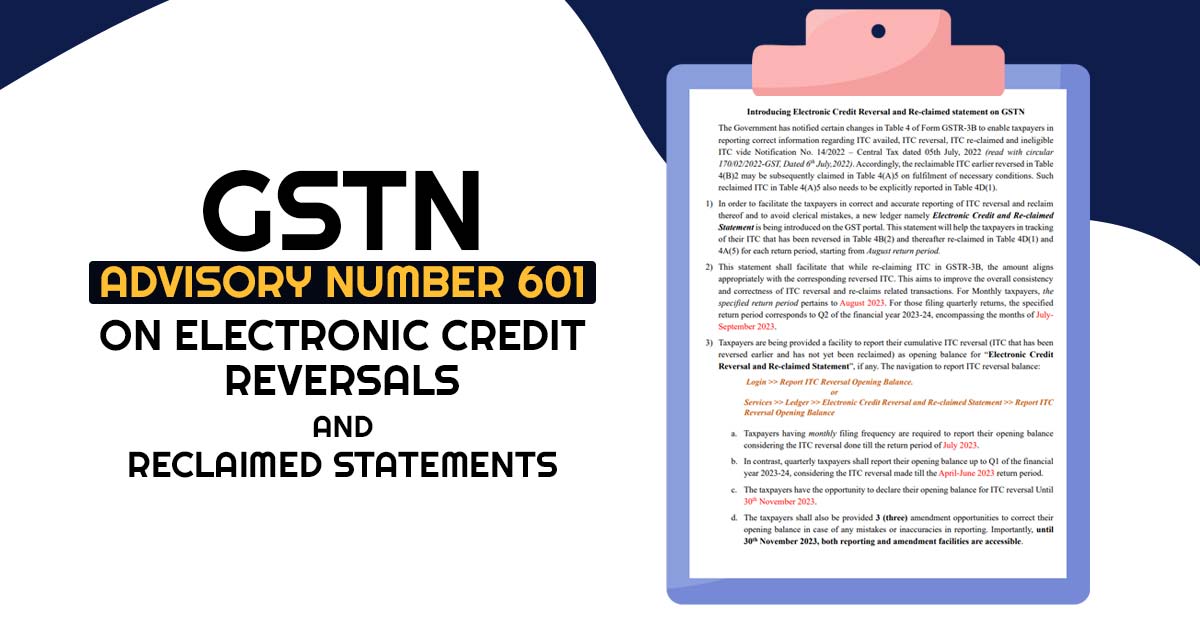

Through the common GST portal, the (Goods and Services Tax Network) GSTN issued Advisory No. 601 on August 31, 2023, concerning the introduction of an Electronic Credit Reversal and Re-claimed statement.

The government has released the notification about the changes to form GSTR-3B, specifically Table 4, to ensure accurate reporting of Input Tax Credit (ITC) availed, ITC reversal, ITC re-claimed, and ineligible ITC, as per Notification No. 14/2022 – Central Tax dated July 5, 2022, along with circular 170/02/2022-GST, dated July 6, 2022. Consequently, after completion of the required criteria, the reclaimable ITC reversed previously in Table 4(B)2 may be thereafter claimed in Table 4(A)5 also requires to be explicitly reported in Table 4D(1).

- To simplify the reporting process and reduce the chances of errors, a new ledger called the Electronic Credit and Re-claimed Statement has been introduced on the GST portal. This statement enables taxpayers to monitor ITC that was earlier reversed in Table 4B(2) and later reclaimed in Table 4D(1) and 4A(5) for each return period, starting from the August return period.

- This announcement ensures that when taxpayers reclaim ITC in GSTR-3B, the amount aligns accurately with the corresponding ITC reversed, enhancing the accuracy of ITC reversal and re-claims. For monthly taxpayers, this applies to the August 2023 return period, while quarterly filers should consider Q2 of the financial year 2023-24, covering July to September 2023.

- Additionally, taxpayers can report their cumulative ITC reversal (ITC that was earlier reversed but not yet reclaimed) as the opening balance for the “Electronic Credit Reversal and Re-claimed Statement,” if applicable.

The step-by-step process to report ITC reversal balance:

Login >> Report ITC Reversal Opening Balance.

or Services >> Ledger >> Electronic Credit Reversal and Re-claimed Statement >> Report ITC Reversal Opening Balance.

Taxpayers who file their taxes monthly must reveal their initial balance, accounting for the ITC reversal up to the July 2023 return period.

In contrast, taxpayers who file quarterly must declare their starting balance for the 2023-24 financial year, considering the ITC reversal until the April 2023 return period.

Taxpayers can declare their opening balance for ITC reversal until November 30, 2023.

Taxpayers will have up to three opportunities to correct errors or inaccuracies in their initial balance reporting until November 30, 2023. Moreover, both reporting and amendment options are available during this period.

However, from December 1 to December 31, 2023, only amendments will be permitted, and the option for new reporting will not be accessible. The amendment facility will be discontinued after December 31, 2023.

- Allowing taxpayers to reveal their accumulated ITC reversal balance, the portal will maintain a record of both the reversal and re-claimed amounts periodically in a statement. To ensure accuracy, the GSTR-3B form is incorporated with a validation mechanism. This validation will notify through a warning message if a taxpayer tries to claim ITC in excess in Table 4D(1) than what’s available in the ITC reversal balance from the statement, along with the ITC reversal made in the current return period in Table 4B(2). Even though this warning message alone is enough for precise reporting, taxpayers still have the option to proceed with their filing. However, it’s advised to taxpayers not to exceed the closing balance of the “Electronic Credit Reversal and Re-claimed Statement” and report any due ITC reversed as an opening balance.

- Starting with the August 2023 return period, monthly taxpayers will begin to be notified through the warning message during GSTR-3B filing. Similarly, for quarterly taxpayers, these warning messages will start notifying from the filing period covering July to September 2023.