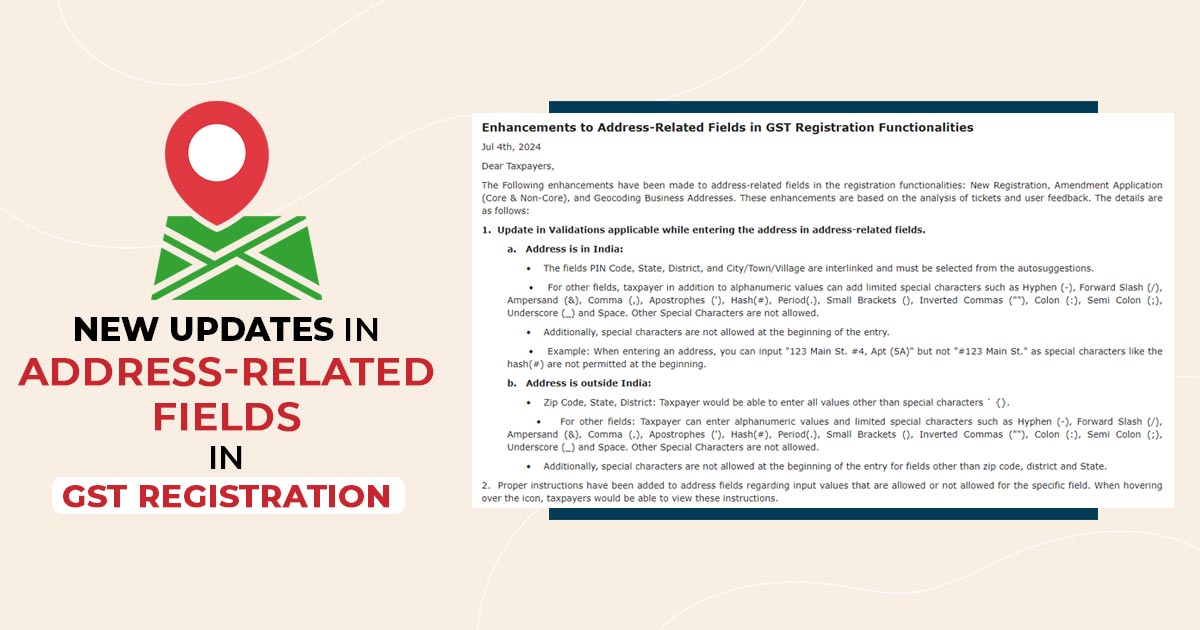

From time to time, the government has been making changes to avoid evasion of taxes and according to a recent update, the government will soon push the efficiency of the indirect tax system These types of taxes paid on Consumption by the consumer but they do not pay directly to the government (unlike income tax). […]