A service tax demand of ₹25.25 lakh has been upheld by the Patna High Court against a travel agency, dismissing its defence that crucial business records had been lost in a fire.

The Division Bench comprising Justice Rajeev Ranjan Prasad and Justice Ashok Kumar Pandey observed, “this petitioner having surrendered his service tax registration had not disclosed the transactions in ST-3. The Taxing Authority were not aware of this, they were looking for cooperation on the part of the petitioner, they called for relevant information and records during investigation but the petitioner did not provide those information to the Taxing Authority. In such circumstance, if the Taxing Authority has taken a view that it is a case of suppression and the facts which have surfaced during investigation were not earlier known to them and they would not have come to know it if the investigation would not have taken place, cannot be found fault with.”

Further, the bench held, “no jurisdictional error has been committed by the respondent no. 2 or respondent no. 3 in invoking the extended period of limitation of five years under proviso to Sub-Section (1) of Section 73 of the Act of 1994.”

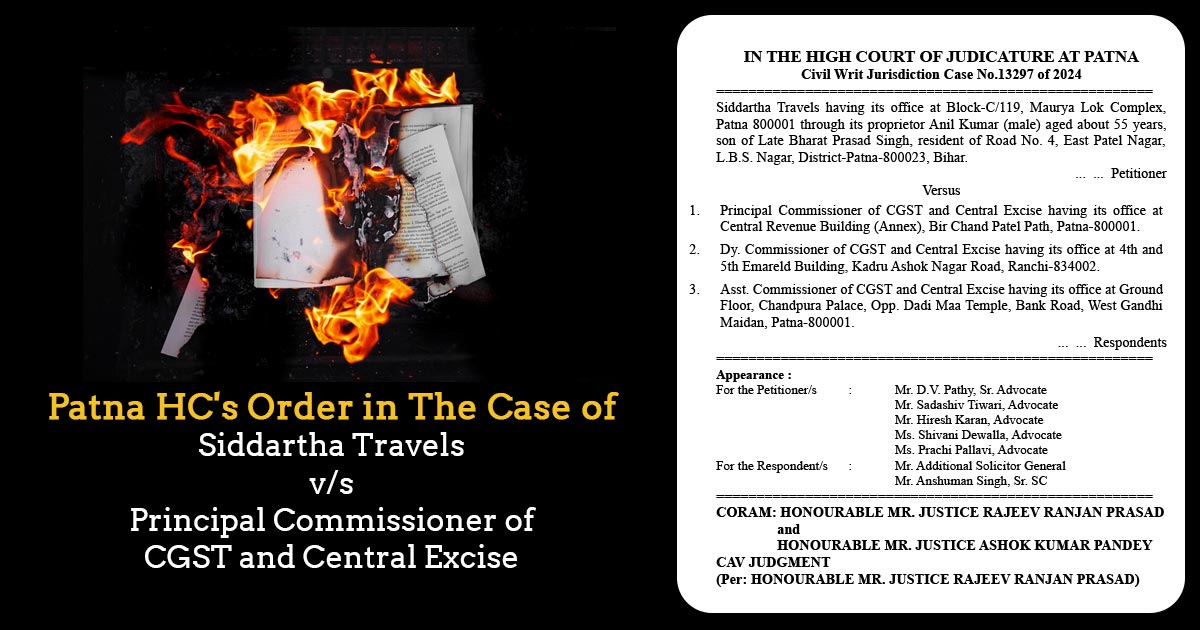

A travel agency based in Patna filed a writ petition to challenge a demand-cum-show cause notice issued by the Assistant Commissioner of CGST and Central Excise on October 17, 2020. This notice concerned the financial years 2015-16 and 2016-17. In it, the Respondent requested the petitioner to explain why they should not be required to pay a service tax of ₹25,25,313, along with an equivalent penalty and additional interest.

The petitioner also challenged the order from the Deputy Commissioner of CGST and Central Excise, which confirmed a service tax demand of Rs. 25,25,313, along with interest and an equivalent penalty.

The applicant, SCN, was restricted, and tax cannot be imposed on gross receipts, though merely on the commission made from ticket sales. It asserted that it was not able to file the records as of the fire that allegedly destroyed all documents.

Read Also: GST Rates and SAC Codes for Services By Travel Agents

Proceeding via distinct judicial pronouncements concerning what shall comprise a fraud, suppression or collusion, the court mentioned that “of the prima-facie view that no jurisdictional error has been committed by the respondent no. 2 or respondent no. 3 in invoking the extended period of limitation of five years under proviso to Sub-Section (1) of Section 73 of the Act of 1994.”

The Court cited, “in the present case, this Court finds that the show-cause notice was issued during Corona period and the petitioner filed it’s defence reply in the month of February 2024 whereafter he was given three opportunities of personal hearing.”

Within 4 weeks from the date of receipt/communication of a copy of the order, an applicant can take their remedy of statutory appeal before the Appellate Authority and if the appeal is filed to the appellate authority then it will be regarded holding that the applicant was pursuing his remedy to this court post passing the impugned order, court concluded.

Consequently, the writ application has been disposed of by the court.

| Case Title | Siddartha Travels vs. Principal Commissioner of CGST and Central Excise |

| Case No.: | Civil Writ Jurisdiction Case No.13297 of 2024 |

| For The Petitioner | Mr. D.V. Pathy, Mr. Sadashiv Tiwari, Mr. Hiresh Karan, Ms. Shivani Dewalla, and Ms. Prachi Pallavi |

| For The Respondents | Mr. Anshuman Singh |

| Patna High Court | Read Order |