A notice from GST authorities has been received to a panipuri vendor from Tamil Nadu after he reportedly received online payments of Rs 40 lakh in the FY 2023-24. On performing a fact check of the notice it was seen that it was issued before a hotel vendor and the to-address part was rigged.

According to a tax expert, Panipuri Wala makes 40 lakh per year and gets an income tax notice. The story’s spread on social media led to a discussion, with many comparing their yearly earnings.

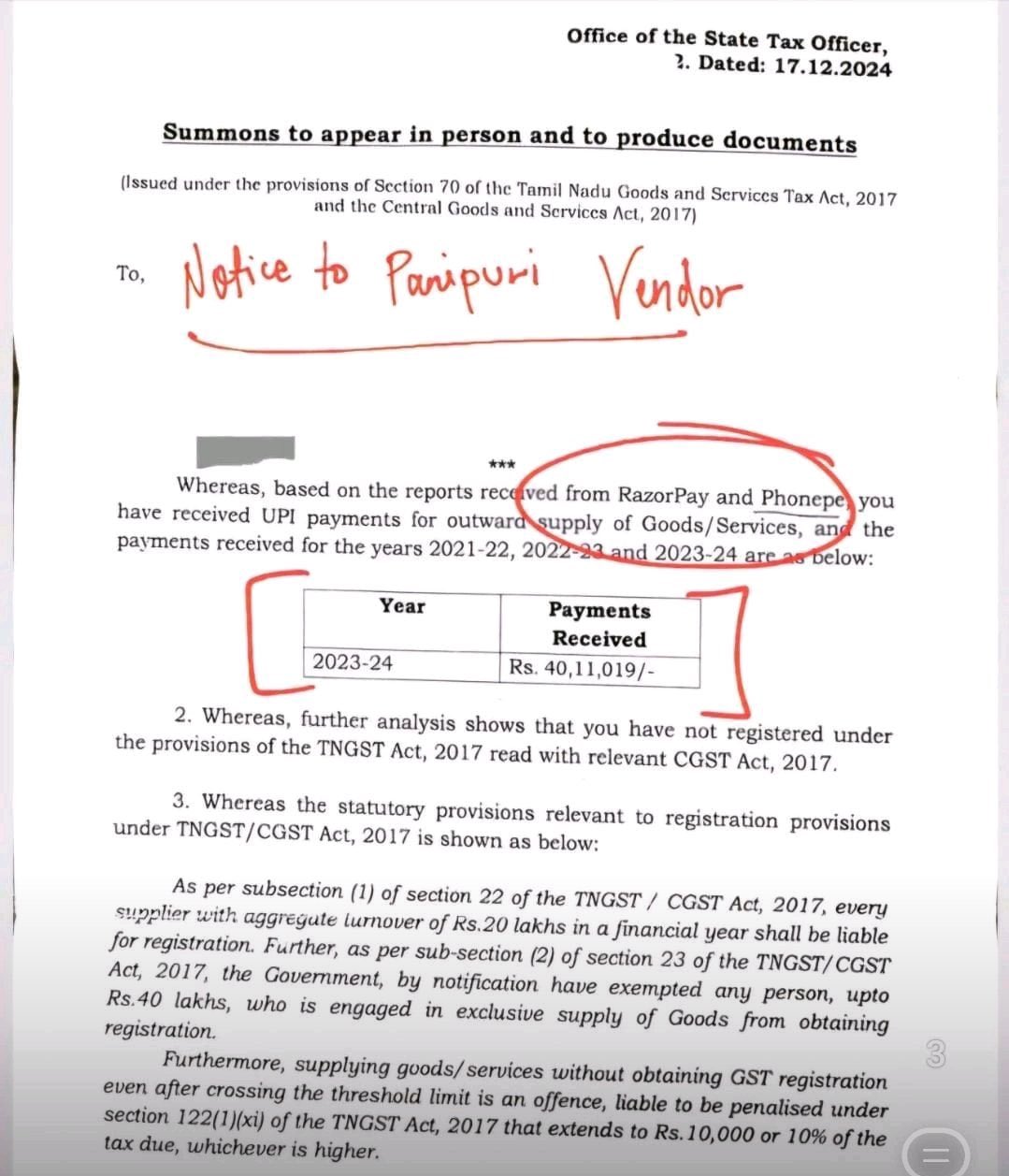

According to the reports, the vendor was issued a summons under Section 70 of the Tamil Nadu Goods and Services Tax Act and the Central GST Act on December 17. Under the GST norms, businesses that are making over 40 lakhs per year must enrol and file the tax.

This image is circulating on social media, but SAG Infotech has not officially verified it.

As per the notice, the vendor was furnished with the summons and sought to show the financial documents pertinent to the financial transactions for the last three years. It indeed mentioned that furnishing the services or supplying goods without GST registration even after having a Rs 40 lakh annual turnover was an offence.

From the fact check by India Today, it was witnessed that the notice had been furnished before a hotel vendor in Kanniyakumari. But the ‘to address’ was discovered to be handwritten and the remaining content was typed.

The notice has been misrepresented. It was merely to notify the vendor to get his registration certificate, counted beneath the GST purview, and take on a GST number, which the vendor, too, considered. The major agenda was this, though certain miscreants have modified the to-address.