The Goods and Services Tax (GST) Council is a federal body between the States and the Centre, but according to the States, Centre is enjoying the creamy side of this arrangement and letting the states wait for the dues.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The Goods and Services Tax (GST) Council is a federal body between the States and the Centre, but according to the States, Centre is enjoying the creamy side of this arrangement and letting the states wait for the dues.

The West Bengal Chief Minister, Mamata Banerjee gearing up for the upcoming election has announced the Election Agenda and with this has tried to assure the national audience for a thorough review of the GST system.

It is 18% GST which is being charged on all the outdoor and industry catering services. The caterers urged that the GST tax levy of 18% on outdoor and industry catering services should be brought down to 5%

E-Way Bill is abbreviated as Electronic Way Bill. It was April 2018, when the e-way bill system came into existence under the GST Regime.

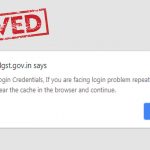

GST taxpayers are encountering a weird situation of invalid credential issues while logging into their GST account on the govt portal even if they input correct details. This issue has now been taken into consideration and the govt has also released a procedure to eradicate such problem.

The Congress president Rahul Gandhi is facing objection by a representative Body of traders especially the small businessmen comprising the retailers, due to his alleged statement where he denoted GST as ‘Gabbar Singh Tax’.

Most of the daily labourers are in deep problems after the implementation of goods and services tax as well as of Demonetisation and are still finding hard to get work and cash in Kerala state.

The GST implementation has affected almost every sector and thus the power sector too. There has been a shift seen in the promotion of the power generation mode.

Clarity regarding GST & ITC is much required by any Company and industry, Big or small, as it touches the Economy part of the Businesses. GST Council has constantly endeavoured to make the process crystal clear and gave proper clarification regarding any discrepancy.