The notifications issued by GST authorities, have been carried out by the Telangana High Court extending the duration for issuing the Show cause notices pertinent to the tax recovery and Input tax credit cases for the FY 2019-20.

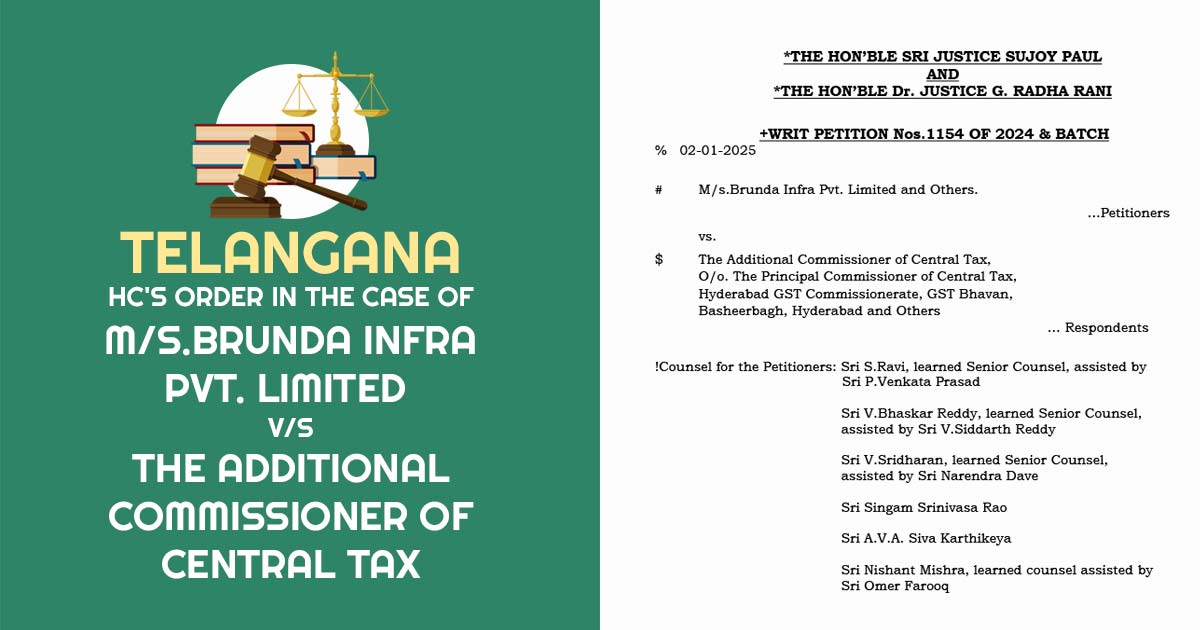

A division bench, Justices Sujoy Paul and G. Radha Rani, allocated this ruling addressing over 300 petitions from different business entities in the state.

The notifications are been contested by the applicant claiming that under the GST Act, Show Cause Notices (SCN) are to be provided within 3 years from the deadline for annual return filing. They claimed that the notices fixed for May 31, 2024, surpass the same time duration and that extensions must merely be allotted in matters of force majeure, not as administrative problems.

It was claimed by the applicant that the time limit could be extended merely under force majeure pre-requisites (acts of God or greater force), not because of administrative challenges.

During Covid-19 the granted relaxations and extensions are no longer applicable as the due date to complete or comply with any measure was extended merely till June 30, 2021.

The petitioners get the advantage of extensions for tax payments during the same period as per the Senior counsel Dominic Fernandes, representing the Central Board of Indirect Taxes.

The HC post getting claims from both parties has wished not to interrupt the notification and SCN. The petitions has been dismissed by the court but preserved the applicant’s right to file the legal pleas against the notices.

Also, the Telangana High Court asked the appellate authorities to regard these appeals on their merits ensuring they are not dismissed merely based on limitation.

| Case Title | M/s.Brunda Infra Pvt. Limited vs. The Additional Commissioner of Central Tax |

| Citation | Writ Petition Nos.1154 of 2024 & Batch |

| Date | 02.1.2025 |

| Counsel for the Petitioners | Sri S.Ravi, and Sri P.Venkata Prasad |

| Counsel for Respondents | Sri B.Narasimha Sharma, and Sri Gadi Praveen Kumar |

| Telangana High Court | Read Order |