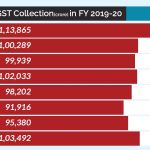

The news suggested that GOI is planning to increase the GST rate As per the recent update, The central government is planning to do changes in the slabs of Goods and Service Taxes (GSTs) soon. As per the rumors on various goods, in the same matter, the GST council is scheduled to meet on December […]