The IT Form 49B must be submitted either online or offline to the NSDL department by those who deduct taxes and are looking to obtain a Tax Deduction and Collection Account Number (TAN). This number is essential for processing tax deductions.

All individuals obligated to deduct tax at source on behalf of the Income Tax Department are required to obtain a TAN. If a deductor does not have a TAN, they will be liable to pay a hefty penalty of ₹10,000. Therefore, the process of downloading and filing the TAN application form is essential.

What Does Form 49B Signify?

To apply for a new Tax Deduction and Collection Account Number(TAN), the individual is required to use the Form 49B. The form could be accessed at the nearest Taxpayer Identification Number (TIN) facilitation centre set up to get e-TDS returns.

Importance of TAN Number

Every person who needs to deduct tax at source (TDS) must have a TAN. Similar to a PAN, a TAN is a 10-digit alphanumeric number allotted to a tax deductor and collector. The Income Tax Department provides this number to individuals who apply for it. Every TDS or TCS payment must be made using the TAN.

The TDS return should secure a TAN mentioned on the same. A penalty of Rs 10000 will be imposed if a person deducting tax at the source does not secure a TAN. Indeed, Rs 10000 is imposed for the failure to quote TAN in the TDS challans and TDS certificates.

Instructions for Filing of Form 49B

For filing Form 49B, you must enter all the information in English and block letters. Also, you should fill in one character in each box, including punctuation, alphabet or number, to ensure clarity.

Steps to Apply for the New TAN (Form 49B) Through Gen TDS Software

Here we have discussed simple steps to apply for a new TAN using Form 49B by Gen TDS Software:

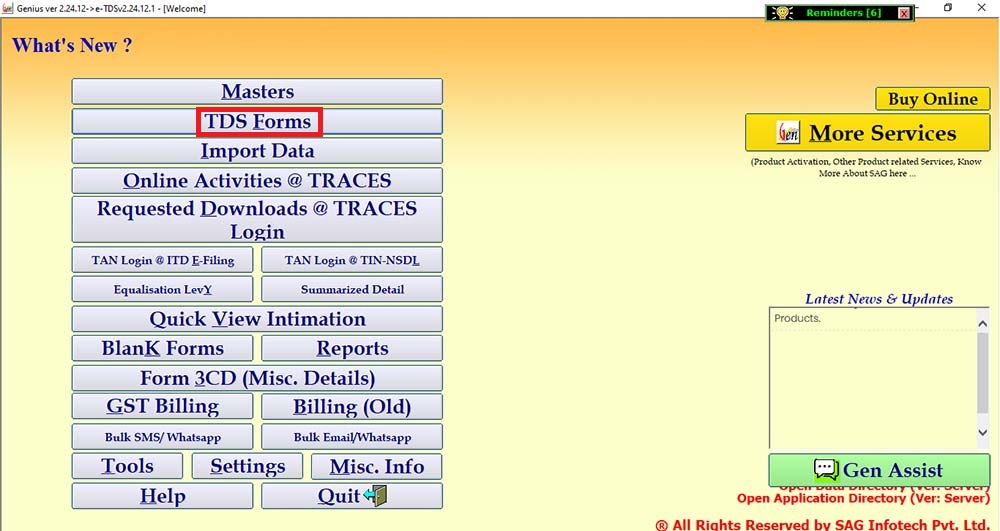

Step 1: First, install the Gen TDS and TCS Return Filing Software and move the cursor to TDS Forms.

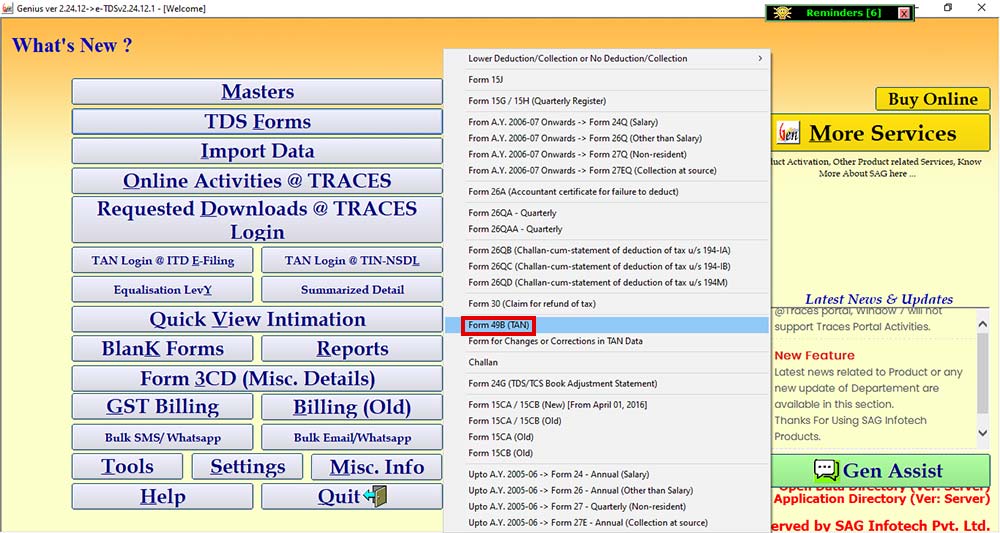

Step 2: Then select Form 49B(TAN).

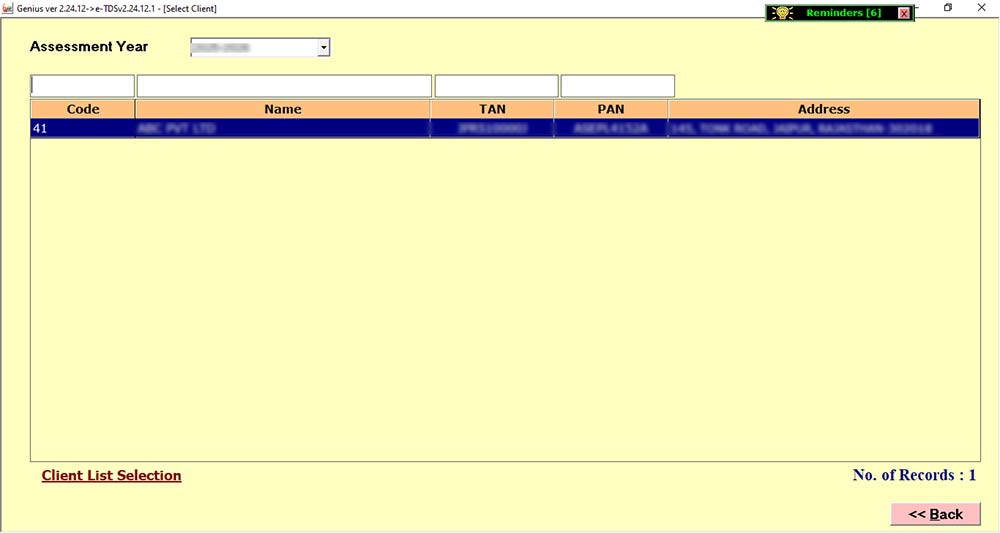

Step 3: Then Select the Client.

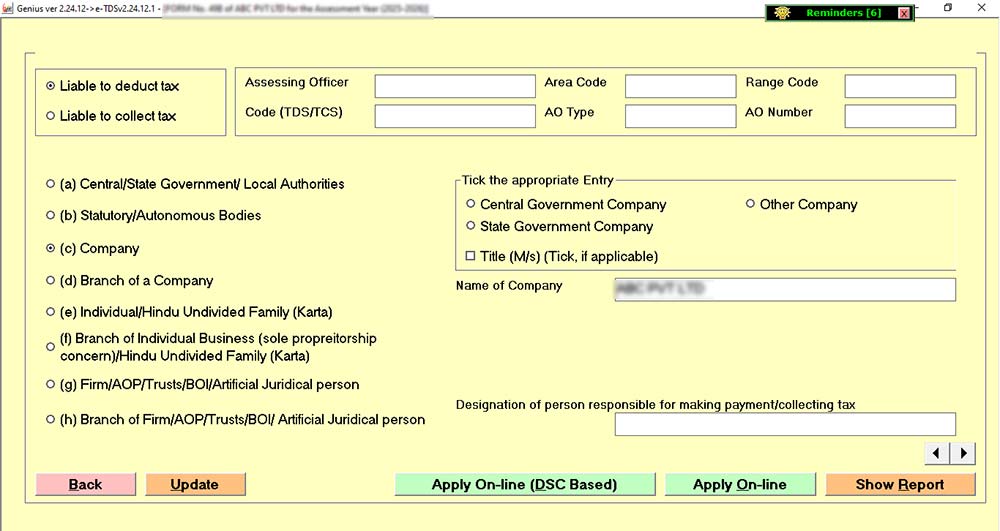

Step 4: Then you need to fill in the data.

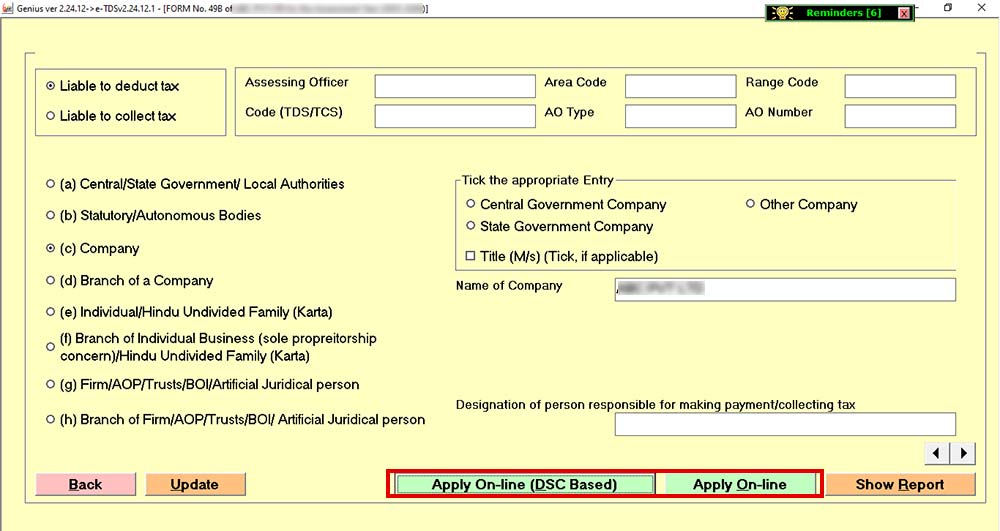

Step 5: Then you have to click on Apply Online.

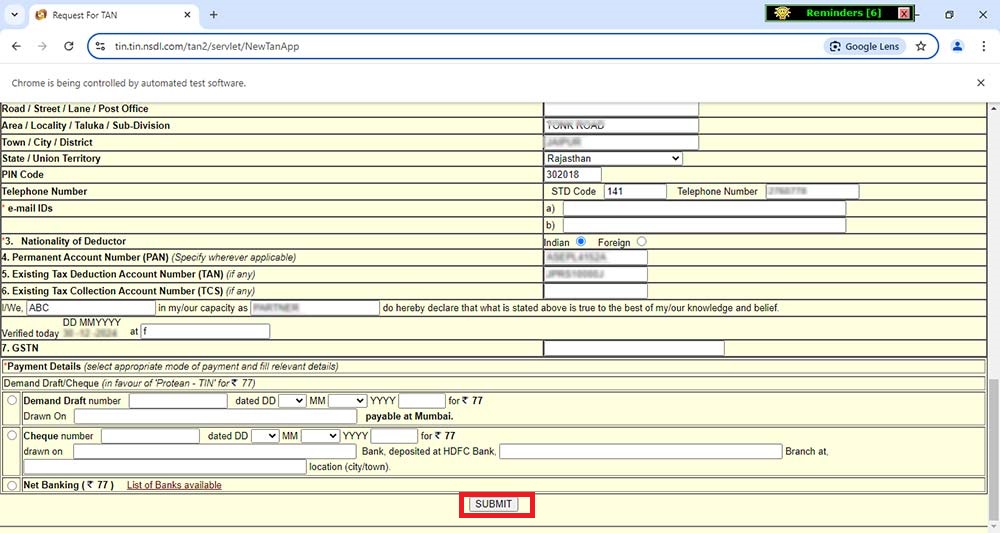

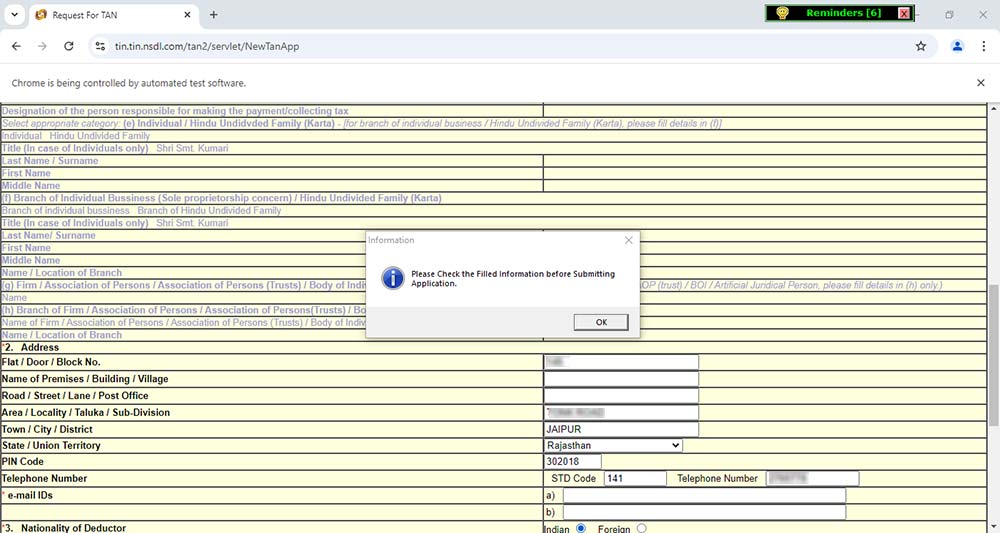

Step 6: Then data will be filled online.

Step 7: Now, please check the data and then click on Submit Button.