The computer system of the GST portal failed on Tuesday when there was only a day left for filing the GSTR-3B return form. Many taxpayers started facing trouble in filing the returns on GST portal as the portal crashes. Thousands of filers complaint about the issues on Twitter underlining the difficulty they are encountering while filing GSTRs right before the deadline.

One user tagged Finance Minister Nirmala Sitharaman & GST Council’s Twitter and wrote on twitter: “The last day to file your monthly #GST return form – #GSTR3B is November 20, 2019. Happy compliance to you!”

Two others complained about the as usual unserviceability of GST portal, writing : “Today is 19th & as usual, #GST portal is not working!” and “#GST portal is not working as usual since morning!!”

Read Also: Reasons: Why GSTR 3B Filing Gets Extended Everytime?

Another person tagged @narendramodi and asked : “Sir, why not declare 19th & 20th of every month as World Glitch Day to be celebrated courtesy @GSTN_IT?”

One user regretted the hardship: “#GSTR3B my 1.26L stuck. bank debited cash ledger not credited. portal says come back after 24 hours. salt over wounds!”

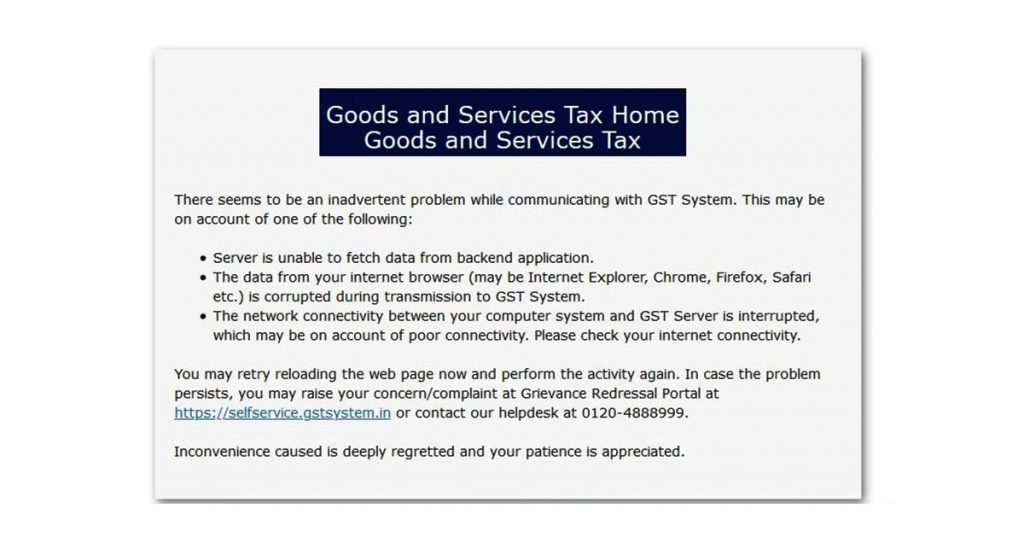

Taxpayers visited the GST portal to files GSTR 3B Return

The due date to file monthly return GSTR 3B is 20th November 2019. The Government was expecting all the GSTR 3B to be filed by this deadline. However, last moment GST portal crash blockade an on-time filing of GSTR-3B by many taxpayers. The Government has not even announced any extension in this due till yet. Taxpayers need to wait for the solution to this issue.

The GST portal have multiple times crashed at the moments of GST return filing due date