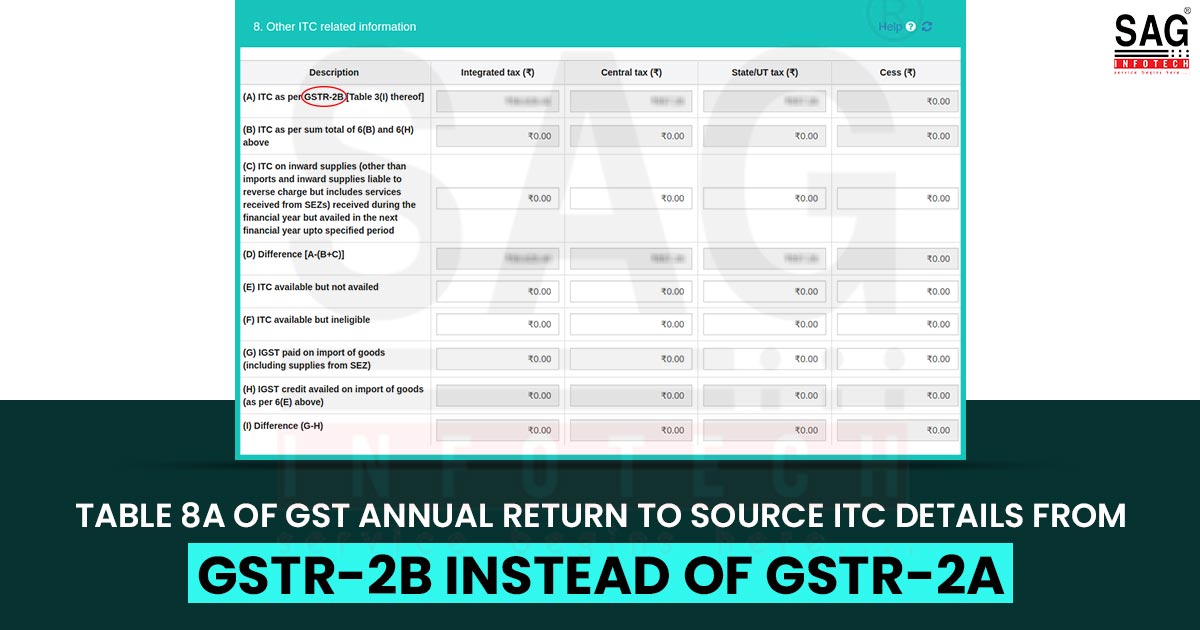

The government has this time to have an increased Tax to GDP ratio by 12 percent in coming two years by FY20. For this, the authorities will be having benefits of newly implemented GST and the thorough cross checking of accounts with their taxpayers.