In this article, we try to understand why the GST audit framework is pegged to bring the taxpayer landscape in India. Also, we throw light on the increased role of Chartered Accountants in good tax governance in the Indian Finance Sector.

Tax Audits were part of the erstwhile VAT regime too. The VAT Laws mandated the submission of state-wise annual VAT Audit Reports by an authorized CA within a given time frame. The move was aimed to ease the workload on the tax officers through fast-track verification. The current GST regime also tries to bring into effect stringent tax compliance and governance with similar measures as part of the GST regime too. And in addition to the periodic statutory and tax audits, Annual Audit by certified accountants will be a big step forward in this regard. A major thing that separates the current Audit structure from that of the erstwhile VAT is the noteworthy reach and effectiveness on tax compliance.

It’s time to put our detective hat on and find prompt answers to frequently asked questions on the annual GST Audits.

- Types of GST Audit

- Are You Eligible for GST Audit?

- GSTR-9C: The GST Audit Form

- The Importance of GST Audit Form

- How To Prepare For The GST Audit?

- Few Points to Keep in Mind Before GST Audit Reporting

- What to Expect?

Types of GST Audit

| Type | Executor | Conditions |

|---|---|---|

| Turnover | Any Chartered Accountant/Cost Accountant | If Turnover is more than INR 5 Crores |

| Normal | Any CGST/SGST Commissioner | On the order of the Commissioner- 15 days’ notice |

| Special | Any CA/CS appointed by Commissioner | On the order of Dy. Commissioner with approval of Commissioner |

Section 35 (5)- Turnover Audit

An assessee is required to get his accounts audited if his annual turnover crosses INR 5 Crores. The audit will be done by a Chartered Accountant or a Cost Accountant every year. A financial year is the time period from April of the first year to March of the next year.

Calculation of Turnover

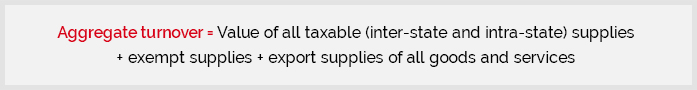

The calculation of turnover is required to be PAN-based which means all the taxpayers registered under the GST Act, having turnover more than INR 5 Crores are required to get the GST audited for all financial years.

Are You Eligible for GST Audit?

GST Audits are mandatory for those registered taxpayers whose annual turnover is greater than Rs. 5 Crore. However, all registered taxpayers must file annual returns at the end of each financial year irrespective of the annual turnover.

The aggregate turnover is evaluated with reference to the Permanent Account Number. In case the aggregate turnover exceeds the minimum prescribed limit, the PAN holder needs to get a GSTIN registration as per the state or union territory in which the business is being run.

An important point to keep in mind for taxpayers is that annual turnover will be evaluated on a PAN India basis whereas audits will be made for each and every GSTIN registered against the PAN.

GSTR-9C: The GST Audit (Self-Reconciliation) Form

For GST Audit, Form GSTR-9C must be submitted. The format for the GSTR-9C form was notified by the Central Tax Notification numbered via notification number 49/2018 on September 13, 2018.

Unlike popular belief, the GSTR-9C is a simple 10-page form. Reportedly, a common concern among business owners was regarding the detailing and complexities of the form. The 10-page GSTR-9C form, however, puts all cush hyped speculations to rest for good. The 10 Page GSTR-9C form is divided into two parts:

- Part 1: Reconciliation Statement

- Part 2: Certification from the Auditor (Not Mandatory from FY 2020-21)

However, a common concern, since the GSTR-9C Form came into the public domain, was that the reconciliation process along with the mandatory auditor attestation on GST records and documents will increase the GST compliance burden as well as account for important business/work hours of taxpayers. The auditors will also feel the brunt of the increased workload as the notification comes into effect.

The Importance of GST Audit (Self-Reconciliation) Form

Section 35(5) and 42(2) of the Central GST Act 2017 mandates Account Audit and Reconciliation for registered GST taxpayers.

- Section 35(5) of the Central GST Act 2017 says, “Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant…”

- Section 42(2) says, “reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement…”

The GST Audit Form Submission dates For FY18

- Section 44 of the Central GST Act states that the GST audit form for FY 2018 must be submitted by December 31, 2018.

Where And How to submit Form GSTR-9C (Audit Form)?

- In line with other Return Forms, GSTR-9C Forms have also to be filed and submitted through the GSTN portal.

How To Prepare For The GST Audit (Self-Reconciliation)?

In the below section, we are describing the different steps which will be helpful for the preparation of their GST audit report:

Step 1: File the Annual Return Form

The Audit Form is intended to check any discrepancies between audited financial statements and the annual return. Annual return is primarily needed to offer an aggregated representation of all the quarterly returns filed by a registered taxpayer. This makes annual returns form the prerequisite for GST audit. The due date for both Annual Return and GST Audit are the same. But it is important for businesses to submit the annual return a few weeks before the deadline to ensure hassle-free GST Audits.

Note: Taxpayers must also separately disclose any disclosure errors in the annual return during GST Audit reporting to mitigate reconciliation differences. The taxpayers must also include specific reasons for the errors in the GST Audit report. Annual Returns with accurate disclosures and null-error are primary for a smooth GST Audit.

Step 2: How to Prepare for Annual Return Filing and GST Audit Reporting (Self-Reconciliation)?

Annual return Filing and GST Audit Reporting require, on part of the taxpayer, the filing of multiple reconciliation statements for bifurcated ITC Claims as per the nature and expense of ITC Claims. These include:

- Nature-wise: Reconciliation of GST ITC available as per the auto-generated Form GSTR-2A

- Expense-wise: Reconciliation three-way split of ITC availed into inputs, input services, and capital goods credits

This is not just related to expense and nature-based ITC Claims. Monthly ITC claims are credited on an instalment basis. All these records are part of the electronic credit ledger. Bifurcations and reconciliations of these ITC entries will burden the businesses. And the need to keep everything in sync with that is made available during auditor data will require a good amount of pre-planning on the part of the business owners.

Few Points to Keep in Mind Before GST Audit Reporting (Self-Reconciliation):

Any error made during Annual Return or GST Audit cannot be rectified. There are no provisions for corrections and any errors made by taxpayers during monthly compliances cannot be undone.

Taxpayers must answer for Non-Reconciled Items: GST Provisions ensure that taxpayers are answerable for any non-reconciled items in Form GSTR-9C. Taxpayers must furnish justified reasons for a non-reconciled item.

There are still clouds over the Submission process for the Audit Report as well as the Annual Return form. The GST department has released both forms in the public domain but it has remained silent over the submission process. Lack of clarity on whether the submission process would be via GST Portal or physical submissions is something undesirable.

Selection of Auditor (Not Mandatory from FY 2020-21):

GSTR-9C, the GST Audit Form, contains two certifications.

- In first, the reconciliation statement is drafted and certified by a statutory or external auditor only.

- In the second, the reconciliation statement is drafted and certified by a non-statutory auditor.

Both certificates differ significantly from one another in terms of language as well as scope.

- Certification of account books is only within the domain of statutory auditors.

- The third person can certify GST records and documents but not the reconciliation statement.

Internal Auditors cannot be appointed as GST auditors.

Keeping in mind the importance of GST Audits in the current indirect tax laws as well as the amount of information to be furnished in the GSTR-9C form, it is advisable to be careful of the institute policies before opting for a GST Auditor.

What to Expect?

The GSTN Portal has been time and again marred with technical glitches. Earlier, traffic issues plagued the network at important hours and hence it would be naive on taxpayers’ part to expect hassle-free Annual Return and Audit Report submission. Furthermore, as the due dates for both submissions coincide, it is advisable to perform run the submission process for Audit Report and Annual Return parallel with one another.

However, a GST auditor is the perfect catalyst for smoothening the Annual Return filing and Audit Report submissions. From documentation to return filing, a GST auditor ensures all verticals work in perfect tandem for zero-friction reconciliation with audited financial statements with the GST audit.

I respectfully disagree with your statement: “In the second, the reconciliation statement is drafted and certified by a non-statutory auditor.”

In my humble opinion, the same statutory auditor can certify in both cases.