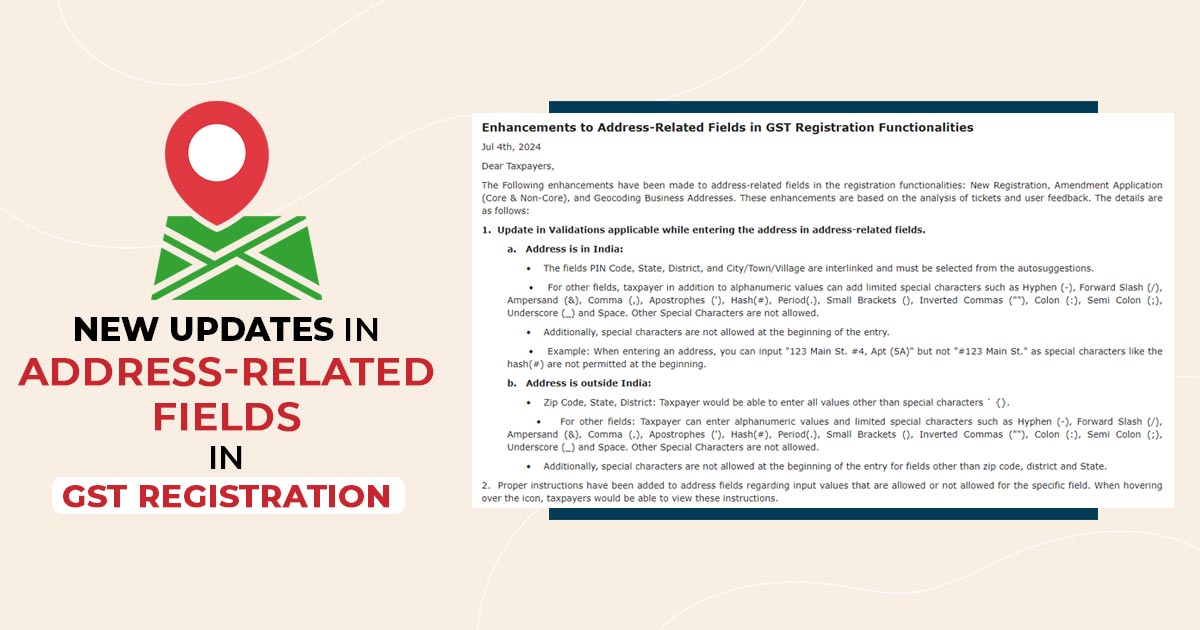

The reassessment notices have been quashed by the Bombay High Court and have been issued based on the data obtained via the Directorate General of GST. The bench of Justice K. R. Shriram and Justice Neela Gokhale has marked that the AO is referring to the data obtained from the Directorate General of GST. Nothing […]