The taxpayer has been permitted by the High Court of Uttarakhand to file a Goods and Services Tax registration cancellation revocation application to restore his cancelled registration for non-filing of GST returns.

As a consequence of a communication gap between the petitioner and his tax consultant, the cancellation appeared, failing to file Goods and Services Tax (GST) Returns of the petitioner for a consecutive period of 6 months.

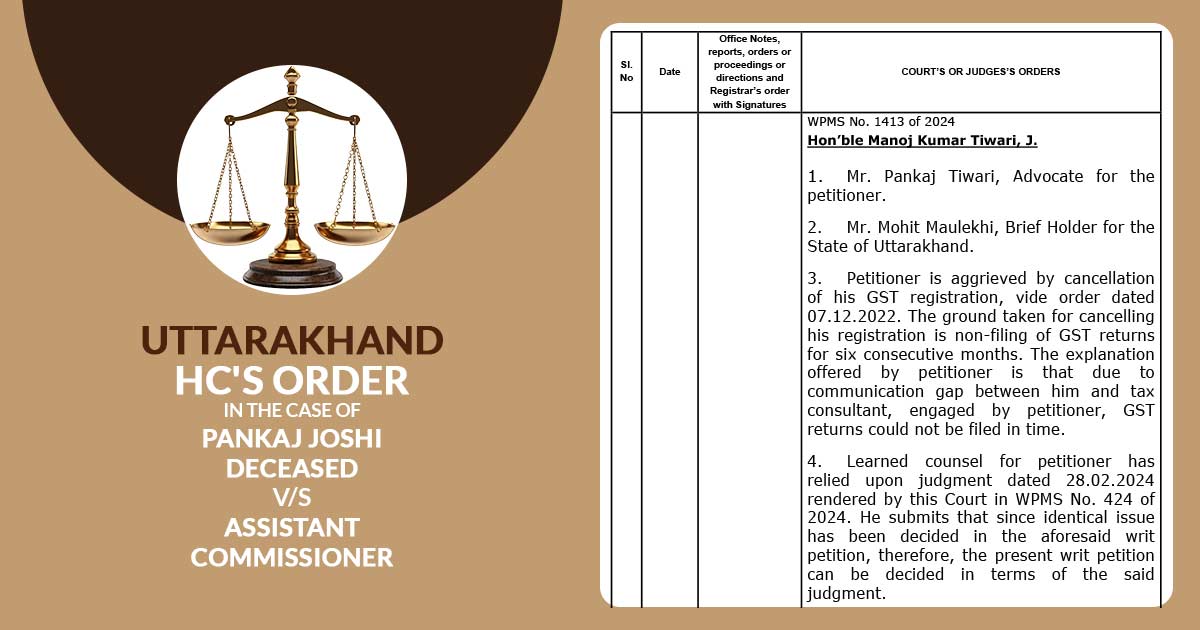

The applicant, Mr Pankaj Tiwari, contested the December 7th, 2022 order via the tax department at the Uttarakhand High Court.

Justice Manoj Kumar Tiwari, presiding over the matter, remarked on the explanation of the applicant concerning the miscommunication with his consultant that directed to the missed filings.

Read Also:- An Analysis of Court Cases on Belated GST Return Filing

Mohit Maulekhi, State Counsel, on guidelines furnished that the dispute involved in this case is identical, consequently, the instant writ petition can be determined as per the judgment rendered in WPMS No. 424 of 2024.

Given the consensus between the parties that the case is covered via the order passed in the aforesaid case, concerning the said order, the present writ petition was decided.

For the revocation of the cancellation order, the applicant can apply within 2 weeks u/s 30 of the Central Goods and Services Tax Act.

The applicant should comprise all the unfiled GST returns and any liability tax dues. If within the said time the application is provided then the related authority shall analyze the same and provide a final verdict within 4 weeks. Consequently, the writ petition in the above terms has been disposed of by the single bench of the Uttarakhand High Court.

| Case Title | Pankaj Joshi Deceased V/S Assistant Commissioner |

| Case No. | WPMS No. 424 of 2024 |

| Date | 16.06.2024 |

| Counsel For Appellant | Mr. Pankaj Tiwari, Advocate |

| Uttarakhand High Court | Read Order |