No rejection should be there for the taxpayer’s claim since the same was not notified in the tax audit report, certainly in the cases where the other proof is available on record recommending the deduction as per the provisions of section 43B on a payment basis is available, Rajkot ITAT ruled.

The Bench of the ITAT constituting of TR Senthil Kumar (Judicial Member) and Waseem Ahmed (Accountant Member) witnessed that “the tax audit report is a significant piece of evidence/ document but based on that the genuine claim of the assessee cannot be denied especially in the circumstances when other details are available on records. As such the assessee has claimed deduction u/s 43B of the Act on payment basis and therefore in our considered view, the same should have been allowed by the authorities below.” (Para 8)

On the matter, the taxpayer under section 43B claimed a deduction in the calculation of the income of Rs 47,83,396 which was disallowed in the generated intimation u/s 143(1). It was disallowed on the reasoning that the incurred claim as per the income calculation did not match the tax audit report.

Therefore for the sum of Rs. 47,83,396/- to the total income of the assessee the addition was incurred. The CIT(A) also confirmed the AO addition. The Bench witnessed that the basis of making the disallowance is that these deductions were not claimed in the tax audit report.

The bench cited that the taxpayer’s income must not be over-assessed despite when the taxpayer incurs a mistake. The legal deduction to which the taxpayer is entitled should be permissible while defining the taxable income, bench cited.

The Bench repeated while referring to the Gujarat High Court’s decision in the case of S.R. Koshti Vs. CIT reported in 276 ITR 165 that regardless of whether the revised income tax return was filed or not, once a taxpayer is in a position to show that the taxpayer has been over-assessed under the provisions of the Act, irrespective of whether the over-assessment is as a result of taxpayers owns mistake or otherwise, the CIT has the authority to rectify such an assessment u/s 264(1) of the Act. If the CIT declines to provide relief to the taxpayer, in these circumstances, he would be acting de hors the powers under the Act and the provisions of the Act and, hence is duty-bound to provide ease to a taxpayer, where due, following the provisions of the Act.

The taxpayer’s petition has been permitted by ITAT.

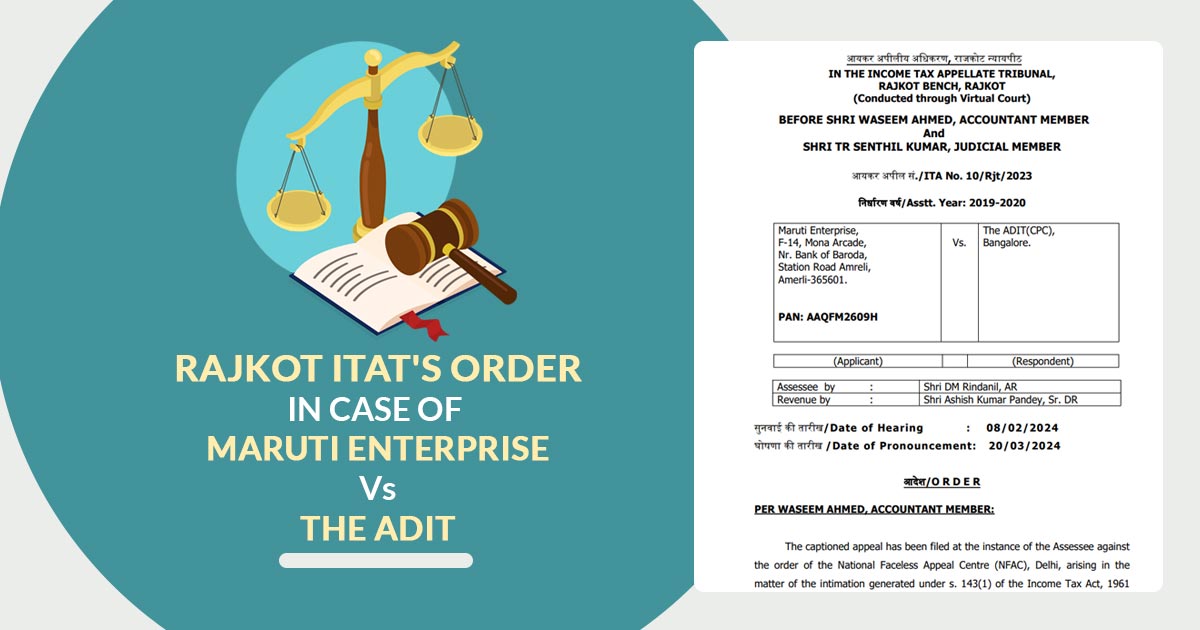

| Case Title | Maruti Enterprise verses ADIT |

| Citation | ITA No. 10/Rjt/2023 |

| Date | 20.03.2024 |

| Appellant/Assessee by | DM Rindanil |

| Revenue/Respondent by | Ashish Kumar Pandey |

| Rajkot ITAT | Read Order |