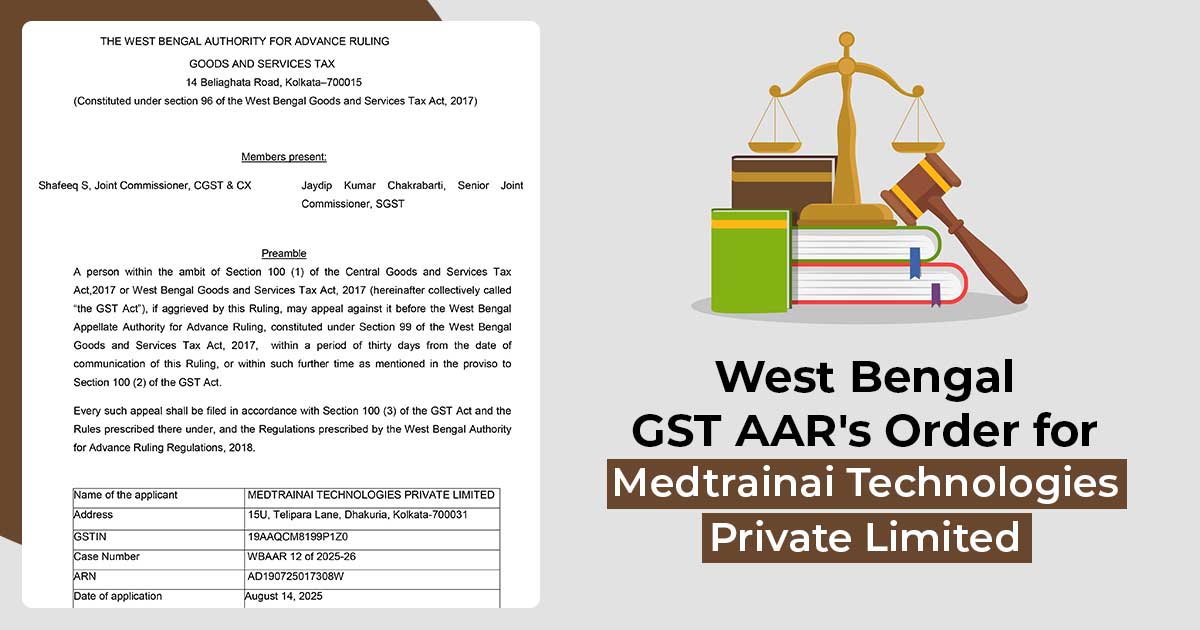

The West Bengal Authority for Advance Ruling (AAR) has issued a clarification regarding the taxation of fees paid to foreign patent attorneys for overseas patent filings. According to the AAR, such reimbursement is classified as a taxable ‘import of legal services’ and is subject to Goods and Services Tax (GST) in India.

A committee, including Shafeeq S, Joint Commissioner (Member-Central Tax), and Jaydip Kumar Chakrabarti, was analysing a dispute originating from patent filings made in Japan, the United States, and the United Kingdom through foreign attorneys, promoted by an Indian intellectual property firm.

The petitioner, Medtrainai Technologies Private Limited, had engaged Seenergi IPR, an Indian intellectual property firm, to manage patent filings abroad for an invention related to smart manikins and augmented reality.

The patents were filed in favour of one of the applicant’s directors. Seenergi IPR raised invoices in two parts: Part A, which includes reimbursement of foreign attorney and government charges, and Part B, which has its own handling and professional fees, and advised the applicant to release GST under the Reverse Charge Mechanism.

While the petitioner accepted the GST obligation on Seenergi IPR’s handling charges, it disputed tax on the reimbursed foreign attorney fees. It said that the services were used abroad, did not generate financial benefit in India, and hence fell outside the extent of GST.

It mentioned that Seenergi IPR served as a pure agent and that the services must be entitled to exemption as legal services. The AAR, in analysing the case, examined the definition of supply u/s 7 of the CGST Act, the “pure agent” framework under Rule 33 of the CGST Rules, and the place of supply provisions u/s 13 of the IGST Act.

The Bench examined the pertinent exemption and reverse charge notifications, as well as the definition of an advocate outlined in the Advocates Act of 1961. It ultimately dismissed the arguments presented, with the GST Authority for Advance Rulings (AAR) describing the assertion that overseas patent filings fall outside the scope of GST as questionable.

It ruled that, in the absence of any contractual agreement confirming Seenergi IPR as a pure agent, the reimbursement must be included in the taxable value. The Authority ruled that services rendered by Japanese, US, and UK patent attorneys were directed to an import of legal services, with the place of supply being India, as the receiver was from India.

The authority said that patent filing is integrally linked to business activity, observing that:“…. the act of filing a patent is to protect their intellectual property in the respective jurisdiction, which, in our view, is very much in the course or furtherance of the applicant ‘s business.” AAR on the question of exemption aligned its analysis with Entry 45 of Notification No. 12/2017–Central Tax (Rate) and explained that foreign patent attorneys are not entitled as “Advocates” or “Senior Advocates” under the Advocates Act, 1961.

Legal services furnished by Japanese and other foreign attorneys were not qualified for exemption. The authority mentioned that such services were provided in the course or furtherance of the foreign attorneys’ business and thus included a taxable supply.

Read Also: WB AAR: 18% GST to Be Levied on Hiring of Air Conditioning and Fire Extinguishing Systems

As per that, the AAR ruled that GST at 18% was subject to be filed via the applicant on both Part A (foreign attorney fees) and Part B (Seenergi IPR’s handling charges) on a reverse charge basis.

| Applicant Name | Medtrainai Technologies Private Limited |

| GSTIN | 19AAQCM8199P1Z0 |

| Case Number | WBAAR 12 of 2025-26 |

| Applicant | Mr. Nilabhra Banerjee |

| West Bengal GST AAR | Read Order |