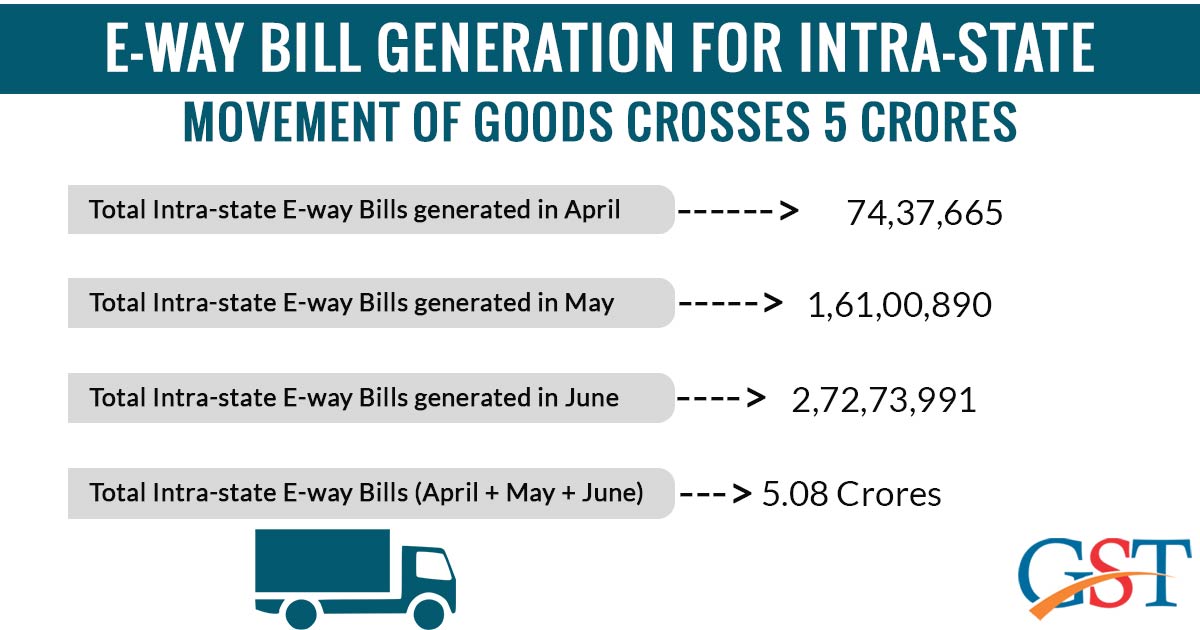

According to the latest infographic shared by none other than GSTN official tweeter handle confirms that the GST eway bill generations have crossed a staggering 5 crore number across all the states combined.

For a rough idea, the total intrastate eway bills generated in the month of April came close to 74,37,665 eway bills. The number may not excite you while comparing it with the present numbers of GST eway bills generated.

Read Also: GST E Way Bill Still A Problem For Traders in Rajasthan

Still at that point in time when the GSTN portal was struck with server issues and technical glitches came with a good number of generation. Now coming to the month of May, the total intrastate GST eway bills generated were 1,61,00,890.

That was almost more than double from the previous month, which shows the credibility of the GSTN servers getting improved day by day. Now if we go through the GST eway bills generated through the month of June, it comes out to be 2,72,73,991 which again proves the success of eway bill implementation.

Till now a whopping 5 crores 8 lakh GST eway bills have been generated making it accountable for goods transported of worth billions of rupees. This shows that the government is tapping each and every corner of Indian businesses to find out the actual transactional data.

Recommended: Gen GST E Way Bill Software For E Way Bill Solution

GST E waybill is an electronically generated bill which is to be carried along with the goods valuing more than INR 50,000 being transported through motorized vehicles across the country or the state.