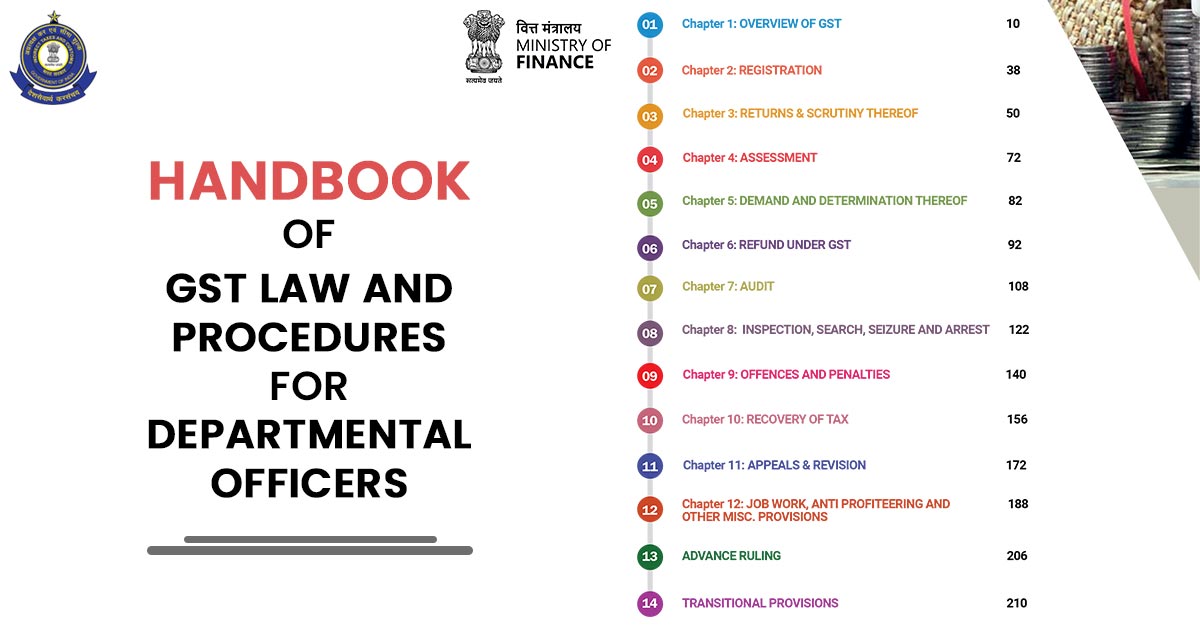

The government is in deep confusion ahead of goods and service tax as for fitting various services across the nation into a fruitful tax slab along with the categories including logistics and transportation which are expecting a lower application of taxes while compared to the current 18 percent spread across on several another kind of services.