The Cuttack bench of the Income Tax Appellate Tribunal (ITAT) in a case has remanded the petition via the taxpayer against the commissioner Of Income Tax (Appeals) order after condoning a 69-day delay.

It was remarked by the tribunal that the non-compliance and the absence of documentation in the order of the CIT (Appeals) furnished the taxpayer another opportunity to get heard. For the statistical objectives, the petition was partially permitted.

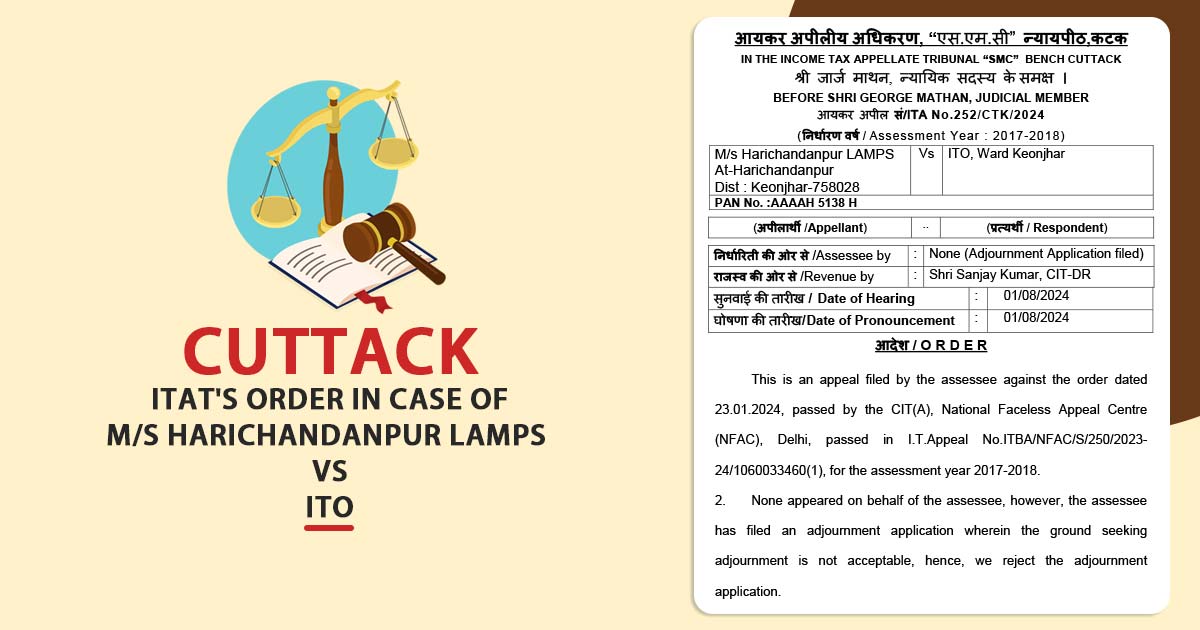

The appellant-assessee, Harichandanpur LAMPS, filed an appeal against the order passed by the Commissioner Of Income Tax (Appeals), National Faceless Appeal Centre (NFAC), dated 23.01.2024 for the assessment year(AY) 2017-2018.

It was observed by the tribunal that no one has appeared for the taxpayer. However the taxpayer had filed an adjournment request, the furnished reason was not considered and hence the adjournment application was rejected.

In filing the present petition there was a delay of 69 days. An application for condonation of delay has been filed by the taxpayer mentioning enough reasons. No serious objection to the condonation has been raised through the departmental representative.

Read Also: Mumbai ITAT Quashes Addition Due to Lack of Proof About Money Receipt from Seized Documents

Therefore the delay of 69 days has been condoned by the tribunal and proceeded to dispose of the petition.

Section 235(5) of the Income Tax Act, 1961 permits the tribunal to admit an appeal after the stipulated period if it is pleased that there was adequate cause for not presenting it within that period.

It was remarked by the tribunal that the order of CIT(A) shows the absence of compliance via the taxpayer in the process of appeal, which leads to the dismissal of the petition. Also, the assessment order cites that the taxpayer does not furnish the related documentation.

It was mentioned by the bench that, to ensure fairness and permit the taxpayer an effective chance to show their case, the tribunal has wished to send the issues back to the CIT(A) for reconsideration, with adequate opportunity for the assessee to be heard.

Read Also: ITAT Raipur Removes Income Tax Reassessment for Unspecified Reasons

A single bench comprising George Mathan (Judicial Member) partially permitted the appeal for statistical purposes.

| Case Title | M/s Harichandanpur LAMPS Vs ITO |

| Citation | ITA No.252/CTK/2024 |

| Date | 01.08.2024 |

| Assessee by | None |

| Revenue by | Shri Sanjay Kumar |

| Cuttack ITAT | Read Order |