The Pune Bench of the Income Tax Appellate Tribunal (ITAT) has removed the late fees levied under Section 234E of the Income Tax Act, 1961, for the delayed filing of quarterly Tax Deducted at Source (TDS) returns before June 2015.

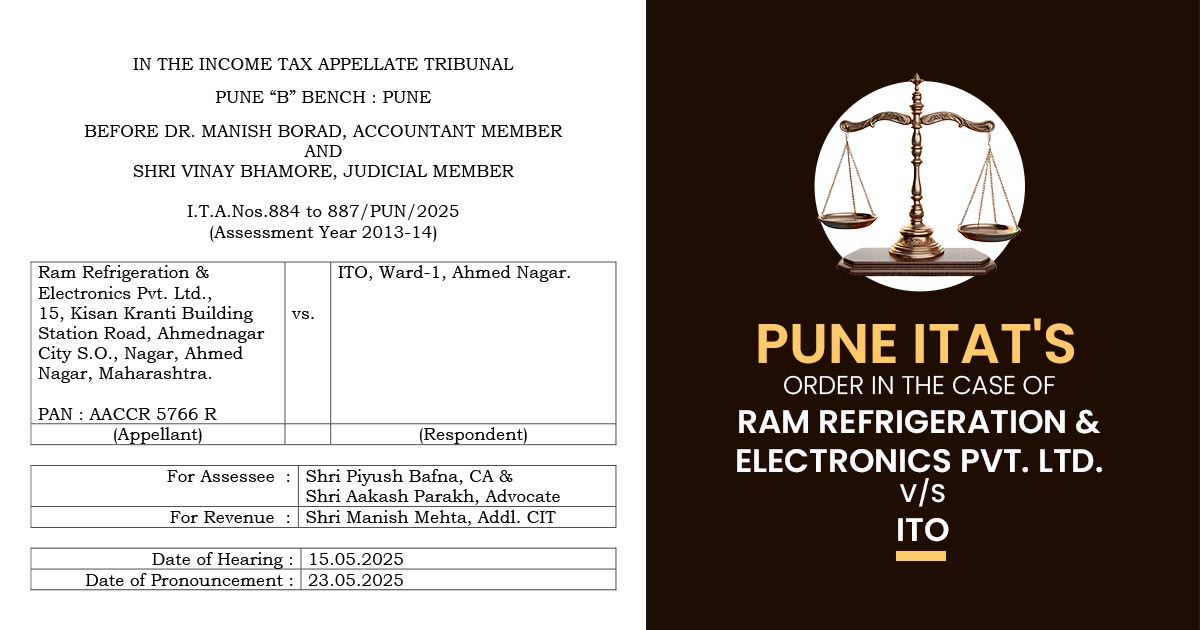

Ram Refrigeration & Electronics Pvt. Ltd., a private corporation, has filed an appeal against the rulings of the Commissioner of Income Tax. The appeal focuses on late fees imposed under Section 234E due to the delayed submission of Tax Deducted at Source (TDS) returns by the Centralised Processing Centre (CPC).

For late filing of quarterly TDS returns for FY 2012-13, AO levied a late fee u/s 234E along with consequential interest u/s 220(2). U/s 154, the taxpayer has furnished a rectification application claiming that, based on the judicial precedents, the levy was not valid.

The application of rectification was rejected. The taxpayer, dissatisfied with the order of the AO, submits a plea to the Commissioner of Income Tax (Appeals). The appeal was dismissed by the CIT(A). The taxpayer, dissatisfied with the order of the CIT(A), submitted a plea to the ITAT.

The counsel of the taxpayer claimed that the TDS returns for the Fiscal year 2012-13 were furnished and processed before June 1, 2015. It was ruled by the counsel that no provision was there to impose the late fees u/s 234E for the returns processed u/s 200A before the revision in section 200A(1)(c) by the Finance Act, 2015.

On a decision of ITAT in Pancharatna Buildcon Pvt. Ltd. vs. ITO, counsel relied where the same problem was determined in the taxpayer’s favour. The case facts were similar to those of the case of Pancharatna Buildcon Pvt. Ltd, a two-member bench comprising Dr. Manish Borad (Accountant Member) and Vinay Bhamore (Judicial Member) said.

Read Also: ITAT: 234e for Late Fee Not Levy Before June 2015 for Delay TDS Filing

W.e.f. June 1, 2015, the Section 200A(1)(c), which enables the levy of late fees under Section 234E, was introduced, and no late fees can be levied for the TDS returns processed before that date, the tribunal cited.

The tribunal underscored important judicial precedents, notably the rulings from the Kerala High Court in the cases of Olari Little Flower Kuries Pvt. Ltd. vs. Union of India and Jiji Varghese vs. ITO. These decisions clarified that late fees stipulated under Section 234E cannot be imposed for periods preceding June 1, 2015.

U/s 234E for FY 2012-13, the levy of late fees was legally unsustainable, the tribunal ruled. The orders of the CIT(A) have been set aside by the tribunal and asked the Assessing Officer (AO) to remove the late fees and the consequential interest u/s 220(2) of the Income Tax Act. The taxpayer’s appeal was authorised.

| Case Title | Ram Refrigeration & Electronics Pvt. Ltd. vs. ITO |

| R/Special Civil Application No. | I.T.A.Nos.884 to 887/PUN/2025 |

| For Assessee | Shri Piyush Bafna, Shri Aakash Parakh |

| For Revenue | Shri Manish Mehta |

| Pune ITAT | Read Order |