The three and a half lakh e-Way bills generated each day in Coimbatore are an indication of the successful implementation along with large-scale acceptance by the taxpayer.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The three and a half lakh e-Way bills generated each day in Coimbatore are an indication of the successful implementation along with large-scale acceptance by the taxpayer.

The Indian handset manufacturers have sought clarifications regarding the taxes applicable on smartphone batteries and asked for the rationalisation of the taxes.

Recently, the GST council had decided to slash some more tax rates on around 54 services and 29 items in a meeting. Presently, there are 4 GST slab rates namely, 5 percent, 12 percent, 18 percent and 28 percent.

Reserve bank of India (RBI) the highest institution went ahead in progress of multiple regulatory provisions which will impact the entire banking plethora towards a better management.

Alexandre de Juniac, Director General and CEO International Air Transport Association (IATA), was addressing the opening session of the 74th IATA Annual General Meeting and World Air Transport Summit, Sydney today.

Recently, there was discontentment within the finance ministry over the Tax revenues collected by the separate authorities including state and central government.

Under GST provisions, the government collects integrated tax for Goods and Services utilization and later share this collection between the centre and states.

In a bid to give relief to the transporter over the issues related to the GST e way bill, the Allahabad high court had given statement according to which there is no need to carry a hard copy of a GST e way bill along with the goods.

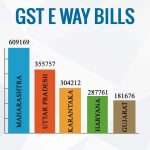

In a report and a tweet from the GSTN account had clearly stated that the Maharashtra tops in generating e way bills for the transportation of goods through motorized vehicles of value more than 50,000.