The end of February brought a downfall in the collections of the Indirect Tax- GST. The GST collected for the month of January, amounted to ₹ 1,10,828 crore (CGST- ₹ 20,944 crore SGST- ₹ 28,224 crore IGST- ₹ 53,013 crore Cess- ₹ 8,637 crore) whereas that for the month of February it was ₹ 1,05,366 crore (CGST- ₹ 20,569 crore SGST- ₹ 27,348 crore IGST- ₹ 48,503 crore Cess- ₹ 8,947 crore. The month has brought a huge difference of ₹ 5,462 crore in the collections of GST.

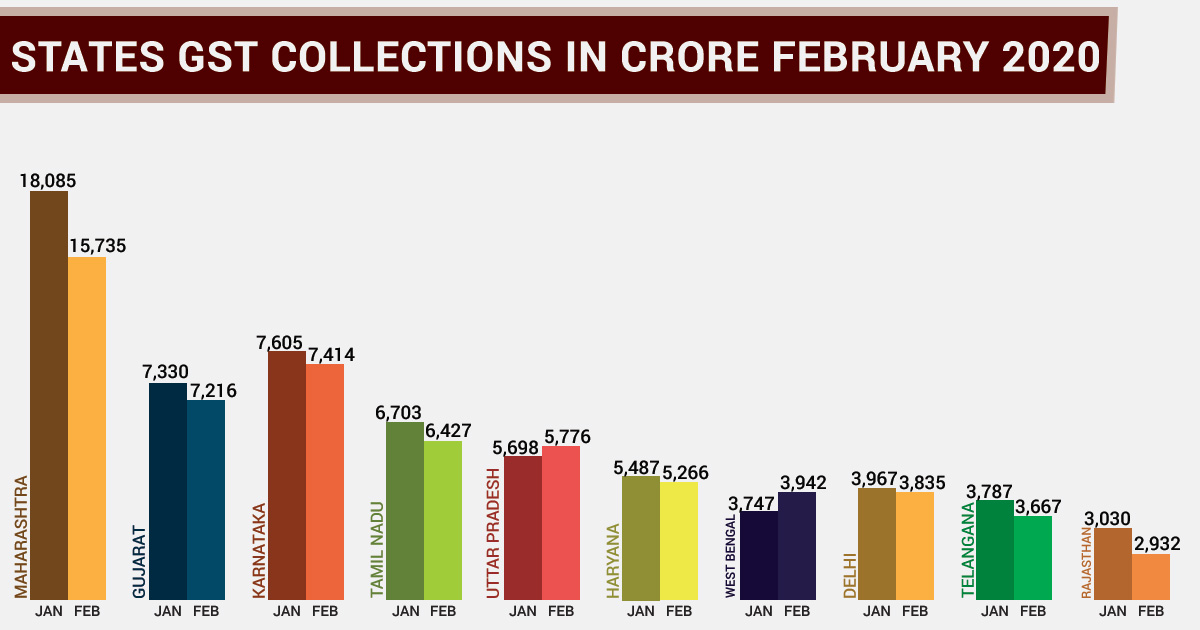

Out of the top 10 states securing the highest amount of GST collections in February, merely two states showed a growth in the collections as compared to that in the month of January 2020 while the rest of the states saw a downfall in the same.

Out of these ten states, only four states noticed a rise in tax collections for the month of February 2020

GST Collections in Top 10 States

| Sr. No. | States | January 2020 (₹ Crore) | February 2020 (₹ Crore) | Year Growth 2019 (%) | Year Growth 2020 (%) |

|---|---|---|---|---|---|

| 1 | Maharashtra | 18,085 | 15,735 | 19 | 12 |

| 2 | Gujrat | 7,330 | 7,216 | 19 | 11 |

| 3 | Karnataka | 7,605 | 7,414 | 4 | 14 |

| 4 | Tamil Nadu | 6,703 | 6,427 | 18 | 8 |

| 5 | Uttar Pradesh | 5,698 | 5,776 | 4 | 13 |

| 6 | Haryana | 5,487 | 5,266 | 14 | 8 |

| 7 | West Bengal | 3,747 | 3,942 | 7 | 13 |

| 8 | Delhi | 3,967 | 3,835 | 13 | 12 |

| 9 | Telangana | 3,787 | 3,667 | 19 | 6 |

| 10 | Rajasthan | 3,030 | 2,932 | 9 | 10 |