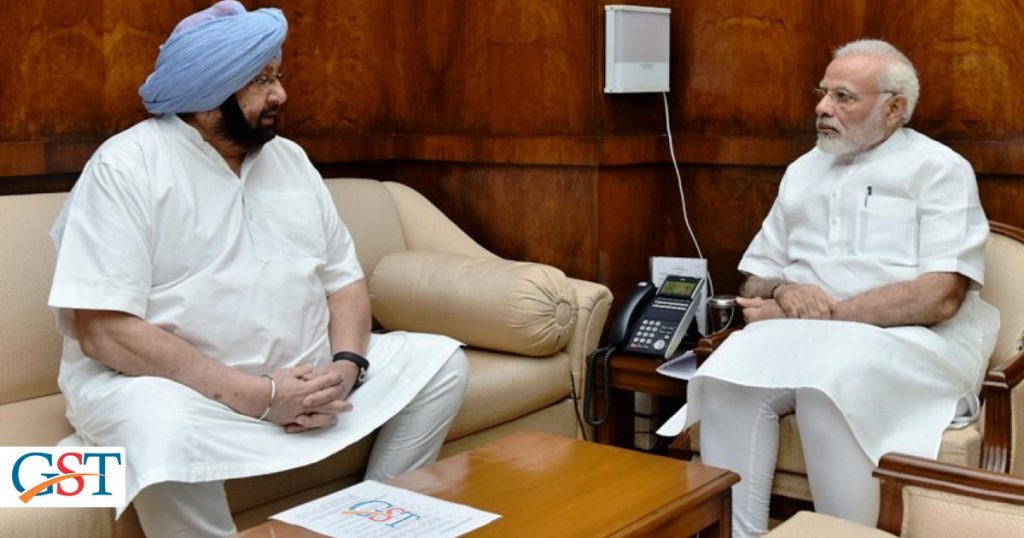

In the congratulating letter to the P.M. on his big triumph in the last Lok Sabha Elections, Punjab Chief Minister Captain Amarinder Singh has presented 101 suggestions to Prime Minister Narendra Modi for simplifying the GST Tax mechanism and abbreviating the issues faced by businesses due to the implementation of GST 1.0. He also suggested the introduction of petrol and diesel in the GST ambit.

The suggestion on elevating the SGST rate over the CGST rate was also made by him to evade the chances for states to suffer high deficits.

In addition to the petrol and diesel, Captain has suggested widening the scope of GST by including electricity and real estate also, which could create a better position for both states and business. He laid emphasis on the fact that the total cost of production in many important sectors includes up to 30 per cent of the cost of electricity generation, and its elimination from GST results in high cascading of up to 10%.

He also said that there is no need to continue the VAT taxation system and it should be fully eliminated. Ideally, there should be uniform GST rates and there should not be more than two GST rates for any chapter. In this way, the mission of “One Nation One tax” will be achieved without any disputes.

An exception of 1.5 per cent increase in GST remained unfulfilled

The anticipated hike of up to 1.5% in GDP after GST remain unfulfilled because Indian businesses have been suffering continuously due to high cascading. He said that the tax credit is the true spirit of VAT and any obstruction in it acts like bad cholesterol in the human body. He further made many suggestions to abolish embedded taxes so that Indian businesses can flourish rather than giving the edge to the imports over domestic production.

With the increasing dependency on technology, Captain Amarinder Singh has presented various tips which would ease the automation of processes under the GST regime in compliance with the constitutional norms.

Despite many revamps and significant alteration in the recent past, GST could not bring clear laws, standard compliance costs and uniform tax rates which obstructed economic growth and left people bewildered. Witnessing all this, Captain Amarinder Singh is looking forward to work with the prime minister to invite prosperity to the entire nation.