AAAR ruled that the Authority for Advance Ruling, Rajasthan had made a mistake in pronouncing the ruling on merits. AAR ruling, Rajasthan on 18.10.2022 has been set aside and the case is remanded back to the AAR to determine the application afresh on merits post acknowledging all the questions secured by the appellant in their application on 11.03.2022.

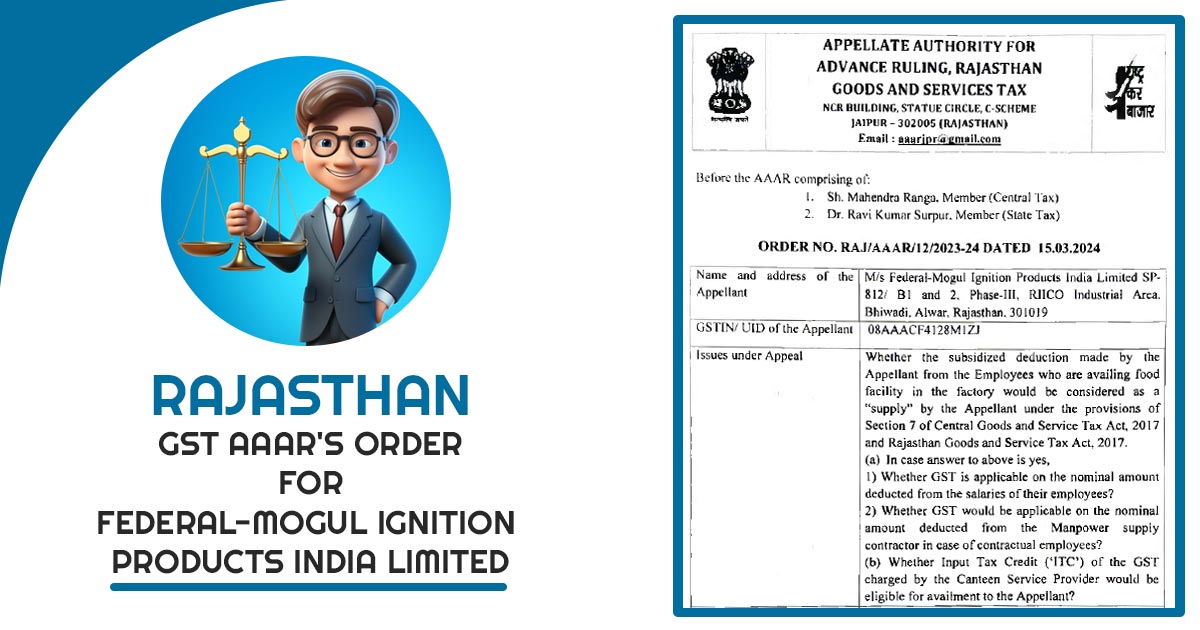

The matter “In re Federal-Mogul Ignition Products India Limited (GST AAAR Rajasthan)” specifies the intricate elements of GST applicability on subsidized deductions for employee meals and input tax credit (ITC) eligibility. This examination delves into the ruling to comprehend the implications for businesses furnishing canteen facilities to their employees.

In-Depth Analysis

From the Authority for Advance Ruling (AAR), Rajasthan, the petitioner, Federal-Mogul Ignition Products India Limited asks for clarity on whether the subsidized deductions from employees claiming canteen services comprise a “supply” under GST laws. Questions raised are:

- GST Implications on Nominal Deductions: Whether GST applies to the nominal amounts deducted from employees’ salaries for claiming canteen services.

- GST on Deductions for Contractual Employees: Whether GST is subjected to be applied on the amounts deducted from contractors for canteen services furnished to contractual employees.

- Eligibility of ITC: Whether ITC is available for the GST levied via the canteen service provider.

The appellant contracted M/s Punjabi Flavours Catering Service to function the canteen within the factory premises, deducting a portion of the meal costs from employees’ salaries and contractors. Since July 2017 the appellant has filed the GST on such recoveries.

Read Also: Gujarat GST AAR: ITC on Employer-Provided Canteen Services (Excluding Employee Contribution)

Initial Decision of AAR

The AAR, Rajasthan, investigated whether the questions posed related to transactions “being undertaken” or “proposed to be undertaken” under Section 95 of the CGST Act, 2017. The appellant was not the supplier but rather a recipient of the canteen services, therefore the application for an advance ruling was deemed non-maintainable, the authority concluded.

Make an AAAR Appeal

The appellant claimed that the term “ongoing” signifies the continuing transactions, which comprises such undertaken since July 2017 and continuing. They quoted the rulings from the additional matters and the Central Board of Indirect Taxes and Customs (CBIC) clarifications sustaining their stance that advance rulings can cover enduring transactions.

Analysis of AAAR

The Appellate Authority for Advance Ruling (AAAR), Rajasthan, concentrated on the interpretation of “supplies being undertaken” u/s 95 of the CGST Act. The AAAR recognized that the appellant’s canteen service contracts, valid at the time of the application period, covered a series of ongoing supplies. Consequently, the transactions persisting after the application date dropped within the scope of “supplies being undertaken.”

AAAR witnessed that each contract covered multiple supplies, and while past supplies cannot be regarded, ongoing and future supplies are qualified for advance ruling. AARs failure to consider the contracts’ validity period during their ruling was emphasized.

Closure: The decision of AAR has been set aside by AAAR, remanding the matter back to the AAR for a fresh ruling on merits. The very decision shows the essentiality of considering the ongoing nature of transactions and advance rulings eligibility under the GST statute. The GST obligations need to be computed by the businesses carefully and the eligibility of ITC during furnishing the subsidized services before employees to ensure compliance and optimize tax advantages.

| Case Title | Federal-Mogul Ignition Products India Limited |

| GSTIN/UID of the Appellant | 08AAACF4128MIZJ |

| Date | 15.03.2024 |

| Present for the Appellant | Shri Vikash Agarwal |

| Rajasthan GST AAAR | Read Order |