Since it will be mandatory for GST taxpayers with turnover of ₹5-₹10 crore to issue e-invoices from 01 August, GSTN has enabled e-invoicing for eligible taxpayers on all IRP portals. Taxpayers can now check their eligibility status on the e-Invoice portal here: https://einvoice.gst.gov.in.

This step has been taken to make such taxpayers familiar with the e-Invoice reporting mechanism and ensure a hassle-free transition to the GST e-Invoice system.

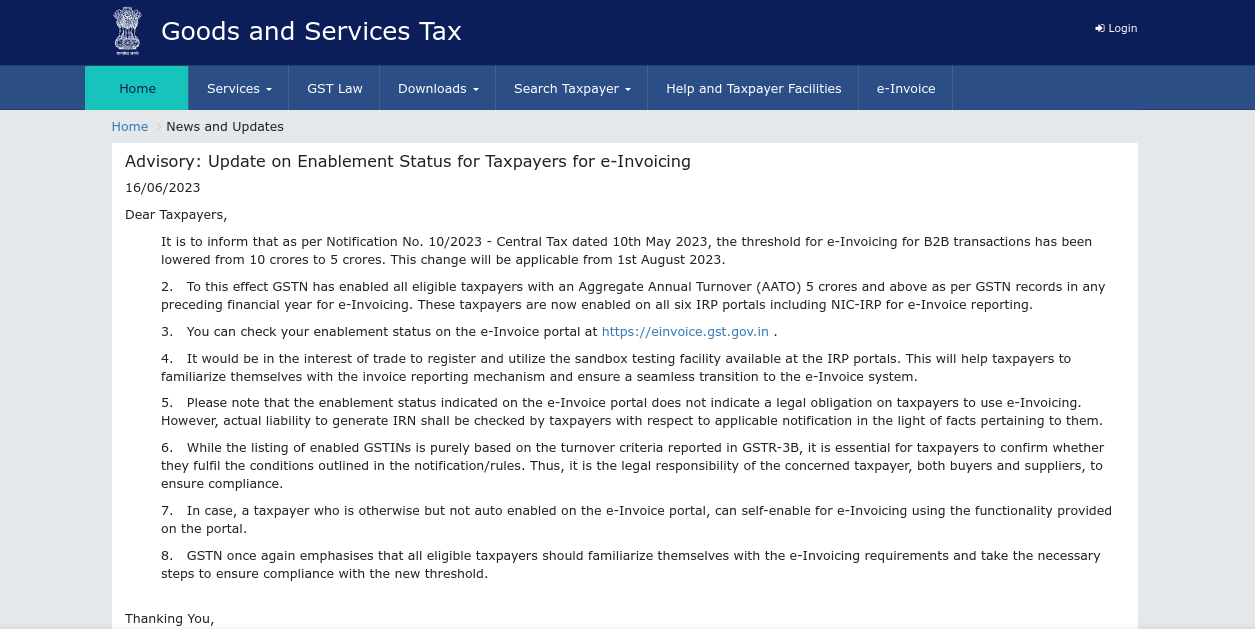

According to an advisory issued by GSTN “GSTN has enabled all eligible taxpayers having Annual Aggregate Turnover (AATO) 5 crore and above in any previous financial year for e-invoicing as per GSTN (GST Network or IT backbone of Indirect Tax System) records. These taxpayers are now enabled for e-invoice reporting on all the six IRP (Challan Registration Portal) portals including NIC-IRP,”

It further added that “It would be in the interest of the business to register and use the sandbox testing facility available on the IRP portals.”

According to CGST’s Rule 48(4), these taxpayers have to generate an invoice by providing the specified details of the invoice (in FORM GST INV-01) on the IRP and getting an Invoice Reference Number(IRN).

The invoice copy having the IRN (with QR code) issued by the notified supplier to the buyer after following the above ‘e-invoice’ process is commonly referred to in GST as an ‘e-invoice’.

Being a standard scheme, ‘e-invoice’ facilitates the exchange of invoice documents (invoice data) between the supplier and the buyer in a unified electronic format. The fact to be noted here is that ‘e-invoice’ in ‘e-invoicing’ does not refer to the generation of invoices by the Government portal. However, an Invoice not registered on the portal will be invalid. In such a case, the recipient can’t avail of Input Tax Credit (ITC) and will attract penalties.

Important: GST E-invoicing Mandatory for Taxpayer T.O. Exceeding 5Cr

The issued advisory further states that the enabling status displayed on the e-invoice portal does not imply a legal obligation on the taxpayers to use e-invoice. However, the actual liability to generate IRN will be examined by the taxpayers as per the facts relating to them as per the applicable notification.

While the list of eligible GSTINs is completely based on the turnover criteria represented in Form GSTR-3B, taxpayers will have to confirm whether they satisfy the conditions mentioned in the Notification/Rules. The advisory adds that .”it is the legal responsibility of the concerned taxpayer, both buyers and suppliers, to ensure compliance”.

In cases where a taxpayer is not auto-enabled, they can utilize the provided function on the portal to self-enable for e-invoicing.

GSTN advised that “All eligible GST taxpayers should familiarize themselves with the e-invoice requirements and take necessary steps to ensure compliance with the new limit.”