Taxpayers are advised to pay their Income tax on or before 31st December as on non-payment of the returns on the stipulated time, would lead to the payment of huge penalty and the penalty amount could be between Rs. 5000 and Rs. 10,000.

If one has not filed Income Tax Return (ITR) for the Financial year 2017-18, then he/she ought to get this work completed as soon as possible, else would be liable to pay heavy penalty and charges. If the Return is filed after 31st then a double penalty of late filing would get charged, i.e. 10 Thousand. If the return is filed before December 31, 2018, then a fine of Rs 5,000 would be charged a late fine.

The Tax department has taken help of Advertisement for the taxpayers so that it could convey the message of tax payment by the taxpayers before 31st December.

This Rule of tax filing became effective from the assessment year 2018-19. Assessment year would be considered the year after the Financial year for which Income tax is to be filed. Following this, the income tax for the financial year 2017-18 would be filed in the assessment year 2018-19. Just like that the assessment year for the financial year 2018-19 would be 2019-2020. The Extended due date for filing ITR for the Financial year 2017-18 without late fine was 31st August 2018.

The delayed filing of IT returns would subject to paying penalty and this was decided by the Assessing Officer. A new section in this regard was added to the Income Tax Act in budget 2017.

As per the new Section 234F, if a person files a return (Belted ITR) after the last date of filing income tax, then in the maximum charge up to Rs 10,000 would be charged to him.

However, the fee would solely, depend on the duration of the delay.

- If the income tax return date has passed, but the ITR for the relevant assessment year is filed before December 31, then the amount of fee charged would be Rs. 5,000. (In this case, December 31, 2018)

- If the income tax return for the relevant assessment year (January 1, 2019-31, March 2019) is filed between January 1 and March 31, then the fee will be Rs 10,000.

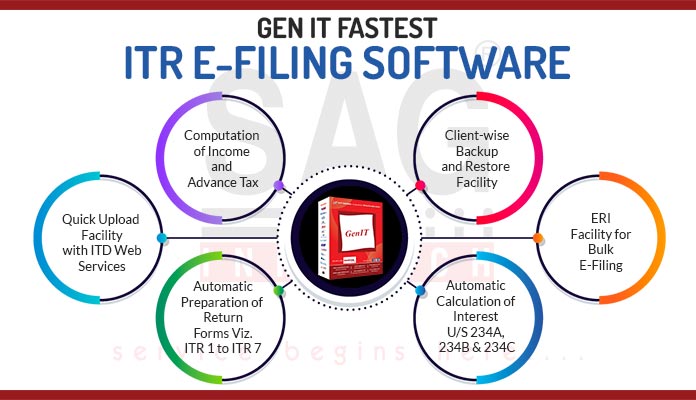

Recommended: Free Download Income Tax Return E-Filing Software

Therefore, if one has not yet filed the Income tax return, file it before December 31, 2018, and avoid heavy duty.

However, if taxpayers’ earnings are within five lakh rupees in the respective financial year, then on March 31, 2019, the amount of penalty against ITR would be Rs. One thousand rupees.