The reassessment of the assessee has been quashed by the Delhi Bench of Income Tax Appellate Tribunal ( ITAT ), which held that an assessment u/s 147 of the I-T Act,1961 cannot be reopened based on mere modification of opinion.

Bhartiya Samruddhi Investments and Consulting Services Limited, the appellant-assessee, asserted ₹91,47,928 as ‘sundry advances/assets written off’ in the Profit and Loss account for the assessment year 2012-13. The Assessing Officer (AO) decided this expenditure was capital in nature and must be added back to the income.

AO observed that the taxpayer does not furnish information in the assessment proceedings consequence in an overassessment of loss. U/s 148 a notice was issued on 31.03.2019, followed via a notice u/s 142(1) mentioning the deduction was not permissible u/s 37 of the act and asking for justification for the claim, warning that non-compliance shall directed to the addition of the amount to total income.

The taxpayer in answer to the notice mentioned that a regular assessment u/s 143(3) was finished dated 12.01.2015 accepting a loss of Rs 23,20,15,750. It was claimed by the taxpayer that the reopening of the assessment dated 31.03.2019 was not justified since the claim of Rs 91,47,928 for ‘sundry advances/assets written off’ had been consulted at the time of the original assessment.

They observed that AO does not furnish proof of undisclosed material or suppression and that the needed approval for the notice u/s 151 had not been discovered. It was argued by the taxpayer that no new tangible proof was there for the reopening and quoted the case regulations to assist their position, urging for reassessment proceedings cancellation.

The taxpayer’s submission was been denied by AO, citing that the claimed expenditure was capital in nature and not permissible u/s 37(1) of the Act. It was observed by AO that the taxpayer is not able to furnish enough justification for the deduction of Rs 91,47,928 towards sundry advances/assets written off. Consequently, the AO disallowed the amount and added it to the income of the taxpayer.

It was appealed by the taxpayer to the commissioner of Income (appeals) against the disallowance of the AO of Rs 91,47,928 towards ‘sundry advances/assets written off’ as capital in nature u/s 37 of the Income Tax Act. U/s 147 the AO reopened the case due to overassessment of loss.

The appellant’s response does not have satisfactory justification, prompting the AO to add the amount to income. The AO findings have been kept by the Commissioner of Income Tax (Appeals) (CIT(A)) who dismissed the appeal, specifying inadequate proof of the expenditure’s genuineness.

The assessee dissatisfied with the order of CIT(A) appealed before the tribunal.

The tribunal examined the records and discovered that the taxpayer furnished its return for AY 2012-13 on 27/09/2012, reporting a loss of ₹23,20,15,750, which was accepted in the regular assessment completed dated 12/01/2015. The AO reopened the case on 31/03/2019 because of the claim of ₹91,47,928 for ‘sundry advances/assets written off.’ The AO added this amount back to income, mentioning a shortage of tangible proof for the claim.

It was observed by the bench that no new material was there to explain the reopening which was only an amendment of opinion. As the reassessment took place more than 4 years after the finish of the related assessment year, it breaches the proviso to section 147.

Read Also: Delhi HC Quashes IT Reassessment Notice U/S 147 Issued By Non-Jurisdictional Officer

The appellate tribunal cited a ruling from the High Court, highlighting that simply changing an opinion does not give the Assessing Officer (AO) the authority to reopen assessments. As a result, the tribunal invalidated the reassessment and did not consider the merits of the case, as they were considered irrelevant.

The two-member bench including Madhumita Roy(Judicial Member) and Shamim Yahya(Accountant Member) permitted the taxpayer’s plea.

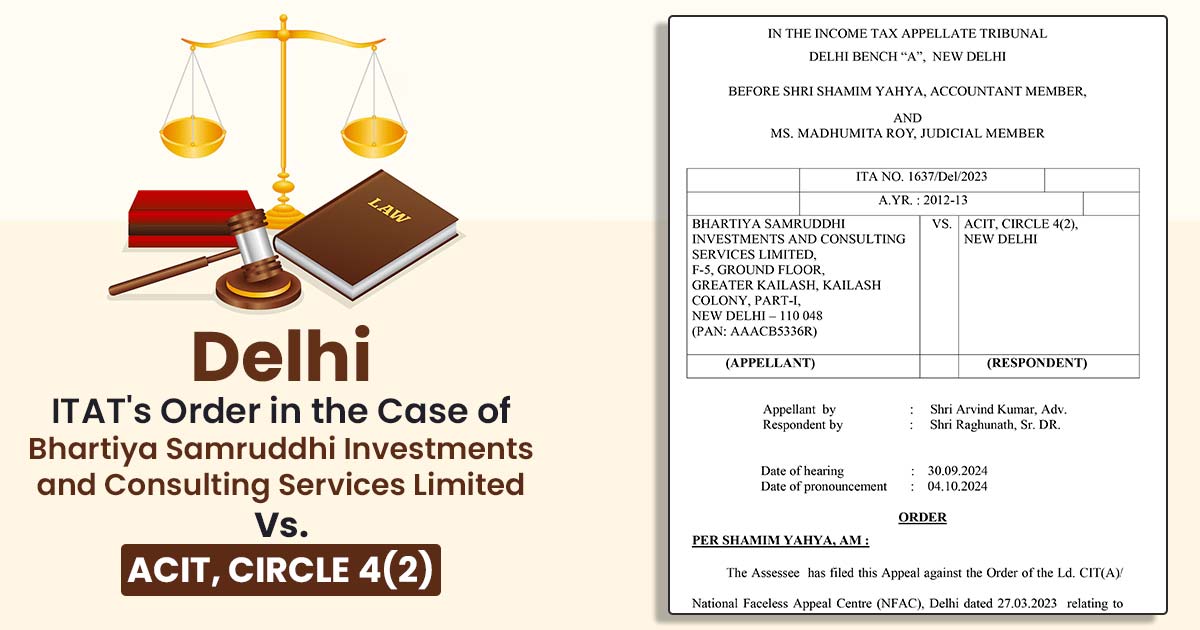

| Case Title | Bhartiya Samruddhi Investments and Consulting Services Limited Vs. ACIT, CIRCLE 4(2) |

| Citation | ITA NO. 1637/Del/2023 |

| Date | 04.10.2024 |

| Appellant by | Shri Arvind Kumar |

| Respondent by | Shri Raghunath |

| Delhi ITAT | Read Order |