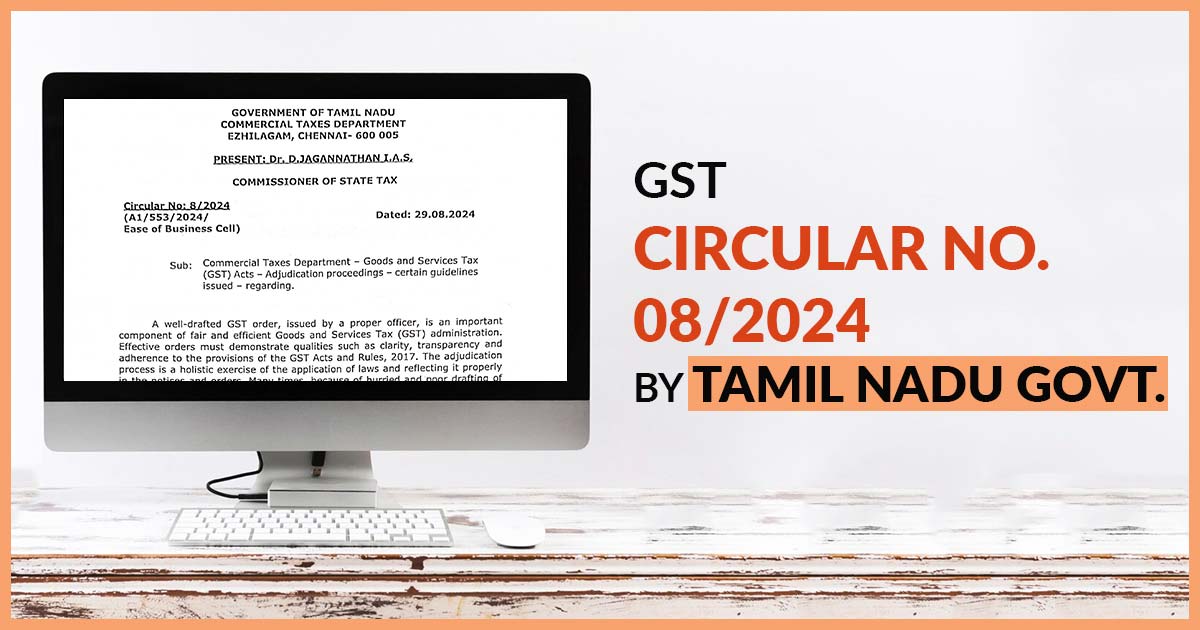

The first meeting of the GST review committee, exclusively formed for making the Goods and Services Tax (GST) recovery more effective, went inconclusive on Tuesday. The new meeting is proposed to be held in the next week. In the last meeting which was held on Tuesday, the committee reviewed the current situation of GST and […]