The Union government has formed the Hyderabad bench of the Goods and Services Tax Appellate Tribunal (GSTAT) in Telangana to hear appeals against orders passed under the GST law.

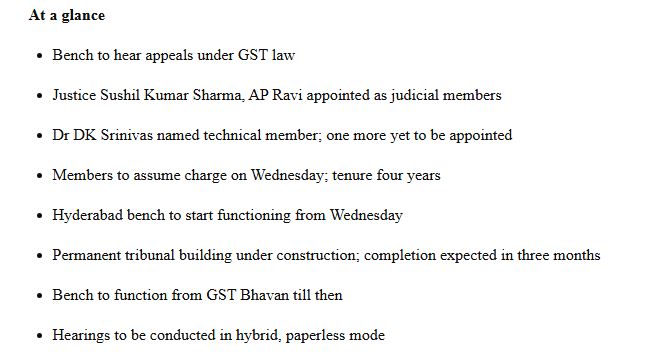

Official directives have been released, designating Justice Sushil Kumar Sharma and Justice AP Ravi as judicial members, with Dr DK Srinivas appointed as the technical member. The members are set to take charge on Wednesday and will serve a four-year term.

The GST Appellate Tribunal (GSTAT), under the GST framework, adjudicates appeals against orders passed by GST authorities and revisional authorities. In New Delhi, the principal bench of the GSTAT is located. While state benches hear cases within their respective jurisdictions.

Till now, GST appeals in the state have been addressed by commissioners serving as appellate authorities, necessitating that dissatisfied traders and taxpayers take their challenges to the high court. The creation of the tribunal means that appeals will now be directed to the GSTAT, establishing a specific appellate body within the GST framework.

The Hyderabad bench, with the members assuming charge on Wednesday, will start operating. The Tribunal’s permanent building development is ongoing and is expected to be completed within the next 3 months. Till then, the bench shall function from a temporary office in the GST Bhavan.

Also Read: Allahabad HC Closes Tax Writ Noting Operationalisation of GST Appellate Tribunal

Proceedings will be conducted in a hybrid mode, permitting both physical and virtual hearings, and will operate in a paperless manner. One more technical member is yet to be appointed to the Hyderabad bench.

The same decision has been admired by legal and trade circles, citing that the tribunal is anticipated to enhance access to appellate remedies under the GST system and ease dispute resolution.