The Bombay High Court’s ruling has been kept by the Apex court, which restored the assessing officer’s 100% addition of Rs 20.06 crore as fake purchases u/s 69C, dismissing the Special Leave Petition.

The court, post-hearing the counsel and analysing the record, does not discover any reason to interrupt with the findings of the High Court on the taxpayer’s failure to confirm the purchases, thereby permitting the disallowance to attain the finality.

A modest income of INR 2,84,700 for A.Y. 2009-10 has been declared by the Kanak Impex; however, the department, after some time, again opened the assessment when the DGIT (Investigation) and the Sales Tax Department flagged the assessee as a beneficiary of hawala purchases. Under Sections 148, 142(1), and 133(6) of the Income Tax Act, 1961, the notices were issued various times via post, email, and affixture, but the taxpayer did not appear or answer.

Since the taxpayer is not able to substantiate the purchases or the source of funds utilised for them, the assessing officer passed a best judgment assessment under Sections 144/147 of the Income Tax Act, 1961, and added the whole amount of ₹20.06 crore as unexplained expenditure under Section 69C of the Income Tax Act, 1961.

On appeal, the CIT(A) denied the claim of the taxpayer that notices were not served, noting that the addresses matched and the emails had not bounced. The taxpayer was engaged in receiving the fake bills, CIT(A) concluded. Even after these findings, the CIT(A), by applying the profit estimation principles drawn from Simit P. Sheth (3012), lessens the addition to 12.5%.

The revenue in cross-appeals before the tribunal claimed that the CIT(A) had made a mistake in limiting the addition, and the taxpayer contested the addition. The Tribunal asked the AO to find the gross-profit part embedded in the alleged purchases rather than sustaining the full disallowance. It makes revenue to submit a plea to the Bombay High Court under section 260A of the Income Tax Act, 1961.

The taxpayer is not able to release its burden of establishing the genuineness of the purchases or explaining the fund’s source, the High Court ruled. The CIT(A) and the Tribunal misdirected themselves by assessing profits when the issue was unexplained expenditure rather than low profitability.

The court outlined that once the taxpayer was discovered to have recorded accommodation-entry purchases and given no explanation for the expenditure, full disallowance was mandated by section 69C.

The High Court stated that the taxpayer neither appeared in the reassessment nor provided proof at any appellate phase for the source of the alleged purchase payments. Hence, the court restored the full addition of Rs 20.06 crore of the Assessing officer, and reversed the orders of the Commissioner of Income Tax(Appeals) and ITAT, directing that the total addition not surpass the said amount.

As the Apex court discovered no reason to interfere with the order of the High court and dismissed the SLP, the findings of the HC on fake purchases and section 69C remain undisturbed.

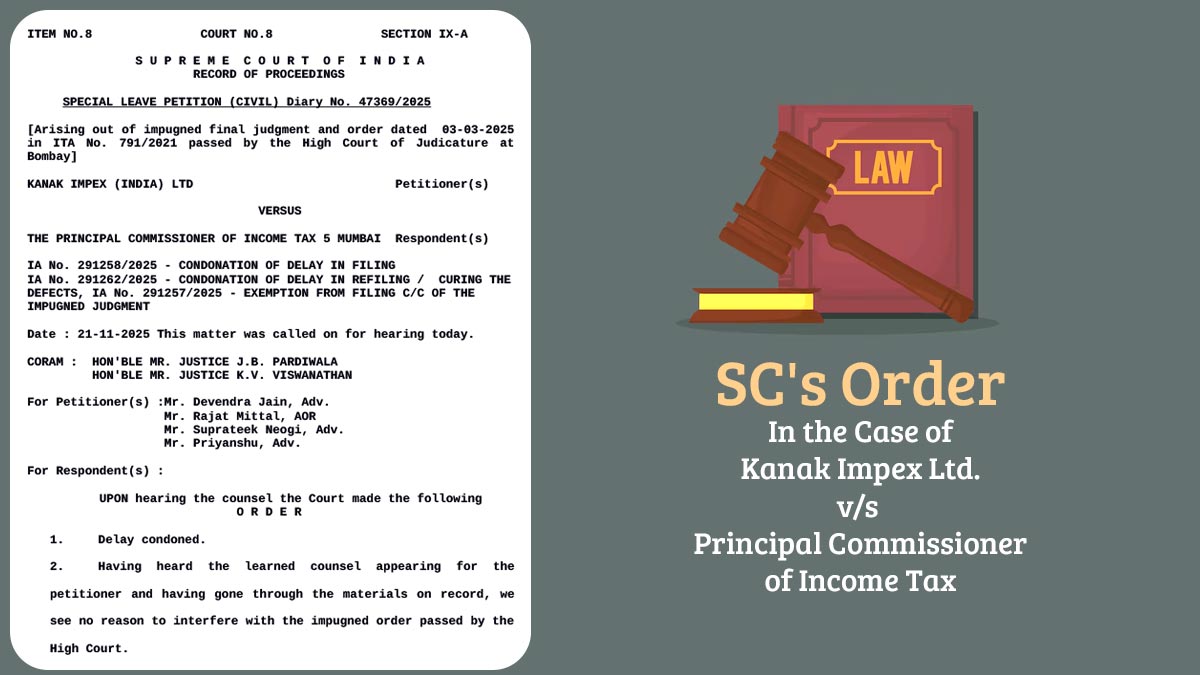

| Case Title | Kanak Impex Ltd. vs. Principal Commissioner of Income Tax |

| Case No. | Special Leave Petition (Civil) Diary No. 47369/2025 |

| Counsel for Petitioner | Mr Devendra Jain, Mr Rajat Mittal, Mr Suprateek Neogi, Mr Priyanshu |

| Supreme Court Order | Read Order |