The petitioner Metropolitan Transport Corporation Limited is a Government of Tamil Nadu operating the business of providing passenger transportation services. As per the Goods and Services Tax Laws, this primary business activity of the petitioner falls under the exempted category.

The petitioner furnished a copy of the challan on 12-02-2024 proofing the payment of application fees of Rs.5,000/- each under sub-rule (1) of Rule 104 of CGST Rules 2017 and SGST Rules 2017. The online application form for advance ruling on 12-02-2024 was physically received on 22-02-2024 as mandated under Rule 107A.

It was mentioned by the petitioner that they had entered into a lease agreement with the Government of Tamil Nadu dated 20th March 2007 shown by the Regional Transport Officer (RTO) Chennai, for the rental of premises owned by the petitioner. For the same property, the applicant has furnished the information.

The petitioner stated that both parties had agreed to amend the rent every three years based on government orders. However, due to unresolved negotiations, rent revisions for certain years were not carried out. In the fiscal year 2023-24, both parties mutually agreed to revise the rent, settling on a 15% increase every year. The revision was retrospectively calculated from September 1, 2005.

Read Also: Employer Can Claim GST Tax Credit on Services of Non-AC Buses to Employees

The RTO in Chennai will pay the applicant the differential amount of Rs. 1,60,42,203 upon submission of supplementary invoices, as per the agreement. The applicant mentioned that the tenant, who agreed to the revised rent rates, argued that GST does not apply to the increased rent. The tenant claimed that the increased rent rates are related to a time when service tax was applicable, and therefore, no GST is to be levied.

Because of this unclarity, the petitioner was not able to collect the amended rent and raise an invoice.

On December 24, 2023, the tenant stated that they are willing to pay the revised rental value, which includes GST, contingent upon the provision of successive revised rental value inclusive of GST, this is contingent upon receiving successive Advance Ruling orders affirming the Metropolitan Transport Corporation’s position that such rents are levied to tax under GST.

The division bench of D.Jayapriya and A. Valli marked that the applicant had rented out the premises owned by them to RTO, Chennai under the lease agreement. According to the agreement, there is no unclarity for the applicability of GST on the differential rent amount due to the upward revision of rent from 01/07/2017 to 31/08/2022.

Before the bench, the question was that if the collection of the surged rents for the renting of the immovable property services furnished via the petitioner at the time of 01.09.2005 to 30.06.2017 must be considered as the term supply and whether the same is demandable to GST or not.

As per section 142 Miscellaneous transitional provisions in the matter of surged price revision when an enrolled person provides a supplementary invoice or debit notice within 30 days from the revision date and when this revision would be considered as a supply under the GST act and is levied to tax.

Applying it in this case the raised rents in the period 01/07/2017 to 31/08/2022 will be treated as supply under GST and the increased rent amount of Rs.1,60, 42,203 as proposed by the petitioner from 01.09.2005 to 31.08.2022 shall also be obligated to Goods and Services Tax.

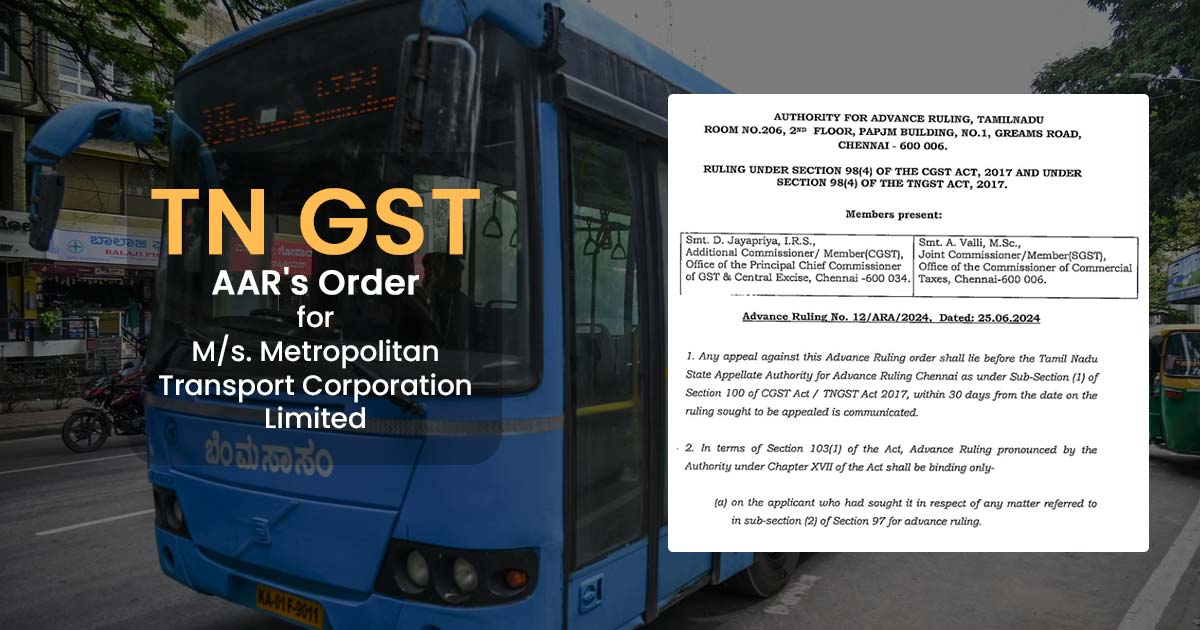

| Name of Applicant | M/s. Metropolitan Transport Corporation Limited |

| Order No | Advance Ruling No. 12/ARA/2024 |

| Date | 25.06.2024 |

| GSTIN | 33AAACP1935C1Z0 |

| Tamil Nadu AAR | Read Order |