Have you ever encountered the error “Failed to establish a connection to the server, kindly restart the emsigner” while signing your GST return or application with DSC? If yes then you can try the following.

While filing GST returns with DSC people occasionally encounter the emsigner errors in two situations: first, when you are filing your GST return and second when you are Registering or updating your new DSC on the GST Portal.

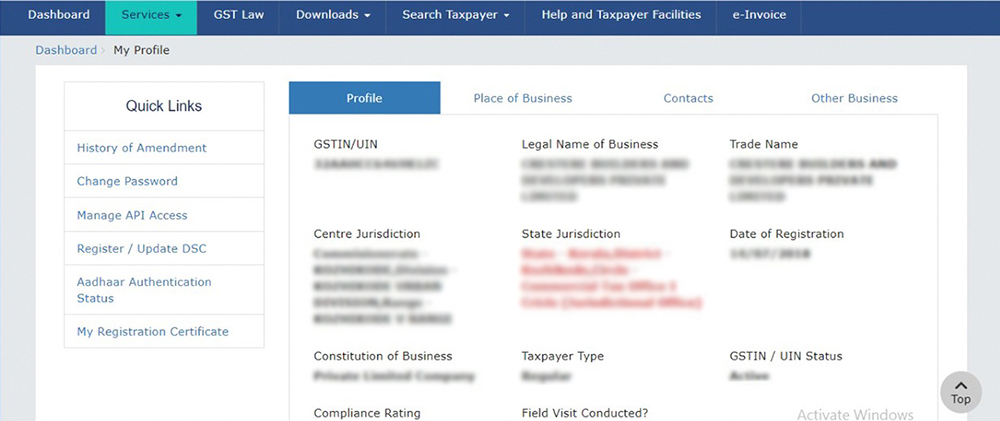

It is worth mentioning that DSC stands for Digital Signature Certificate and it is mandatory for Private Limited Company; Public Limited Company; Unlimited Company; Limited Liability Partnership (LLP); Foreign Company; Foreign Limited Liability Partnership and Public Sector Undertakings.

The following solution will help you to fix the emsigner error or DSC error in GST Portal.

Please make sure that you have the latest version of Internet Explorer and Java installed, then proceed to register or update your DSC in the GST portal. It is because to update your DSC on the GST portal Latest version of both is required.

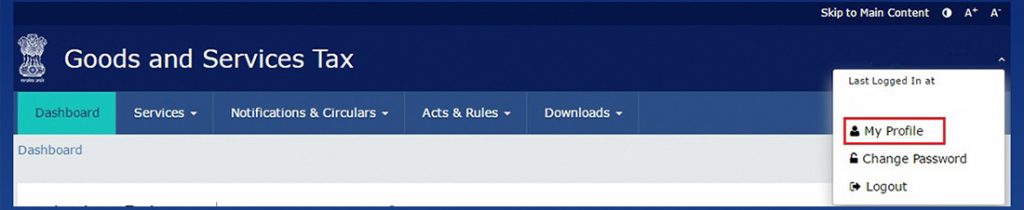

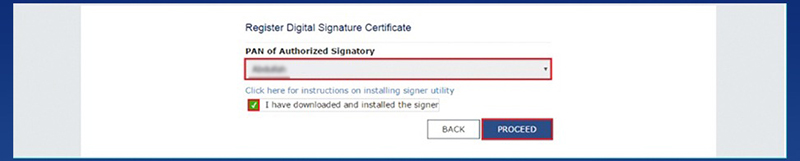

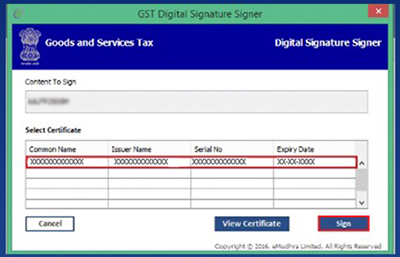

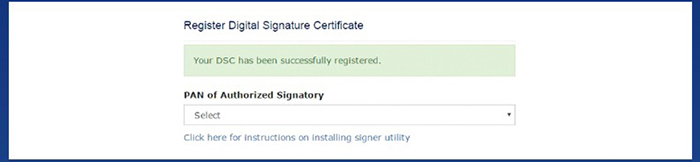

It is worth mentioning that to use your DSC on the GST portal you have to add the person as an authorized signatory to your GST registration, and then you have to register/update your DSC on the GST portal.

That is, you can now digitally sign GST documents using your digital signature certificate.

If you encounter the DSC error “Sorry digital signature certificate missing please plugin the token” when you try to sign a GST return with DSC stick. Then this error occurs when you are using the DSC stick for the first time on your computer, and you have to install a dedicated setup for the stick or pen drive.