The Supreme Court has upheld the imposition of a 100% GST penalty for wilful suppression of facts arising from the non-filing of monthly GST returns. The Andhra Pradesh High Court previously affirmed the penalty under Section 74 of the CGST Act, finding that failure to file mandatory returns and pay GST constituted wilful suppression with intent to evade tax.

The writ petition challenging the penalty was dismissed, and the resulting recovery proceedings by tax authorities were also upheld.

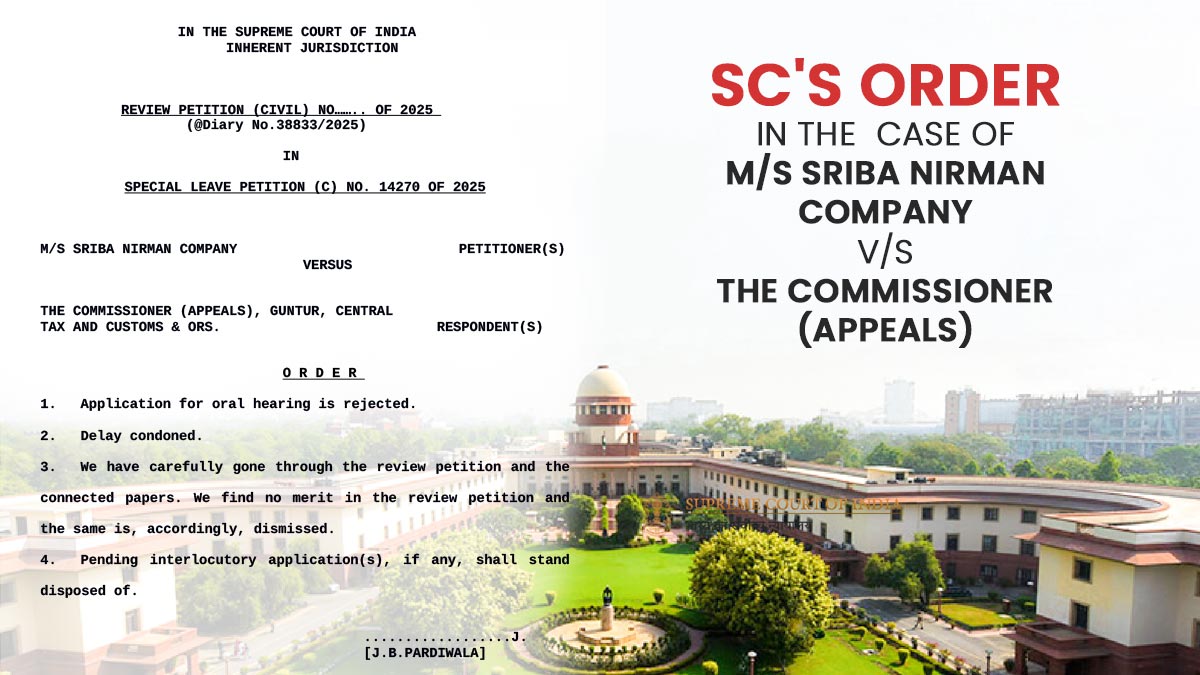

Therefore, the taxpayer, by filing a Special Leave To Appeal (C), approached the Apex court of India questioning the High Court ruling. But, the Apex court did not discover any merit in the challenge and dismissed the petition, thereby affirming the decision of the High court.

The Supreme Court ruled that “No good reason to interfere with the impugned order passed by the High Court of Andhra Pradesh at Amaravati. The Special Leave Petition is, accordingly, dismissed. Pending applications, if any, shall also stand disposed of.” The same reasoning was reiterated when the review petition was filed by the assessee, with the Court repeating, “We have carefully gone through the review petition and the connected papers. We find no merit in the review petition and the same is, accordingly, dismissed.”

The Case

The case is related to a registered works contractor operating under the GST regime, whose activity involved the execution of EPC works as a subcontractor. The taxpayer from July 2017 to March 2018 has raised nine invoices of Rs 920.92 crore, inclusive of GST of 93,19,12,234, in March 2018.

The taxpayer, even after issuing the invoices, does not submit GSTR-3B monthly returns within the statutory deadlines, claiming inability to pay GST because of late payments from its main client. As per the taxpayer, even the partial receipts from the client were not enough to fulfil the tax obligations and execute the project simultaneously.

Officials of the Directorate General of GST Intelligence (DGGI) on 31 July 2018, performed an inspection, seized records, and recorded statements. The taxpayer, after the inspection, had deposited the remaining tax in instalments between 31 July 2018 and 29 September 2018 and submitted all pending returns for FY 2017-18.

But the GST authorities thereafter issued two Show Cause Notices (SCN) in August and September 2020, demanding interest and imposing a penalty, alleging wilful suppression. Via order dated 24 December 2021, the adjudicating authority had validated the penalty u/s 74. The same finding had been kept by the appellate authority, after which a recovery notice was issued asking 93,20,72,233.

The penalty had been contested by the applicant mainly on three bases-

Firstly, section 74 cannot be invoked, as the entire tax amount was paid nearly 2 years before the issuance of the SCN, which does not leave any basis for alleging fraud or suppression.

Secondly, because of financial issues, the non-payment has arrived and is not due to the intent of evading tax.

Read Also: Supreme Court: 100% GST Penalty Requires Proof of Fraud, Orders High Court for Rehearing

Thirdly, with the deadline for annual returns under Section 44 pushed to 7 February 2020, tax authorities had no grounds to act sooner based only on that extension. Yet, the Court made it clear that Section 37 of the CGST Act requires monthly returns, and skipping these filings amounts to suppression of facts according to Explanation 2 to Section 74.

The court stated that u/s 74(5), the immunity from notice has emerged merely when the tax, interest, and 15% penalty are paid before the issuance of notice. Tax was filed before the notice, though interest was paid subsequently, and a 15% penalty was never paid.

Thus, the conditions were unfulfilled to bar issuance of the notice. The Court observed that the taxpayer had received partial payments but chose not to remit GST or file returns, suggesting a deliberate intent to avoid compliance.

In this context, it is challenging to accept the argument that there was no willful intention to conceal facts or misrepresent the turnover of the petitioner, as well as the obligation to pay tax.

| Case Title | M/S Sriba Nirman Company vs. The Commissioner (Appeals) |

| Case No. | Diary No.38833\/2025 |

| Date | 18.11.2025 |

| Supreme Court | Read Order |