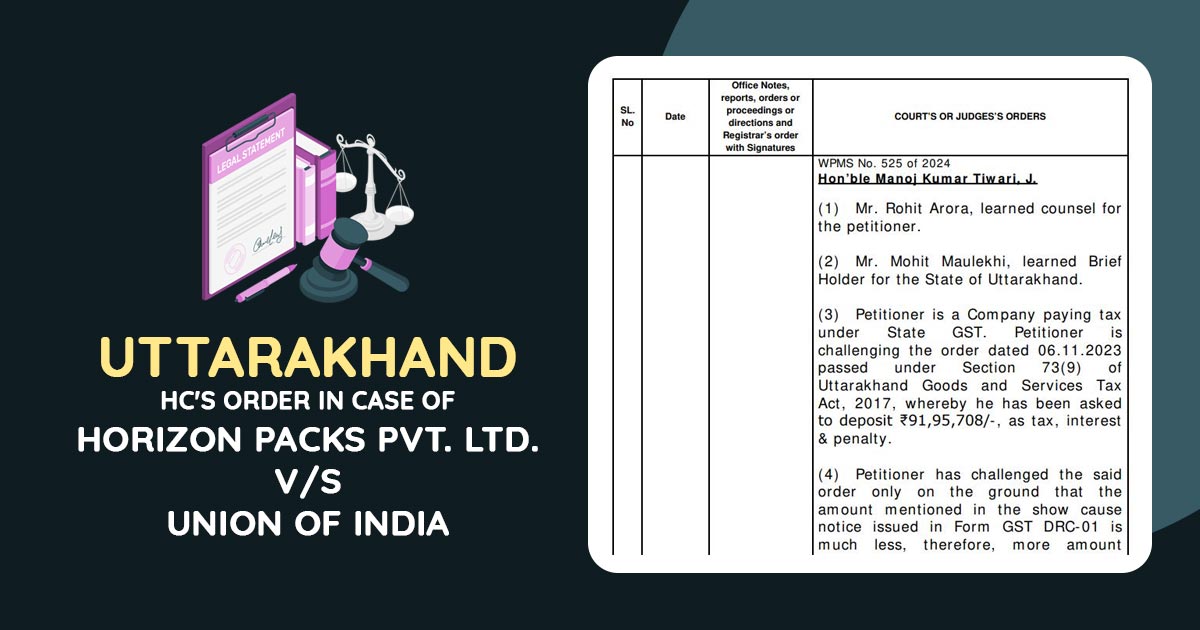

The Uttarakhand High Court, under Section 73(9) of the Uttarakhand Goods and Services Tax Act, 2017, addressed a petition filed by a company contesting an order demanding ₹91,95,708 as tax, interest, and penalty.

The discrepancy between the demand in the final order and the amount stipulated in the initial show cause notice (Form GST DRC-01) is the sole foundation of the challenge by the applicant, which cited a lower sum of Rs. 27,06,340.

The counsel of the applicant, Section 75(7) of the Act, states that the amount of tax, interest, and penalty demanded in the final order cannot surpass the amount mentioned in the SCN, and no demand can be verified on grounds not cited in the notice.

The counsel for the state accepted that the impugned order was not under the above-mentioned provision of the Uttarakhand Goods and Services Tax Act, 2017, as the final demand surpasses the amount cited in the Show Cause Notice (SCN).

The HC determined that the writ petition was obligated to be permitted under the clear breach of the statutory provisions.

Thereafter, the court quashed the impugned order on November 6, 2023. A proper officer has been granted liberty by the court to begin the proceedings afresh in the case.

Read Also: Uttarakhand HC Slams Dept Over Unlawful GST ITC Blocking, Questions Legal Basis for Coercive Action

The HC mentioned that the proper officer shall pass a final order in 4 months, though only after complying with the obligated process under the law.

| Case Title | Horizon Packs Pvt. Ltd. V/S Union Of India |

| Citation | WPMS No. 525 of 2024 |

| Uttarakhand High Court | Read Order |