The GST Portal secures a pre-filled GSTR-3B form, which automatically populates the tax obligation from the declared supplies in GSTR-1/GSTR-1A/IFF and the Input Tax Credit (ITC) from GSTR-2B.

GSTN is improving the GST return filing process to assist taxpayers in filing their returns precisely and diminish manual errors. Also, the system generates a detailed PDF for every taxpayer that has the auto-filled GSTR-3B form, quoted from the Goods and Services taxes website.

What is the New Hard-Locking System?

The assessees have the option to improve their wrongly reported outward supply in GSTR-1/IFF via GSTR-1A Form furnishing them a chance to do the essential corrections before furnishing their GSTR-3B. The taxpayers could use the updated accessible Invoice Management System (IMS) to manage the inward supplies and guarantee appropriate ITC claims in GSTR-3B.

Taxpayers through this system can make informed choices for accepting, rejecting, or awaiting the inward supplies.

W.e.f January 2025 tax period the GST portal shall proceed to restrict doing amendments in auto-populated values in pre-filled GSTR-3B from GSTR-1/1A/IFF or GSTR-2B to improve the accuracy in a return filing system. It is again recommended that any revision needed in auto-populated values be managed via GSTR-1A or IMS, GST website cited.

At What Time System-generated GSTR 3B Form?

System-generated Form GSTR-3B will be generated and shall be available on their GSTR-3B dashboard page on the grounds of Form GSTR-1 or Form GSTR-2B (monthly or quarterly frequency) when the taxpayer files the Form GSTR-1 and/or Form GSTR-2B has been generated.

The values that are auto-drafted in the system-generated GSTR-3B via Forms GSTR-1 and GSTR-2B and the earlier duration GSTR-3B are not absolute and can be modified via the taxpayer.

What Are the Values Auto-populated from GSTR 1 and 2B to GSTR 3B Form?

Based on the values declared via the respective suppliers in their Form GSTR-1 along with the system-generated Form GSTR-2B, Form GSTR-3B is auto-populated.

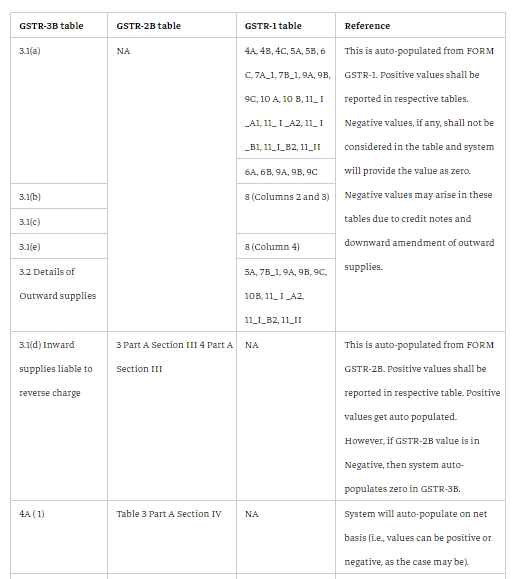

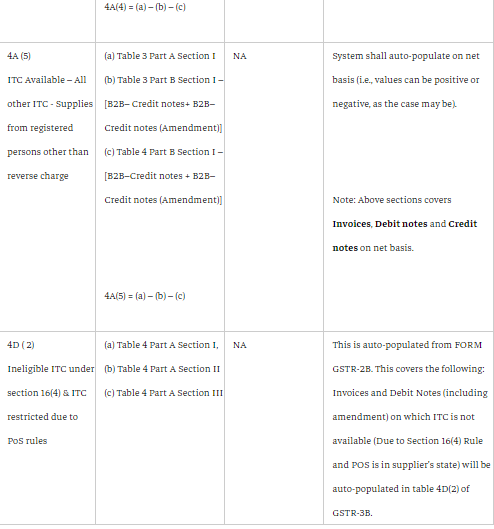

The table-wise data of auto-population are mentioned as:

Note- ITC tables 4A(1), 4A(3), 4A(4) 4A(5), and 4D(2) shall be auto-populated with negative values if there is the case of the GSTR-2B table that has negative values.

Is It Possible to Modify the Values of Auto-populated from Forms GSTR 1 and 2B in Form GSTR-3B?

Yes, at present the auto-populated values in GSTR-3B are kept editable. But the tile with the edited field shall be stressed in RED, and a warning message shall be shown in the matter of the values are edited in the specific way-

- Table 3.1 (a,b,c,d,e ), 4B & 3.2 – if edited downwards

- Table 4A – if edited upwards

On hovering the mouse over the box the system shall furnish both auto-populated values and edited values.