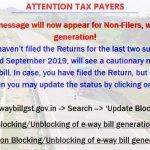

The computer system of the GST portal failed on Tuesday when there was only a day left for filing the GSTR-3B return form. Many taxpayers started facing trouble in filing the returns on GST portal as the portal crashes. Thousands of filers complaint about the issues on Twitter underlining the difficulty they are encountering while […]