The Authority for Advance Ruling or AAR (Rajasthan) has cleared all pervading ambiguities over GST and Electricity. While Electricity is not under the direct ambit of the GST, but electricity invoices can have GST components at times.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The Authority for Advance Ruling or AAR (Rajasthan) has cleared all pervading ambiguities over GST and Electricity. While Electricity is not under the direct ambit of the GST, but electricity invoices can have GST components at times.

In a bid to check whether the IT and ITes companies of India are evading their GST liabilities, the indirect tax department has started an investigation into the GST credit claims and liabilities of such companies.

In a bid to secure the consumer interest as well as their hard earned money, B Raghu Kiran joint commissioner GST Hyderabad introduced a much-anticipated app called ‘GST Verify’.

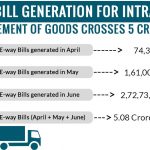

As the GST eway bill is scoring new heights on the parameters of all across the country, there is news coming of surging GST eway bill generation months over a month.

The goods and services tax is a groundbreaking indirect tax regime appeared in the history of Indian economy and politics.

In a move to appease small traders, the Central government has postponed the provisions of Reverse Charge Mechanism under GST.

Builders and buyers have found out the new ways to save 12% GST for under construction flats. As under construction projects engage with difficulties in possession holding, further an introduction of GST in this field has reduced the demand for such projects.

Union minister Piyush Goyal who is also acting as an interim union finance minister in the place of Arun Jaitley had cleared on the GST 1st Year ceremony on 1st July 2018 there are chances of GST rate reduction but with one condition.

The GST E way bill intrastate was applicable from 20th May still giving multiple problems to the traders at various stages.