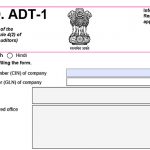

In the context of reducing the tax collections between the bogus invoicing and fake input tax credit, the GST council has now provided the notice to the assessee to conduct an audit. They sought details about the credentials from businesses concerning the fiscal years 2020-21 and Onwards. Latest Update The audit consists of an examination […]