GST Council’s 31st meeting has taken some of the major decisions on the higher slab rate. The meeting deliberately made discussion on the items coming under the highest 28% GST slab rate.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

GST Council’s 31st meeting has taken some of the major decisions on the higher slab rate. The meeting deliberately made discussion on the items coming under the highest 28% GST slab rate.

Recently Assam government issued the notifications regarding GST E Way Bill for intrastate movement of goods and has confirmed the implementation from 16th May 2018.

Finally, the 29 Indian States, it seems, has come to a mutual agreement on bringing petroleum-based products under the Goods and Services Tax (GST) radar.

GST e way bill is an electronic bill which will be required for the movement of goods in case the value of the goods are above 50 thousand rupees. The bill can be generated from the GSTN portal and every registered taxpayer must require this e-way bill along with the goods transferred. And learn its […]

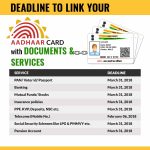

Aadhaar, as the name suggests, has become the basis of all important documents and bank accounts and the government has mandated all the documents to be linked with Aadhaar till 31st March 2018.

Aadhaar, as the name suggests, has become the basis of all important documents and bank accounts and the government has mandated all the documents to be linked with Aadhaar till 31st March 2018.

The Goods and Services Tax (GST) touted as the biggest tax reform since Independence came into effect from 1st July across the country.

Nitin Gadkari, Road Minister has written a letter to Union Finance Minister Arun Jaitley to review the higher taxation rates on alternative fuels such as biodiesel and ethanol, in the light of new regime.

Industry chamber Assocham mentioned that the progress in the implementation of a tax system across the country through the Goods and Services Tax (GST) will be the biggest achievement of the Modi Government. According to Assocham, the other achievements that the NDA government has achieved during the three-year tenure included in the economic area assimilating public inclusion on a financial scale, digitisation and infrastructures like railway and power distribution.

Central Board of Excise and Customs (CBEC) has proposed an e-way bill in the event of transiting goods worth INR 50,000 under the GST regime. This will ask for online registration of the goods consignment and this will give the tax authorities a right to inspect the element anytime if suspected of a tax evasion.