the appeal of the appellate authority and asked that the appeal be regarded on merits, even after the pre-deposit that has been made via the electronic credit ledger.

Case Facts

Through Electronic Credit Ledger the applicant has filed the 10% of the disputed tax amount. The appeal has been rejected by the Appellate Authority and the ruling that the 10% pre-deposit is required to be made from the electronic cash ledger.

The Appellate Authority laid on a ruling by the Division Bench of the High Court in M/s Flipkart Internet Pvt. Ltd. v. The State of Bihar & Ors. (decided on 19.09.2023). The same ruling stated that a 10% pre-deposit should be incurred from the Electronic Cash Ledger.

The Apex Court, in Special Leave to Appeal (C) No. 25437 of 2023, stayed observations in paragraphs 77 and 78 of that High Court ruling, creating anticipation towards the correct interpretation of the law

Notification No. 53/2023 dated 02.11.2023 cited that in delayed appeals i.e. beyond the period authorized u/s 107 of the GST Act, 12.5% of the disputed tax is to be paid. From that, at least 20% of the 12.5% is to be paid through the Electronic Cash Ledger. It indicates that the GST Council identified that the 10% pre-deposit can be paid via Electronic Credit Ledger.

Held That

The High Court acknowledged its obligation to adhere to the Division Bench ruling; however, since the Supreme Court has stayed important findings in that judgment, the case remains unresolved.

The High Court consequently overturned the Appellate Authority’s denial of the appeal and ordered that the appeal be evaluated based on its merits, even though the pre-deposit was made from the Electronic Credit Ledger.

The High Court granted the writ petition and instructed the Appellate Authority to evaluate the appeal based on its merits, acknowledging that the 10% pre-deposit already made through the Electronic Credit Ledger renders the appeal valid.

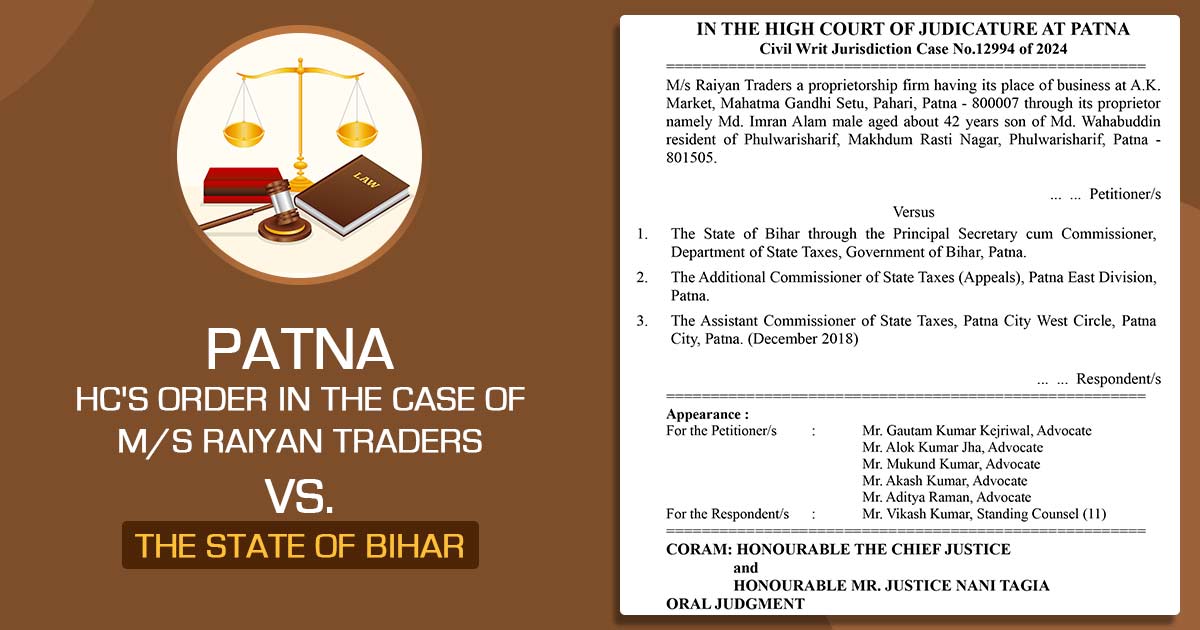

| Case Title | M/s Raiyan Traders vs. The State of Bihar |

| Citation | No.12994 of 2024 |

| Date | 06.09.2024 |

| For the Petitioner | Mr.Gautam Kumar Kejriwal, Mr.Alok Kumar Jha, Mr.Mukund Kumar, Mr.Akash Kumar, and Mr.Aditya Raman |

| Respondent by: | Mr. Vikash Kumar |

| Patna High Court | Read Order |