People looking to download free TDS return filing software that can easily handle online TDS and TCS filing, along with quick intimation, don’t need to look any further. The solution is Gen TDS software for FY 2025-26, available with the latest version 2.25.7.1 as a free trial.

This TDS return filing software is designed to file returns as per the requisitions of the Income Tax Department, Government of India.

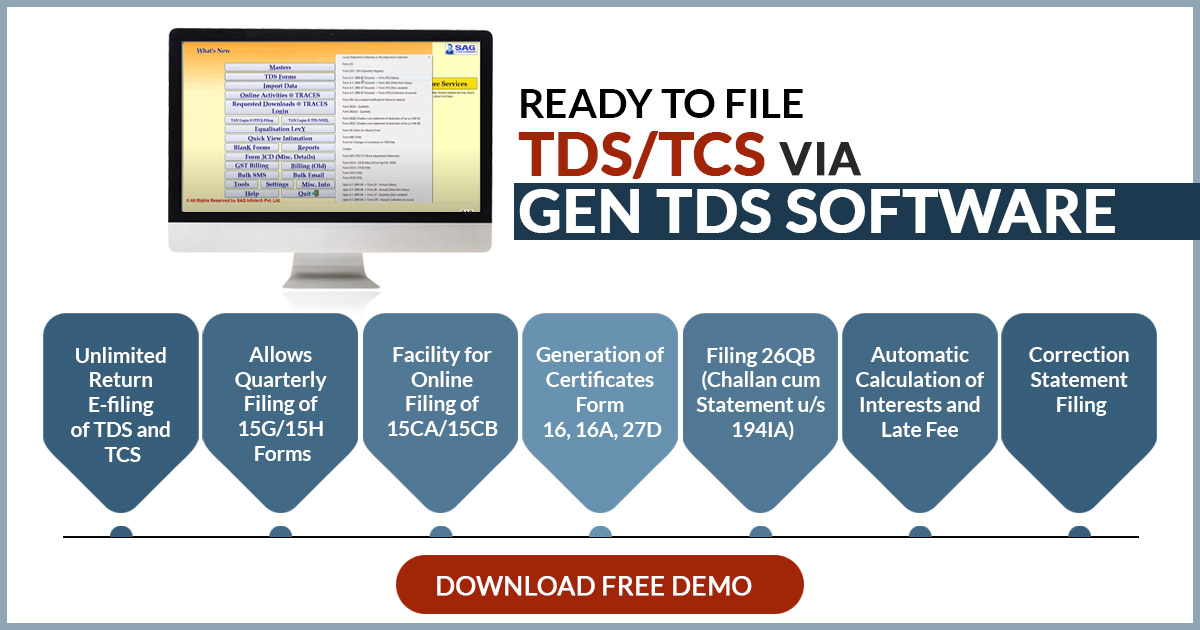

Need a Demo of TDS Return Filing Software

The Gen TDS software user can directly log in to the Traces CPC and NSDL. They can also learn how to prepare TDS returns using Gen TDS. The software is encoded with recognised standard codes such as All India PIN codes, ISD codes, TAN/PAN AO codes, TIN FCs MICR & IFSC codes, service tax ranges, bank BSR codes, etc.

If somebody is not comfortable with the software, then customers can also learn how to file TDS returns online without the software. But you must know that it is time-consuming and complex.

Here we will inform you about the free download of the TDS Return Filing Software AY 2026-27. If you are looking for a free trial of TDS software. SAG Infotech provides a free trial. Free demo of Gen TDS Software download today for filing of TDS/TCS return.

Currently, there is up to a 20% discount running on the Gen TDS software. Step by step to download the free trial version of TDS Software with 5 active hours

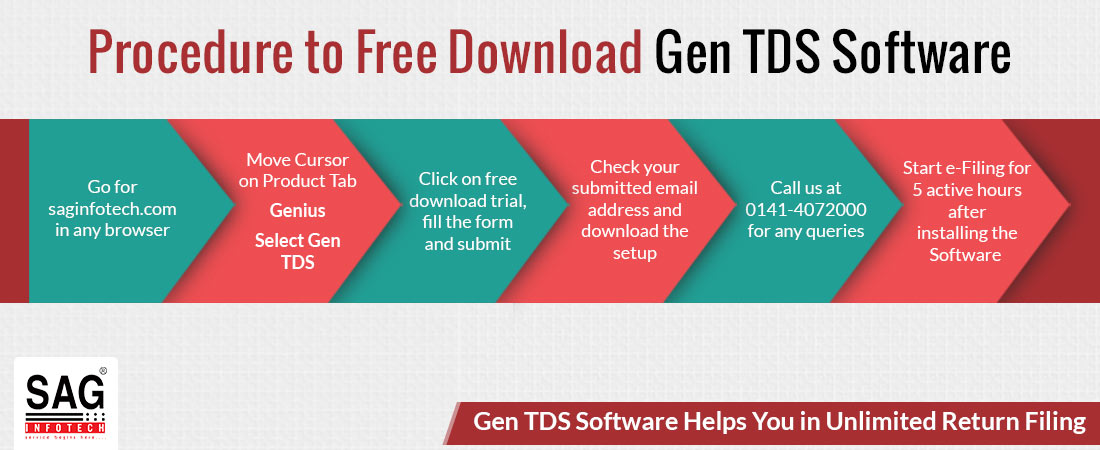

Procedure to Free Download Gen TDS Software

- Open a browser and type https://saginfotech.com/

- Go to the Move Cursor on Our Product Tab –> Genius –> Select Gen TDS software in the tab.

- The option of a free download trial comes up. Now, just click on the column and fill in the information in the form. Furnish all the details and submit the form

- Evaluate your given email address, and afterwards, download the setup

- For clarification of any doubts, contact 0141 – 4072000

- You can start e-filing after installing the software and after 5 active hours of installation

Features of TDS Return Filing Software for the Trial Version

- User-friendly software

- Free download TDS certificate 16A

- Free download the TDS software from NSDL

- TDS return form 26Q

- TDS traces the facility

- TDS on salary calculation

- TDS return utility

- 5 hours of usage of the free trial version, whereof you can file the TDS Return

- Prepare the e-TDS return and calculation of tax

- e-TDS filing of Returns by a single input 24Q, 27Q, 27EQ with proper validations

- File the TDS/TCS return online from the assessment year 2003-04 onwards

- Fill forms 15CA/15CB online, along with an XML generation facility and direct upload

- Calculate the education cess, secondary and higher education cess

- Prepare challan cum statement of deduction u/s 194IA and 194IB

- Import/export data from MS Excel files/text files/ FVU files

How Can Professionals Get Free TDS Return Filing Software?

Professional individuals like accountants, tax consultants, and bookkeepers often find themselves managing the tax needs of numerous clients. Using free TDS (Tax Deducted at Source) return filing software can facilitate the process and support time-saving. Various no-cost TDS filing solutions cater to the requirements of professionals in this field.

There are two ways in which professionals can access free TDS return filing software-

- Government portals: For filing TDS returns for free, the Indian government proposes a user-friendly online platform. But it has more manual input compared to the specialised software, the same illustrates a budget-friendly alternative for professionals who are adept at using the platform.

- Freemium versions with limited features: Certain companies pertinent to software deliver complimentary basic versions of their TDS filing software. Such versions do not take any charge; they frequently emerge with restrictions like limitations on the number of returns you can file and a lack of advanced features like bulk upload or error checking. For professionals with a small number of clients, such basic versions could be an effective option.

It is crucial to conduct thorough research and compare features while proceeding with free TDS return filing software. It is important to regard distinct factors like ease of use, the restrictions of free versions, and available support options. On storing the data, specific free software options might have limitations or may require an upgrade to access features important for professionals, like bulk filing software.

What are the Benefits of Downloading Free TDS Return Filing Software?

It removes the requirement for manual spreadsheets, and transitioning to TDS return filing software furnishes distinct advantages for both businesses and tax professionals. Learn in what way using the TDS return filing software could optimise and ease your tax process-

- Enhanced Precision: Software automates calculations and ensures data consistency, decreasing the chance of errors that can lead to penalties.

- Improved Association: Software maintains all your TDS data in a central location, making it simpler to retrieve the previous details and handle multiple clients.

- Effortless Time Saving: Pre-filled forms, import functionalities, and automated filing remarkably decrease the time consumed on data entry and processing.

- Compliance Assurance: Regular updates ensure that your software complies with the updated TDS norms, generating confidence in you.

- Simplified Workflow: So, for the sake of the reason that you do not missing any step, the software navigates you via the step-by-step filing procedure.

You are enabled to free your valuable time and resources, minimise errors, and ensure a smoother and more efficient tax filing experience by using the TDS return filing software.

Why Should We Choose Good TDS Software for Return Filing?

January 31, 2026, is the last date for filing TDS returns for the third quarter of the fiscal year 2025-26. You should file a timely return to prevent the penalty for late filing.

For easier TDS/TCS compliance, it is essential to utilise a powerful and stable software that provides efficiency while maintaining the correct tax credits for employees, vendors, and other stakeholders.

Some of the essential fields that need to be analysed within the effective TDS compliance software:

- It should be easier for non-experienced people.

- Should work efficiently with after-sales assistance to attain timely filing.

- Software must be regularly updated to ensure a better experience and faster response times for statutory notifications.

- Compatible with the Income Tax website.

- For error-free returns, smart detection of inconsistencies.

- Managing heavy data at a quicker pace just takes a few minutes.

- Easy generation and distribution of TDS Certificates

- Taking out TDS-related information for Tax Audit

- Easy Procedure for Correction Statements

- Should give the best user experience

- Follow recent guidelines for TDS

- Should be updated every time

- Money and time-saving

- Maintain all the records in a proper format

Companies with larger data volumes are facing issues with operational speed for importing data, generating returns, and other tasks. It is an essential concern that needs to be sorted out.

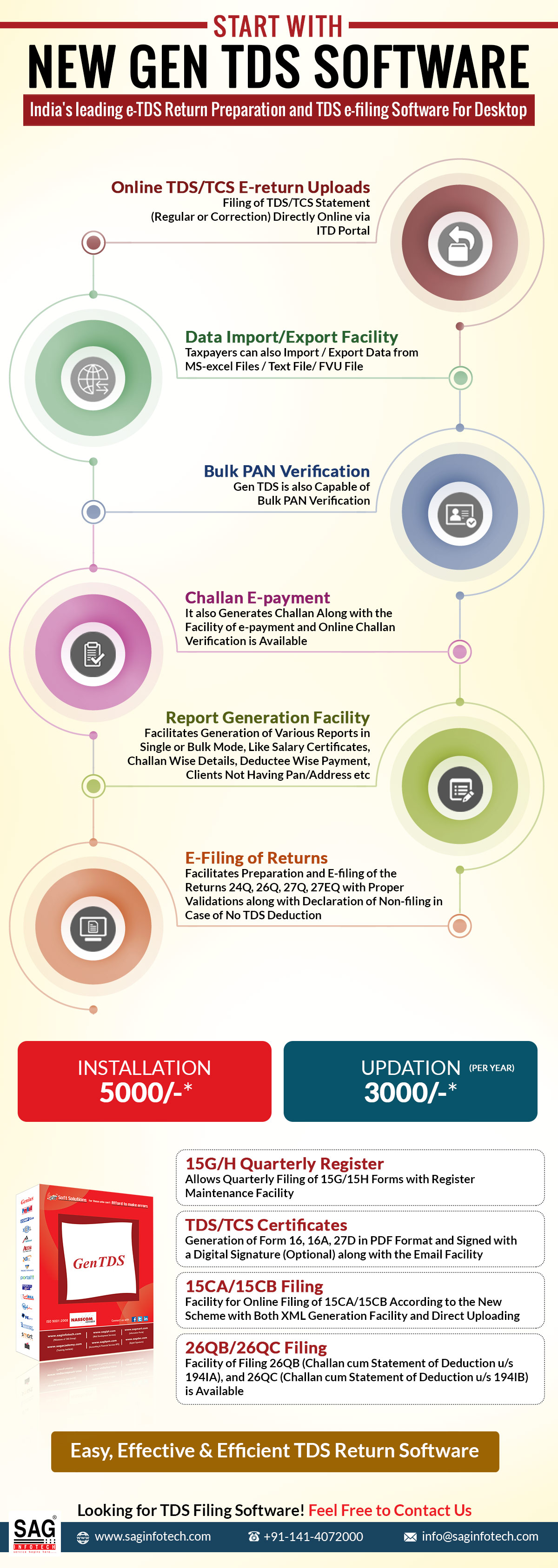

Gen TDS software is reliable software and is known for its speed, support, and value for money. The software has been providing its services for more than 20 years. The Software of Gen TDS returns filing is available in numerous variants with multiple user options.

You are enabled to download the trial copy of Gen TDS and perform one sample return. Currently, there is up to a 20% discount running on the Gen TDS software.

General Queries on Gen TDS/TCS Return Filing Software

Q.1 – Can Gen TDS Software File Unlimited Returns?

Yes, unlimited returns and be filed using Gen TDS filing software. It is a potential tool for all your TDS/TCS filing requirements. The tool is here to help you with preparing and e-filing of returns, gis\ves you online access to Form 24Q, 26Q, 27Q, 27EQ with Proper Validations along with Declaration of Non-filing in Case of No TDS Deduction. Professionals now have the facility of directly logging into the TRACES CPC and NSDL with Gen TDS filing software, this calls off the requirement to, again and again, create a User ID. Gen TDS is one of the most secured government authorized TDS filing software.

Q.2 – Is it Possible to File Annual e-TDS/TCS via Gen TDS Software?

Yes, it is possible to file annual e-TDS and e-TCS via Gen TDS software. Under section 206 of the IT Act, annual TDS return is prepared using Form 24,26 and 27 and TCS under section 26C is prepared using form 27E. Such returns if presented through a CD/pen drive should be affixed with a verification form – Form 27A (in case of annual TDS) and Form 27B (in case of annual TCS)

Q.3 – Is it Possible to File Quarterly e-TDS/TCS via Gen TDS Software?

Yes quarter online compliance of TDS and TCS is possible via Gen E-TDS return Software. Online TDS is an electronic form valid under section 200(3)/206C and amended by the Finance Act 2005 which needs to be presented on a quarterly basis. Forms to file quarterly TDS are Form Nos. 24Q, 26Q and 27Q and quarterly TCS is Form No. 27EQ. Such returns if presented through a CD/pen drive should be affixed with a verification form – Form 27A (in case of annual TDS) and Form 27B (in case of annual TCS)

Q.4 – Does the software allow generating Form 16 B?

Yes. Gen TDS allows generating Form 16B. 15 days from uploading Form 26QB users can download Form 16B from the link visible on the software.

Q.5 – Why is Gen TDS Return e-filing Software Better than Others?

Gen TDS is among the most desired software for filing TDS. It is because the software has a user-friendly interface and each form on the software strictly adheres to the legal norms of TRACES and CPC. Apart from filing TDS and TCS, the software also facilitates pre-determining of the TDS amount, calculates interest and penalty all in a single click.

Q.6 – Is the E-payment of Challan Possible from Gen TDS software?

Generating Challan along with the facility of e-payment of challan is possible via Gen TDS e-filing software.

Q.7 – Is there any Specific Operating System Required for the Functioning of Gen TDS Software on a Computer?

Windows 98, XP(Service Pack 1 or Higher), Vista, Windows 7 or 8 families (32- or 64-bit) is the ideal system to run Gen TDS return filing software.

Q.8 Is there a need for any Technical Configuration in the System to Process Gen TDS/TCS Software?

Configuration required for processing Gen TDS/TCS software:

- Pentium or Later Processor, Minimum of 32 MB of RAM, Minimum Hard-Disk Space 200 MB.

Q.9 Gen TDS Software Trial Version Requires How Many Active Hours of Installation?

The trial version of the software requires 5 active hours of installation to get completely set for processing the returns.

Q.10 What is the Step-wise Procedure to Download Gen TDS Software for TDS/TCS Return Filing?

- Step 1. First of all, open the saginfotech official website

- Step 2. Click on the Move Cursor on Our Product Tab > Genius > Select Gen TDS software in the tab.

- Step 3. Click on the option of Free Trial Download visible on the screen and fill in the form. Complete the details asked in the form and click on submit.

- Step 4. Complete the basic details asked in the inquiry form i.e. Name, Email address and Mobile no. and press “Send”.

- Step 5. You will receive the download link at the email address you provided. Take the help of the link to download for free the Gen TDS software.

Q.11 Is there any Assistance for the Software Purchased?

Yes, there is a customer service support team available to solve issues related to the software. Just dial the helpline number 0141-4072000 and press 5 for TDS assistance. Lines are open from 10 AM to 8 PM.

Mera tds kab tak millega..aap jo path rahe hai.o thoda samjha ke padhe ye humlogo ke sath hi kyu hota..hai..

TDS RETURN FILE

I need to file tds return of AY2021-22

What will be the charge?

if data between 100 charge 500+tds filling charges, if data over 1000+tds return filing charges.

Hi I want to know that I m not a salaried employee. I was working with coal India but now I m on leave due to maternity. I m on leave without pay. However, my company credited a certain amount in my account under some category and the TDS was around 48k for the quarter ending September 2020. Hence I want to know where can I file it and when will I get the refund.

Hi, I am looking for a new

Let me know within how many days do TDS amount gets credited in assessee’s saving account from the date of submission of ITR for the concerned year?

Generally, an ITR gets processed within 30 days of filing and refund is credited within 5-10 days of processing. However, the processing time period is not fixed and may take more time.