GSTR 1 is filed by all the registered taxpayers under the goods and services tax. It includes all the sales returns (outward supplies) of the business firm. It is mandatory to file a GSTR 1 return by every taxpayer and has to file accurate data in the return filing.

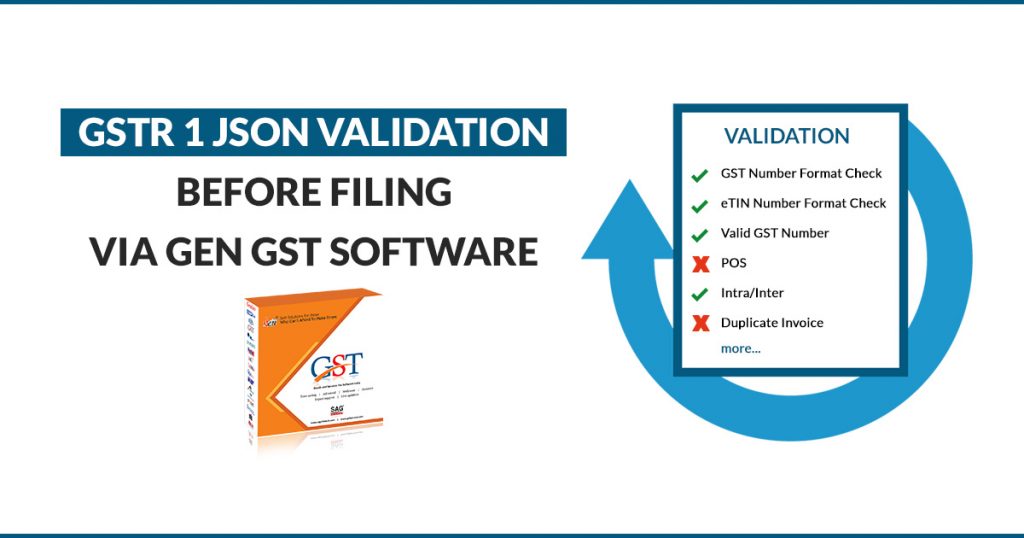

Gen GST software becomes the solution for all the JSON validation issues while filing GSTR 1 on the GSTN portal.

Sometimes it is a complex task to find errors in the JSON uploading and the reason behind them, therefore, Gen GST software (Return & Billing) find the actual issues and offers the solution in the spot to make you aware of your mistakes before filing a GST Return.

Here we will learn some of the common JSON file validation issues with their reason. Let us go through all those issues and their reason in brief for the understanding:

GST Number Format Check – The system will check the GST Number format from the selected JSON file.

eTIN Number Format Check – The system will check the eTIN Number format from the selected JSON file and show the total number of records, valid, invalid, the status of the records.

Valid GST Number – The system will check the Valid GST Number from the selected JSON file and show the total number of records, valid, invalid, the status of the records

POS – The system will check the POS from the selected JSON file and show the total number of records, the valid, invalid, status of the records.

Intra/Inter – It will check the Intra/Inter from the selected JSON file and show the total number of records, the valid, invalid, status of the records.

Duplicate Invoice – It will check the duplicate invoices from the selected JSON file and show the total number of records, valid, invalid, and status of the records.

Duplicate Dr/Cr Note – It will check the duplicate Dr/Cr Note from the selected JSON file and show the total number of records, valid, invalid, status of the records.

Invoice No. and Date In Dr/Cr Note – It will check the Invoice No and Date in Dr/Cr Note from the selected JSON file and show the total number of records, valid, invalid, status of the records.

Tax Type Check GSTN – It will check the Tax Type Check GSTIN from the selected JSON file and show the total number of records, valid, invalid, and status of the records.

POS Tax Type Check – It will check the POS Tax Type Check from the selected JSON file and show the total number of records, the valid, invalid, status of the records

Schema Check – It will check the structure from the JSON file like Key and Value Pair. If the key is blank then it will show an error message. It will check the Schema Pattern from the selected JSON file and show the total number of records, valid, invalid, status of the records.

Summary – It will check the Compulsory Field from the selected JSON file and show the total number of records, the valid, invalid, and status of the records.

Check Date – The system will check out for the accurate date on which the JSON file has been uploaded to ensure compliance clearance.

Export – All the export details are analyzed and checked out whether they are appropriately input while also cross-checking if they are from the SEZ unit or not.

Tax Amount Check With Rate – Complete cross-checking is done by matching the tax amount with the eligible tax rate and correcting if there is a mismatch.

Check eTIN – The system also checks the eTIN given in the JSON file and validates it as per the required format.

Registration In Billing – The system will check through the registration date and invoice date and will further cross-verify that the registration number must be dated before the invoice date.

Credit Check – The system will further check the credit from the uploaded JSON file while checking out the whole number of the valid, and invalid status of the record data.

Difference B/w Invoice Value & Total Value – The system will check through the item value as well as the total value to determine the figures of the invoice submitted.

Check Invoice Date & Invoice No In CDNR – The system will go through the invoice date and invoice no. in the CDNR and will further show the total valid & invalid status of the records.

Check SEZ GST No. – The system will check the eligibility of GST Identification Number (GSTIN) with the SEZ ID so the applicable compliance and revisions can be sorted from the JSON file.

Check Cancelled/Suspended GST No. – The system will bring out the Cancelled/Suspended GST no. list from the existing records so that the user can update the same into a B2C transaction.

HSN Code – The system will bring out the incorrect HSN code that the user has entered in GST Software before uploading the same on the GST portal.

Gen GST offers all the return filing features such as unlimited client return filing, GST e-way bill generation and other GST-related compliances. download GST software setup, click here!