It was ruled by the Delhi High Court that GST exemption on foreign reinsurance services in respect to government insurance schemes applies with retrospective effect, from July 1, 2017, onwards.

The same was under the fact that though the exemption was notified dated July 27, 2018, the government standardized GST obligation on these services in the duration between July 01, 2017, and July 26, 2018.

GST liability on reinsurance services has been exempted under Entry 40 in Notification No.12/2017 which is provided to the Government under insurance schemes for which the total premium is paid by the Government

A division bench of Justices Yashwant Varma and Ravinder Dudeja said that Entry 40 was contained in the above notification on 28 June 2017, only w.e.f July 27, 2018.

“The GST Council as well as the Union Government…appear to have taken a conscious decision to regularize the period between 01 July 2017 and 26 July 2018.”

It is to learn that Entries 35 and 36 of the articulated notification waive certain specified general insurance and life insurance schemes from GST.

Entry 36A waived ‘reinsurance’ of the insurance schemes set in Entries 35 or 36. However, on ‘reinsurance’ services concerning government insurance schemes under Entry 40 this Entry was silent.

On 26 July 2018 an ‘amending notification’ was issued which added Entry 40 to the exemption under Entry 36A w.e.f. from the following day.

Thereafter, the Finance Ministry vide Circular dated July 15, 2024, determined to regularize GST payment on ‘reinsurance services’ pertinent to the government insurance schemes (Entry 40 of Notification No. 12/2017) for the remaining period.

Read Also: Nitin Gadkari Requests FM to Remove 18% GST On Insurance Premiums

The query to the court was if the demand order furnished before the applicant, a foreign insurance company that has a reinsurance agreement concerning health insurance coverage furnished under the state government schemes for 01 July 2017 to 25 July 2018 is sustainable.

On 20th December 2023, the demand was there concerning not filing the IGST on reinsurance services for the mentioned duration.

High Court Mentioned

“While it is true that on 20 December 2023, when the impugned order came to be passed, these clarifications had not been rendered, undisputedly, the same would not sustain in light of the stand (regularization of GST liability) which has been taken by the respondents and is principally noticed hereinabove.”

The Delhi High Court towards the aforesaid authorized the writ petition and quashed the impugned demand order.

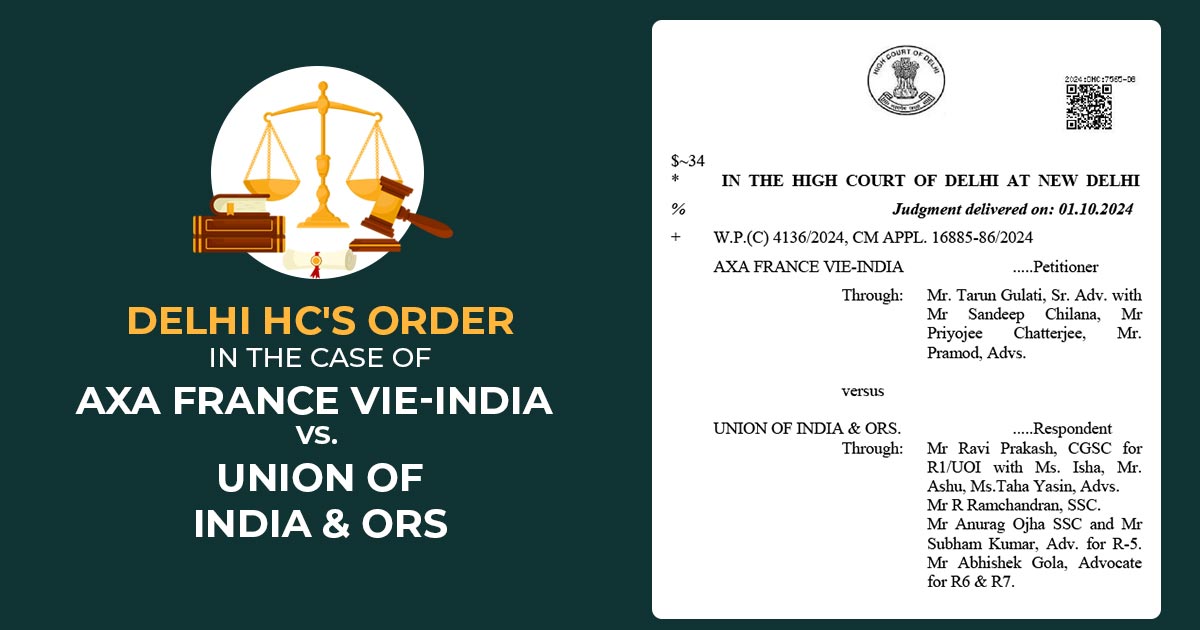

Appearance: Senior Advocate Tarun Gulati, with Advocates Sandeep Chilana, Priyojee Chatterjee and Pramod for Petitioner; Central Government Standing Counsel Ravi Prakash with Advocates Isha, Ashu and Taha Yasin for UOI; Senior Standing Counsel R Ramchandran; Senior Standing Counsel Anurag Ojha and Advocate Subham Kumar for R-5; Advocate Abhishek Gola for R6 & R7

| Case Title | AXA France Vie-India vs. Union of India & Ors |

| Citation | W.P.(C) 4136/2024, CM APPL. 16885-86/2024 |

| Date | 01.10.2024 |

| For Petitioner | Mr Tarun Gulati, Mr Sandeep Chilana, Mr Priyojee Chatterjee, and Mr Pramod |

| For Respondents | Mr Ravi Prakash, Ms Isha, Mr Ashu, Ms Taha Yasin, Mr R Ramchandran, Mr Anurag Ojha SSC Mr Subham Kumar, Mr Abhishek Gola |

| Delhi High Court | Read Order |