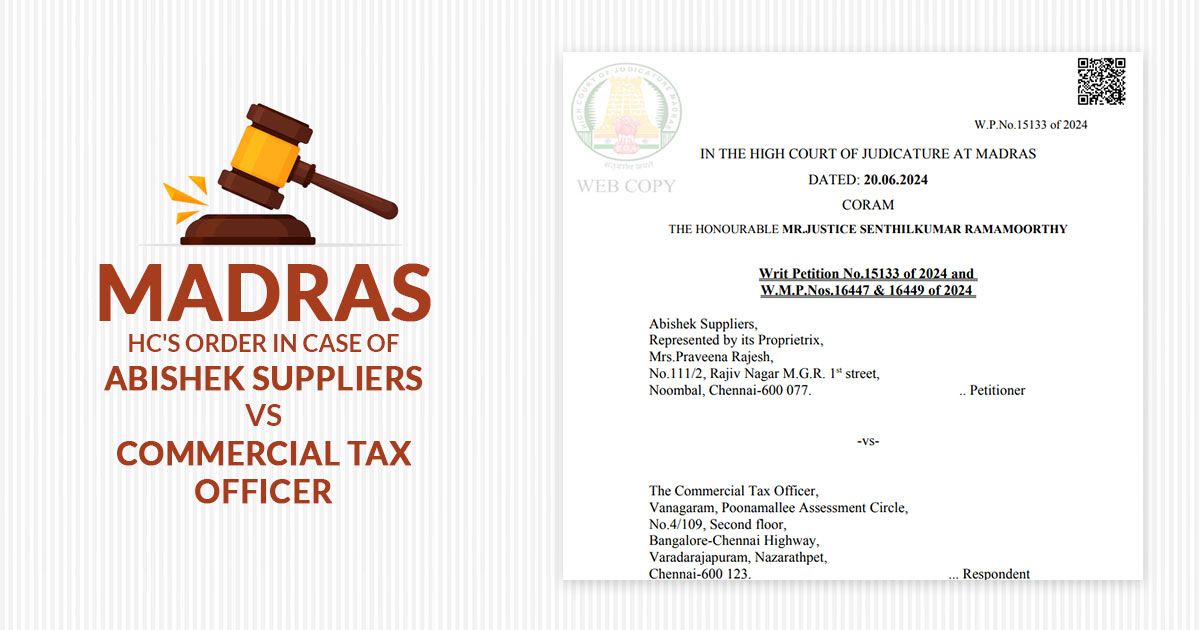

The Madras High Court in a ruling granted relief to Larsen & Toubro by overturning the Goods and Services Tax ( GST ) order and remanding the case for reconsideration. Allegations emerge for the higher Input Tax Credit ( ITC ) shown in the Goods and Services Tax Returns ( GSTR-2A ) compared to what […]