The taxpayer has provided the recommendations to permanently revise the due date since they are facing issues accessing Form 26AS and AIS.

There is a rise in the demand to extend the ITR due date from July 31, 2024, to August 31, 2024, because of the technical problems on the income tax portal.

An extended due date could assist various assessees to prevent the late filing penalties hence diminishing the financial stress.

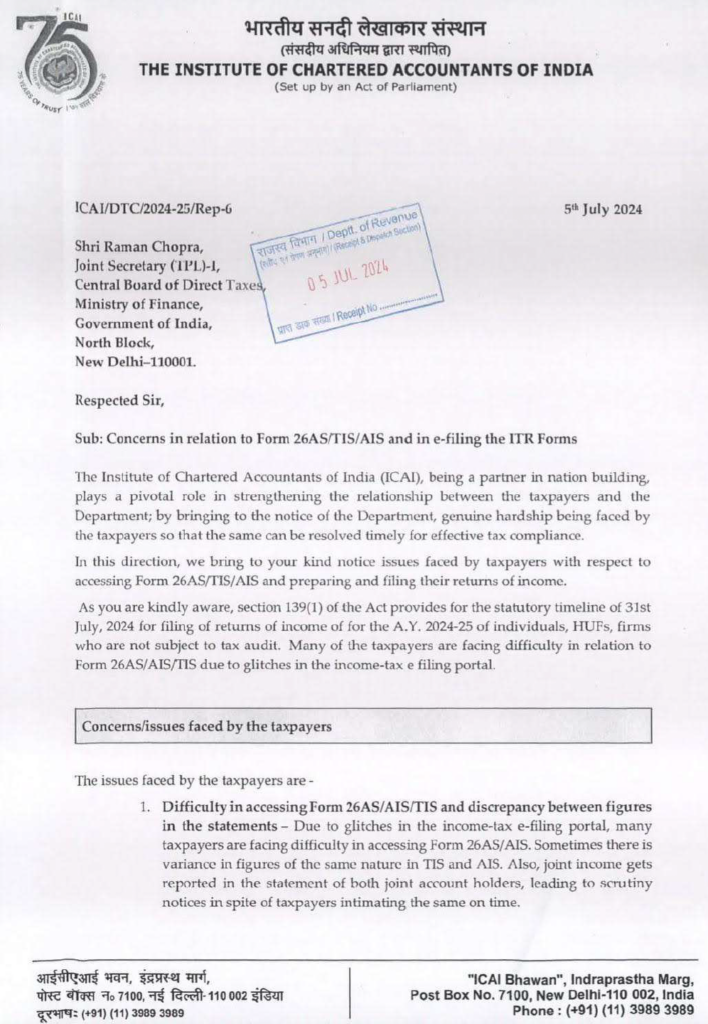

Concern would have been expressed by organizations such as All Gujarat Federation of Tax Consultants, Income Tax Bar Association, KSCAA, and ICAI about the problems of operating the income tax portal and updates in AIS/TIS and asking for an extension.

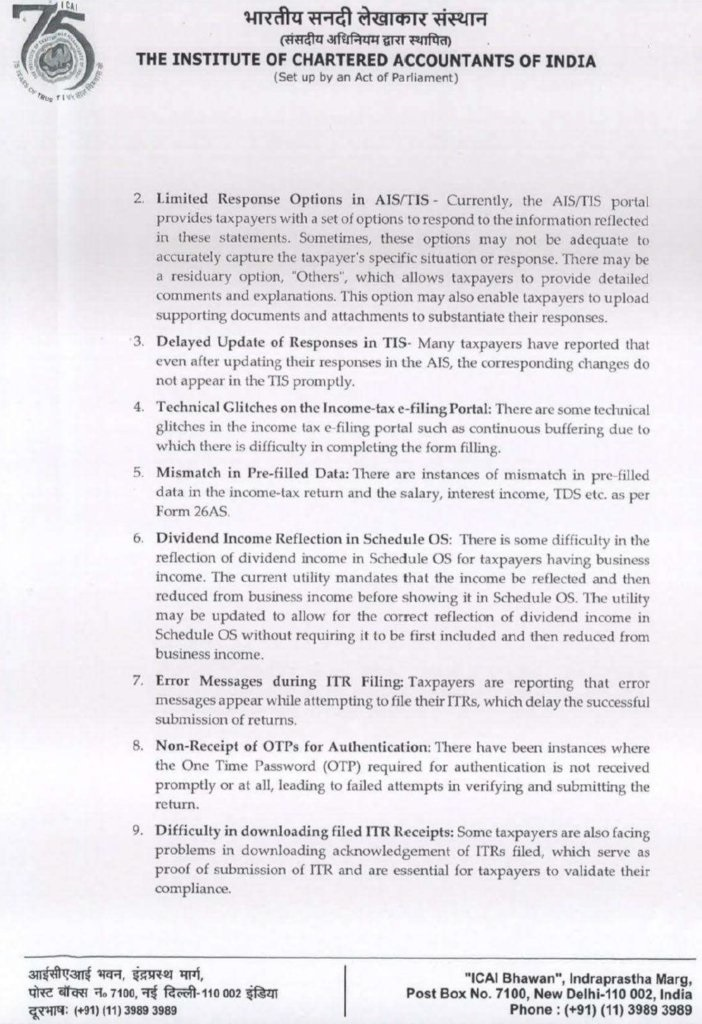

The problems represented by ICAI concerning Form 26AS/TIS/AIS and in e-filling the ITR forms are:

A higher compliance is there if the due date extension is set into position because the taxpayer with poor internet access or residing in remote areas shall have more time to file their returns. If the due date is not extended then the taxpayers would be obligated to pay the late fees.

Under Section 234F,

- If the assessee is unable to file their income tax return (ITR) within the said date then a late fee of Rs 5,000 will be levied if income is above Rs 5 lakh.

- Rs 1,000 when annual income is less than Rs 5 lakh.

- If the gross income is less than the basic exemption limit, no penalty is to be imposed.