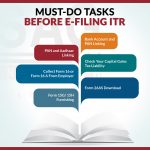

ITR filing is important for all specific people if their taxable income exceeds Rs 250,000 per year. According to the ITR rules, the ITR filing is also important for the person who has furnished more than 1 lac in electricity bills or offered foreign travel exceeding Rs 2 lakh in the financial year. But the […]