The Cuttack Bench of Income Tax Appellate Tribunal(ITAT) carried the decision of the Commissioner of Income Tax(Appeals) to remove the Rs.3,08,11,278 penalty imposed u/s 271(1)(c) for the Assessment Year 2014-15 since the underlying quantum addition no more existed. An appeal has been filed by the revenue against the CIT(A), order on 25.6.2024, which removes the penalty of Rs.3,08,11,278 assessed u/s 271(1)(c) for the AY 2014-15.

Read Also: Cuttack ITAT Remands Case to CIT(A) for Reassessment of Non-Compliance and Evaluation of Evidence

ARSS Developers Limited, the respondent taxpayer, was not represented, although an adjournment application had been submitted. Since the matter can be determined in the absence of the taxpayer, the adjournment request was denied, and the appeal was heard.

Two reasons are been raised by the revenue first the order of CIT(A) was wrong in both facts and law and second CIT(A) is not able to regard the penalty appeal furnished via the department before the Orissa High Court in ITA No.06/2022 against the quantum addition for the AY 2014-15.

The penalty was removed by the CIT(A) u/s 271(1)(c) as the ITAT, in its order dated 23.12.2021 for the AY 2014-15, had removed the quantum addition earlier. The due appeal before the Jurisdictional High Court does not elaborate on reviving the penalty proceedings. The order of CIT(A) was carried out without interference as the quantum addition no longer existed.

Section 271(1)(c) of the Income Tax Act is related to the levying of penalties for “concealment of income” or “furnishing inaccurate particulars of income.” If the taxpayer is discovered to have concealed income or furnished wrong data for their taxable income, the tax authorities can impose a penalty under this section, which varies from 100% to 300% of the tax desired to be evaded.

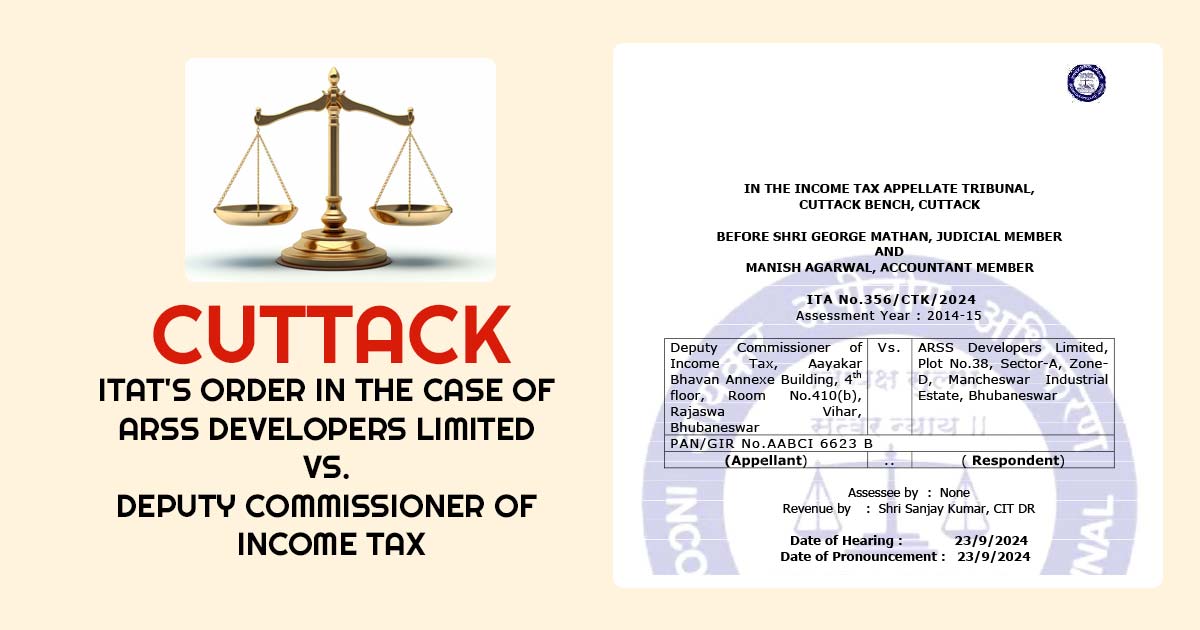

For the complete guide to the law and procedure to file income tax appeals, Tap here. The appeal filed by the revenue has been dismissed by the two-member bench comprising George Mathan(Judicial Member) and Manish Agarwal (Accountant Member).

| Case Title | ARSS Developers Limited Vs. Deputy Commissioner of Income Tax |

| Citation | ITA No.356/CTK/2024 |

| Date | 23.09.2024 |

| Assessee by | None |

| Revenue by | Shri Sanjay Kumar |

| Cuttack ITAT | Read Order |